Normal WOWS service will resume around 11 a.m. tomorrow a.m.

Unfortunately on the ship I paid for one hour what I normally pay for a month and

CAN NOT update any charts. So Monday a.m. I'll resume posting from home. We lave the ship at 9 a.m. and clear customs and have a 15 min drive home. A month's worth of service effectively WASTED! Aggravating.

Sunday, October 31, 2010

Thursday, October 28, 2010

Last Post Before I set off-to Set Sail

These are the 5 min charts of the averages. There is a little deterioration in them surprisingly.

Being today is a POMO day, it should close green, if it doesn't (in which case it will be fighting against the sinking dollar today), it will be in my mind a very bullish sign and perhaps a reason that story was floated this a.m. during the Fed blackout period. Watch volume into rallies, it should increase if it is healthy. Volume that's big into declines is bearish.

Watch the TICK chart if you can, it will give you a good idea of where the market is headed as it trades in a channel, when it moves out of the channel, you'll know that's the most likely directional change.

I'll be updating tonight and if I get on the ship early enough, maybe again during market hours.

There is surprising weakness in the financials today, so look at the list and recent financial trades I've posted, most of all, SET THOSE ALERTS from the trade watchlist.

See ya soon and hope that I float.

Strange thus far...

All of the 3 averages are now in 1 min leading negative divergences-pretty nasty ones as well.

SIRI Up on a BREAKOUT Move

Take a look, the stop is difficult here, but this looks like a breakout. You can always have a wide stop with fewer shares, position sizing.

Muddy the waters

?maybe this is the traditional, screw the little buy we see in early morning trade as they bought the gap up, but DIA is showing a 1 minute NEGATIVE leading divergence.

Starting To Feel A Lot Like a Banana Republic

Initial Claims and continuing claims were both revised higher for last week. Now it's about 40 revisions up and two down. Each week the numbers are made to seem better then they are, when the information doesn't matter anymore, they correct it, and it always goes up-except for twice out of about 42 revisions. So today's beat, can be expected to be a miss by next week.

Ahhhhh... Kind of speechless on this one.

Last night it was clear that 3C was forecasting a bounce in the market, as I said yesterday, it starts at the 1 min charts and the more serious ut gets, the longer term charts it effects, by the end of yesterdy it was on 5 min charts which would suggest to me that the market bounces today, thus a lot of bounce trades last night, but is that all?

It's hard to say for certain after reading this last article, it's hard to believe. I think there's going to be some serious blowback on this one.

http://www.zerohedge.com/article/paralyzed-fed-defers-decision-monetary-policy-primary-dealers

The Euro has liked it so far it seems although it hasn't travelled as far as it seems.

Keep an eye this morning on those bounce and long trades.

It's hard to say for certain after reading this last article, it's hard to believe. I think there's going to be some serious blowback on this one.

http://www.zerohedge.com/article/paralyzed-fed-defers-decision-monetary-policy-primary-dealers

The Euro has liked it so far it seems although it hasn't travelled as far as it seems.

Keep an eye this morning on those bounce and long trades.

Wednesday, October 27, 2010

A New Read... Same Story

Well it's second verse same as the first, this one wasn't on Bloomberg or ZeroHedge, but found right there on the DrudgeReport where millions get their news. What's it about, Insider Selling and it's a doozy.

As I've said here many times in the last month or so as the reports keep coming out with astonishing numbers, "there's a lot of reasons an insider may sell, my stock is going higher is NOT one of them".

Here's the article

As I've said here many times in the last month or so as the reports keep coming out with astonishing numbers, "there's a lot of reasons an insider may sell, my stock is going higher is NOT one of them".

Here's the article

TRADES ARE UP

There are 22 new trades up tonight, many are "Bounce only" trades, as I stated in the wrap up, I expect a bounce so these trades are only for that bounce. If they continue to perform you can always set a tight trailing stop.

There are a couple of "Short" limit order trades where they are executed on a bounce rather then a breakdown, it will explain it in the notes section.

Another way to play the POMO is to just go with the obvious darlings, NFLX, AMZN, maybe AAPL, PCLN, ect. When playing bounces, don't get greedy! Don't let a profit turn into a loss.

As usual, limit trades, I prefer to execute as soon as they hit the limit, intraday and stops are on the close as close to the end of the trading day as possible unless something just gets totally out of hand.

Please be sure to use risk management. My article on risk management concepts is linked at the top right of the site and this is the key to your long term success-the 2% rule or 1% or whatever you are comfortable with and especially position sizing.

I'll have internet access, at some cost as I see on their website, but I'll be updating at night and if possible during the day-who knows, maybe I find a little cafe in Cozumel with FREE WIFI :)

In any case, I'll be here in the a.m., I'll be leaving at 1 p.m. and be back Monday a.m. So it's about a day and a half.

See you in the a.m.-Don't forget to set your alerts.

There are a couple of "Short" limit order trades where they are executed on a bounce rather then a breakdown, it will explain it in the notes section.

Another way to play the POMO is to just go with the obvious darlings, NFLX, AMZN, maybe AAPL, PCLN, ect. When playing bounces, don't get greedy! Don't let a profit turn into a loss.

As usual, limit trades, I prefer to execute as soon as they hit the limit, intraday and stops are on the close as close to the end of the trading day as possible unless something just gets totally out of hand.

Please be sure to use risk management. My article on risk management concepts is linked at the top right of the site and this is the key to your long term success-the 2% rule or 1% or whatever you are comfortable with and especially position sizing.

I'll have internet access, at some cost as I see on their website, but I'll be updating at night and if possible during the day-who knows, maybe I find a little cafe in Cozumel with FREE WIFI :)

In any case, I'll be here in the a.m., I'll be leaving at 1 p.m. and be back Monday a.m. So it's about a day and a half.

See you in the a.m.-Don't forget to set your alerts.

Today we saw two forces at work, in the early going we had the Wall Street Journal Article that seemed to put the brakes, not completely, but in a manner not consistent with the recent predictions by Goldman Sachs as to how QE2 may proceed. Remember, the market has already priced in a lot of high hopes regarding QE2 so that contributed to the early weakness in a big way. As I mentioned in one of the updates, it's likely that some of the gap will be filled as their will likely be some firms caught in the GS mentality with inventory priced at higher levels and that inventory can't be sold at a loss-so look for some gap filling as a possibility, depending on how many were caught off guard.

The second force was front running tomorrow's POMO by the Fed and what better place to front run it then at lows like we saw today. As I said with yesterday's Fed POMO operations, watch for changes of character in the POMO days-including tomorrows.

The Second Shoe?

I mentioned last night that the second shoe was likely to be dropped from the same source that dropped the first shoe, MBS (Mortgage Backed Securities), although this time for a completely different reason. Along those lines we have this story.

Investors in 2600 MBS deals are going to go in for the long haul fighting servicers according to Bloomberg. (click link for the article) Here are some of the highlights:

“Risky lending and the financial crisis that began in 2007 led to the highest number of foreclosures since the Great Depression.”

“This month, attorneys general in all 50 states began investigating foreclosure practices, and a bondholder group said to include BlackRock Inc. and the Federal Reserve Bank of New York asked Bank of America Corp. to repurchase mortgages, citing alleged servicing failures by the company’s Countrywide Financial Corp. unit as part of its strategy.”

“procedural hurdles and banks’ plans to fight a “war of attrition” mean that they may take as long as three years, he said.”

“About one-quarter to one-third of the mortgages packaged into bonds without government-backed guarantees before the market collapsed probably deserve to be repurchased under the terms of securities contracts”

“We found servicer defaults in 100 percent of the trusts”

In Market News...

AAPL Down in After Hours-

AAPL's 10k which was just released said they expect their gross margin to shrink to 36% in Q1 2011. In 2010 it was 39.4%, in 2009 it was 40.1%. Do you see a trend developing here-keep reading! AAPL also announced that it doesn't stop there, they expect further deterioration in the future. Considering, the question is, "was this leaked already?" meaning, "Is it priced in?". AAPL is known for running a pretty tight ship so it's a valid question. This is really important as AAPL's weight on the NASDAQ 100 is the highest of all 100 stocks, at least 19%. From my calculations, AAPL alone offsets the bottom 51 NASDAQ 100 stocks. In effect, those 51 stocks could decrease by 1 % and AAPL could increase by 1.01% and the NASDAQ 100/QQQQ would close in the green for the day if the index were made up of 52 stocks, that's how much weight AAPL has. This is why I said last night that the market itself, meaning a majority of stocks could be declining and by running up a few key stocks like AAPL and XOM, the indices can close up day after day while the actual count of the majority of stocks is down.

AAPL's hourly chart shows a negative divergence that explains the recent hold up/consolidation...

However, this does not tell us whether this news is priced in. The divergence doesn't look especially interesting so I'm guessing that it is not priced in. The two square are the areas in which 3C is measured relatively.

Turning to the Dollar

As 3C suggested, we are seeing strength in the dollar. When the divergence showed up, it was hard to make a logical case for a stronger dollar, as I always tell you though, these divergences occur and you find out the reasons later, such as the GLD negative divergence and yesterday's disclosure by PIMCO that they've severely reduced their gold exposure.

So the dollar has been gaining recently as you can see in this chart below:

As you can see the UUP (dollar proxy) added a day of follow through to yesterday's breakout today from the flag consolidation. Yesterday, intraday, I said “I'd like to see volume pick up”. As you can see in the white box, we did see an increase in volume today on a follow through day, this is bullish and it's something we HAVE NOT seen in recent darling stock gains. Bullish follow through in the market has been largely absent.

The worrisome part is the dollar's gain against the Yen, last time the Japanese government launched a surprise intervention to try to weaken the Yen to help exports. The BOJ (Bank of Japan) meets tomorrow and the dollar has recently gained on the Yen.

Note the recent gains in the dollar, this has to be a concern to the BOJ.

Another Week of Negative Fund Flows...

As I mentioned yesterday, the funds are flowing out of domestic funds and into bond funds. This week makes the 25th week in a row in which money has flowed out of funds, year to date, the outflow is $81 billion meaning the Fed and the market's attempt to pump the market and get funds flowing in (as most volume is simply HFT churned volume in which they derive income through rebates, spreads and their games that have nothing to do with price discovery) has been a total failure. You can thank Brian Sacks and the Fed's POMO for gains in the market-it's not coming from mutual funds, pensions or retail traders. This is again, probably one of the catalysts that has caused 3C to show massive distribution even into higher prices. At some point the music stops and there will be, as always- bag holders, although not as many as there would have been a year ago as so many retail investors have totally exited the market leaving pathetic volume which would be even worse without the HFT churning, leaving an environment in which it is exceptionally easy to manipulate just about anything-just think FLASH CRASH.

Tomorrow is a POMO day and as I told you several times today, we've had some longer term (5 min plus) positive divergences, this is apparently the front running effect of POMO. What happens after POMO ends at 11 a.m. will be the question and an interesting one at that.

AAPL has a longer term negative divergence in effect-it's a relative divergence (leading divergences are the worst), but again you see the 1 p.m. accumulation or positive divergence.

Same for the SPY...

Looking at the longer term (because what we are seeing above is the 1 p.m. Positive divergence I mentioned today which is the result of High Frequency Firms and others front-running POMO tomorrow) which are less influenced by HFT front running/POMO are still showing distribution when looking at the bigger picture.

THE SPY 15 minute chart has shown negative divergences-selling into higher prices, but the recent action where the arrow goes nearly straight down, is showing exceptional recent weakness.

The DIA is showing nearly the same thing, on this layout I also have the extra-long 3C in blue at the bottom, it is looking really bad. These types of charts, being longer term, are more apt to show the underlying trend without the daily ups and downs or what I'd call noise that we so often get hung up on.

The QQQQ is showing virtually the same exact thing. This is just a piece of the puzzle. Consider this with last night's post that was largely focused on market breadth, the more pieces of the puzzle, the higher our probabilities are. Whether the market drops 2% tomorrow and follows through on a reversal or later, you know that if you buy this uptrend, you are not buying a healthy looking uptrend (I showed several examples last night of what healthy up-trends look like-these don't fit the bill).

GLD-Showing Interesting Activity Lately...

While I still think the medium term trend for GLD is going to be down, tomorrow we should see appreciation or a bounce in GLD. As I've stated many times, tops or bottoms are not “V” shaped, they are “U” shaped, or in other words they are a process, NOT an EVENT.

GLD's longer term trend....

As you can see, the first horizontal red arrow at the top was a negative divergence of some importance on the 60 minute chart, there's where the break occurred right after the divergence. Now Both the yellow and the long term blue 3C below are both in leading downside divergences so a day or a few days up here and there are merely part of the process.

Next zone of trouble for precious metals, lawsuits over Silver manipulation. JPM and HSBC are being sued for exactly that. We'll look at JPM in a minute.

With GLD looking as it does, I'd expect some kind of weakness in the dollar tomorrow.

Above we see UUP (the proxy for the dollar) showing a 5 min negative divergence today, so I'm expecting the dollar to lose some ground tomorrow, but this is as I say, “a tree in the forest”.

Above is FAZ, a 3x leveraged short ETF on financials. You can see the red arrow, a negative divergence or distribution led to a decline in FAZ at the August top. Recently I've been saying I like FAZ a lot at these price levels, I believe it to be a short term (maybe longer) bottom. Look at the white arrow on this hourly chart, it shows a positive divergence/accumulation. So if FAZ rises, that means financials decline and we have plenty of reason to see why financials could not only decline, but could be the second shoe dropping. If financials decline, the dollar should be up, so a day down, is again, “A tree in the forest”.

Also in the Financial area...

BAC, which I have been very bearish on is a great looking stock to short on weakness. So long as it does not violate the upper line my Trend Channel, I view it as a short that I'd build a position in on days of strength. Here's the current Trend Channel stop for BAC.

BAC should bounce tomorrow, you may want to consider starting or adding to a short position. So long as we don't get a close above the white arrow, the trend is still in effect. You can see the Trend Channel would have kept you short this trade since Q2 around $19.

JPM is another caught up in the mess that is “Fauxclosure Gate”.

As you can see, MACD has gone negatively divergent. It may trade within this rectangle, which may be a consolidation/bearish continuation pattern. I wouldn't make any serious commitments until it breaks below support, but shorting a little around the top of the rectangle may offer a high probability, low risk short trade entry.

More on the Broader Market...

Today the primary catalyst, as mentioned above, seems to have been the WSJ article suggesting that QE2 will not be anything like Goldman Sachs has been pumping it up to be. Numerous critics of “that type of QE2” and any other type of QE2 have become an increasingly vocal group with some heavy hitters; for example- this article in the NYT with the White House's own former economic advisor, Peter Orszag...

It's amazing that the market didn't take the Janet Yellen "Columbus Day speech" more seriously. She spelled it out almost two weeks ago, instead everyone decided to go with Goldman Sachs rosy, most likely self serving projections. She's the #2 at the Fed, her comments were not off the cuff and they were not spoken without Bernanke's knowledge and blessing. So today the WSJ let the cat out of the bag before the 1 week blackout from the Fed that is traditionally observed before an FOMC meeting. I've said for some time, I truly believe QE2 is not going to be anything like QE1. QE1 has succeeded in what way? It's done what Fed policy seems to always do, create bubbles in an attempt to break or repair damage from previous bubbles, thus my moniker for Bernake, Ben “Bubbles” Bernanke.

Other news today included Greece's budget breakdown-take a look around the web about that one, it threatens to throw Greece right back to where they were in the darker days. Square one and could effect the entire EU once again.

A Short Break...

I'll be taking a short “semi-break” on a cruise tomorrow, I'll be covering the market in the morning. I'll be gone Thursday afternoon and Friday and arrive home Monday morning. I'll be updating as much as possible while on my mini vacation-probably it will be end of day wrap ups like this one for Thursday night and Friday. Monday I'll be home. I'm going to add a bunch of trades to the trade list tonight, please set alerts.

If you don't have a real time alert system-try Telechart tabbed at the top (I can also share many of my indicators with you if you are using TeleChart) or if you want FREE REAL TIME charts, with alerts and no 20-minute exchange imposed delay (real real-time) with alerts, then try www.FreeStockCharts.com there are no catches, no fees, it's totally free. Most charting you find for free is 20 minute delayed, not this one. So I'll be watching the market and updating at night and as often as I can between my hops from Key West to Mexico. I won't drink the water. I hope the cruise ship doesn't take me to the cleaners for Internet access.

In the meantime, please...... set those alerts. We have a lot of great trade opportunities going off everyday. Don't get discouraged if your trade doesn't take off the first day, many of these are STAGE 2 or STAGE 4 trades, that's where the relatively easy money is and also where you will find the trends, so use risk management, take a little longer perspective as we can see, the day to day will kill you if you are not super nimble.

As I suspected...

The market, like it has in past days, is simply following the EUR/USD currency pair.

The move up in the market was exactly the same minute as the move up in the Euro-2:38 p.m.

This is a 1 minute chart.

Looking at the trend of the Euro which is very bearish, you can see we have crossed what I would call the official neckline and are heading toward last support, the trend is solidly down. So in my mind whatever occurs here in the afternoon is pretty much a result of a normal bounce in currencies. The overall trend is what is important and it is quickly breaking important support levels.

As I suggested in the last market update, I didn't think that the last pullback would be it, but rather it would be more likely to see a continued bounce. We'll see as the trend unravels.

The move up in the market was exactly the same minute as the move up in the Euro-2:38 p.m.

This is a 1 minute chart.

Looking at the trend of the Euro which is very bearish, you can see we have crossed what I would call the official neckline and are heading toward last support, the trend is solidly down. So in my mind whatever occurs here in the afternoon is pretty much a result of a normal bounce in currencies. The overall trend is what is important and it is quickly breaking important support levels.

As I suggested in the last market update, I didn't think that the last pullback would be it, but rather it would be more likely to see a continued bounce. We'll see as the trend unravels.

For Day Traders

RFMD is trade that may be worth trying to fade, you could use a stop above today's highs on an intraday basis, so the risk is fairly low. Just don't get too greedy, a couple of percent for an hour or two of trade may be worth the risk here.

Negative 5 min 3C divergence at the top. Profit taking? Or...?

Negative 5 min 3C divergence at the top. Profit taking? Or...?

Market Update

As you can see we have 1 min negative divergences in all 3 averages. The Q's look the worst. I'm leaning toward this being a pullback and that there may still be upside in a bounce as the positive divergence was bigger, but all divergences start at the 1 min and can grow from there, so this one could get worse.

Speculative Bounce Trade.

SMH is performing well today and CRUS seems to be a good bounce candidate.

Here's a 3C 15 min positive divergence. After a fall that big, there's bound to be a bounce I would think. 3C seems to suggest the same.

A stop can be placed a bit below the recent lows at the arrow and the target zone could be as high as the gap, although I don't think it will completely fill the gap, leaving it as a bearish breakaway gap.

More trades may be coming..

Here's a 3C 15 min positive divergence. After a fall that big, there's bound to be a bounce I would think. 3C seems to suggest the same.

A stop can be placed a bit below the recent lows at the arrow and the target zone could be as high as the gap, although I don't think it will completely fill the gap, leaving it as a bearish breakaway gap.

More trades may be coming..

Update

I'm showing 3 positive 1 min divergences on the Q's SPY, and DIA starting around 1:15 p.m. When going to the longer 5 min chart, the Q's are negative, The SPY is confirming the 1:00 divergence and the DIA as well. So we should see some kind of bounce here which is not unusual with a move that far down that quickly.

Update

There are now divergences in the SPY and DIA-both positive, the QQQQ is just trading in line so I would expect some kind of bounce coming.

DIA Update

There is a possible 1 min positive divergence taking shape which would make sense as the DIA is coming up on an area of gap support.

THE MARKET DARLINGS

AMZN 5 min 3C-now in a leading negative divergence

BIDU 3C 5 min also in a leading negative divergence

NFLX also in a leading negative 5 min divergence.

PCLN-same thing

The red arrow is the place where I'd feel most comfortable adding a short of any size.

I think if you set stops just above recent highs and use proper position sizing discussed in my article linked at the top about risk management, you can probably get your toes wet here. You may not want a full size position until you see follow through, but that's fine as there's a lot of room below in all of these, jumping the gun too quick is not a good idea, building a position as it moves in your favor is what I prefer.

If anyone wants to discuss specific on any of these, just email me.

BIDU 3C 5 min also in a leading negative divergence

NFLX also in a leading negative 5 min divergence.

PCLN-same thing

The red arrow is the place where I'd feel most comfortable adding a short of any size.

I think if you set stops just above recent highs and use proper position sizing discussed in my article linked at the top about risk management, you can probably get your toes wet here. You may not want a full size position until you see follow through, but that's fine as there's a lot of room below in all of these, jumping the gun too quick is not a good idea, building a position as it moves in your favor is what I prefer.

If anyone wants to discuss specific on any of these, just email me.

Update

I've had some requests for 3C updates, I haven't sent anything out because they are trading inline with the averages, which means confirming the trend, there are no divergences right now. I'll post them as soon as they appear.

Short Trades Triggered From the List

Include:

CVH

ROC

AWC

POL

JOYG

PLT

TCK

Keep an eye on FMCN and GFA

All these trades are on the September / October list toward the bottom

CVH

ROC

AWC

POL

JOYG

PLT

TCK

Keep an eye on FMCN and GFA

All these trades are on the September / October list toward the bottom

FAZ Update Request

There's a 10:00 a.m. relative divergence and right now another positive divergence, bur leading in the white box.

Yellen is still the key

The market is throwing a hissy fit today because it fears, and probably with good reason, that QE2 is not going to be at all like QE1 and it's not going to be at all like the numbers Goldman and others have floated. Like I said a few weeks ago, the most important thing that happened the week of the Columbus Holiday was the Fed's #2, Janet Yellen's speech in which she lowered expectations. The market instead chose to follow the rosy path that GS laid out, and why wouldn't they? Their making money from it every day it goes on. It's amazing to me that the Fed #2 virtually says the same same thing the Wall Street Journal article said (reducing QE2 expectations) and no one listens. Well someone was listening, those breadth readings and the 3C reading (as I pointed out with GOLD and PIMCO last night) didn't come out of thin air, smart money was listening.

The question is now a question of who, and how big the who is, got stuck with inventory at higher levels. If some big "whos" got stuck, we should see the gap filled as far as they can take it, if not, then we won't see that much of a gap fill, but this looks like it may be a game changer... and right before the Fed blackout period before their next meeting.

The question is now a question of who, and how big the who is, got stuck with inventory at higher levels. If some big "whos" got stuck, we should see the gap filled as far as they can take it, if not, then we won't see that much of a gap fill, but this looks like it may be a game changer... and right before the Fed blackout period before their next meeting.

Tuesday, October 26, 2010

The Wrap

Today's market was more or less a NOTHING day, which after a day up like yesterday is not good news for bulls as it shows no follow through, but as I showed you last night, we had a number of bearish closing candles like shooting stars so today's behavior is not that surprising. What is a bit surprising is that a POMO day like today failed to lift the market unless you consider a .28% gain in the DOW and a -.02% loss in the S&P-500 as significant.

The real action today was in currency, specifically the EUR/USD pair. Earlier I showed UUP (proxy for the dollar) moving up into a technical upside breakout. Apparently a Citigroup note for clients to take profits on the pair sparked selling in the Euro.

Here are a few charts:

Here is today's stock market close to when I captured this image tonight. As you can see, we have seen significant deterioration in the Euro and strengthening in the dollar. Interestingly, the UUP breakout seemed to be a hint this action would continue. In Poker vernacular, you always have to watch the market for "tells".

Here is a longer hourly chart showing the possible Head and Shoulders top in the Euro (base in the dollar), you can see once again the moving averages are crossing and one is left that is almost crossed down into a bearish mode (at the box/arrow).

As I've been telling you, the technical pattern in the pair does not look good (Head and Shoulders top) and we are getting closer everyday to that neckline.

As for GLD, last week I mentioned that traders may watch for a bump in GLD, we saw that Monday, today GLD failed to do much at all. We'll watch it closely tomorrow to see what it's intermediate/short term intentions are. However, the GLD long term negative divergence, which indicates distribution is, still intact in GLD. A member sent in an interesting article that probably explains some... maybe all of the negative divergence we are seeing in GLD. Remember, 3C's job is to show institutional buying (accumulation) or selling (distribution) through positive and negative divergences.

Below in blue is an extra long version of 3C in a negative divergence in GLD.

So this article from CNBC with PIMCO's #2 and a pretty straight shooter, Mohamed El-Erian has some interesting insights, but one of the most interesting comes in the last paragraph:

“El-Erian also explained PIMCO’s significant reduction in a key fund's gold position from 10 percent to 3 percent. He said investing the precious metal “doesn’t make as much sense as it used to.” Because the price has moved so much and the trade is so crowded, he sees potential for a large technical retracement.”

This kind of move from a fund as large as Pimco could easily be what 3C has been picking up on in GLD. Any move up in the dollar should exacerbate the the selling in GLD. As I have always said, some of the biggest and most unexpected, unexplainable 3C reversal signals make absolutely no sense until some time later-this may be that “some time later”.

Still, besides getting your feet wet in the short trade if you like it, I still recommend waiting for a validated price reversal, which arguably we could say we have, I prefer to use the Trend Channel to objectively identify that point.

This is a Swing Trader's stop using my Trend Channel-stop at the red arrow.

This is a Trend Trader's stop-at the red arrow. If you look at the channel of each, you can see how this objective Channel that I wrote does an excellent job keeping you in the trend rather then setting arbitrary stops.

Here's today's upside continuation breakout in UUP (proxy for the dollar)

A bit strange, but the VIX is up both yesterday and today, yesterday was particularly strange as it was a solid close up, today wasn't so solid, but up, still the volatility index is pricing in volatility and acting in a manner in which you'd expect to see in a decline. I've seen this before, a pretty large sell-off occurred soon after.

As I showed in the intraday NASDAQ Breadth charts, the crawl up today was into negative breadth through out-sequentially declining the entire day. The daily NASDAQ Composite Advance Decline line makes this poignantly evident.

While we're on the subject of breadth, the New High/New Low Index is also showing surprising recent weakness.

We're also seeing weakness in the % of stocks 2 standard deviations above their 200-day moving average.

A closer look reveals more recent weakness.

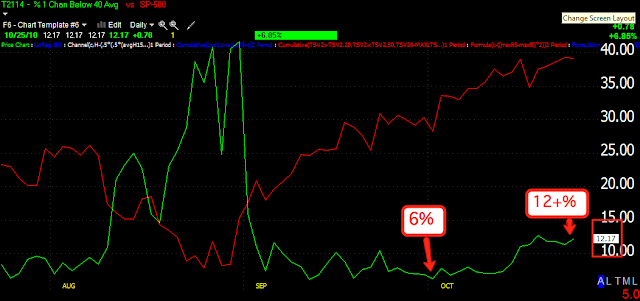

More evidence of recent breadth weakness is the % of stocks 1 channel above their 40-day moving average.

When we look at the stocks that are 2 standard deviations above their 40 day price moving average, we really see a discrepancy. This shows the stocks that were really moving and making extraordinary gains went from 35% to about 7% in a period of about 2 weeks-thus this is probably the reason I'm seeing so many recent bearflags as these once high fliers make their initial breakdown and bounce up slightly in a bear flag. This is a pretty extraordinary reading.

More confirmation of this recent breakdown in market breadth is seen in this chart of the % of stocks trading 1 channel below their 40 day moving average. When prices were lower in early October this number was about 6%, it has now doubled, meaning more even at higher prices, twice as many stocks are trading 1 standard deviation below their 40-day moving averages-this number should be going down into a healthy rally-this is how we can identify bear market rallies, the refusal of stocks to participate into higher prices and fewer and fewer stocks, but heavy weighted stocks, are participating in the rally. The market is essentially manipulated by buying a few heavily weighted stocks on the index. Remember my article a few weeks back, “What If The Market Turned and No One Noticed?”

Again, this is confirmed in the % of stocks trading 2 standard deviations below their 40-day moving averages. Here again, w see that percentage double in the past two weeks.

More confirmation in the Russell 2000 Advance/Decline Line, fewer stocks are participating, especially when you look at equivalent price levels and equivalent A/D levels.

All in all, everyone of these indicators should be going the exact opposite way they are going. They all show a thinning market, more stocks declining then before even though prices are higher, but it is relatively east to manipulate the averages higher using a select few stocks. However, when looking at how many stocks are participating, it is becoming ever increasingly clear that this market is turning or may have turned, with the averages deceitfully making investor think they are missing the buss. By the looks of the flows of fund out of the market, even retail investors aren't falling for it.

I have set more trades for alerts, I have a feeling we'll see some on the last list trigger this week, I'll be adding more to the list in the a.m.