Sometimes it's hard to have faith even in my own indicator, today I showed you a lot of charts and no matter what my mind was telling me, I had to say what I thought, that it looked like the place to be short, even though we still hadn't heard from Slovakia and AA had the potential to send shares rocketing higher and the Euro has been on a rip, everything fundamentally or from a common sense view told me don't do it, but I'm evidence based and even when it's hard, 3C has pulled through for me too many times to doubt it, even if things don't happen like expected, they generally do happen.

I'm not taking any victory laps though, a lot can and does happen overnight, but so far the evidence doesn't look good for the market. AA sent Asia lower, futures across dozens of markets are in the red.

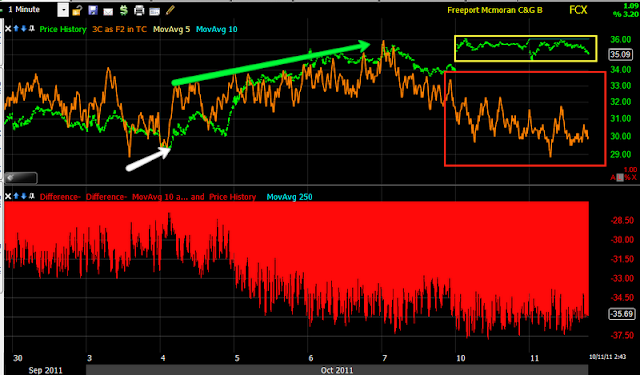

That 2.5 year record rally in the Euro seems to have reversed, it's off the highs from the close as you can see here and remember how I pointed out how the market had diverged from the Euro, a rare event.

The 3C 5 min ES futures went negative last night and today, sending them lower tonight as you can see.

The ES 15 min chart fell off a cliff in a leading negative divergence.

And the hourly continues it's trek down, this is amazing information that is probably being seen by you for the first time, I doubt many others have seen anything like this.

NUGT has given a long signal-perhaps there's an impending flight to safety in the PM's-Gold?

And the hourly 3C SPY extended hours chart is headed lower, although we still have pre-market to add to this.

The AA charts I posted are being called "Amazing" by some members as they seem to have clearly indicated Wall St. was distributing AA most likely on an earnings leak, perhaps I should have posted it as an earnings play, but like I said, no victory laps yet.

The final nail in the coffin would be an upside head fake, whether the market can muster it or not, ????

It's not needed, but it happens about 85% of the time just before a reversal.

On the other hand, this could have been our head fake..

The 50 has acted as resistance, a prior head fake in late July can be seen to the left that sent the market much lower, MANY technical traders take a cross above the 50-day as a buy signal and it hasn't happened since July so this could be the head fake right here, we'll know if prices drop below the 50 day on increasing volume as trapped bulls scramble to sell as their positions go underwater and margin calls start the snow ball effect that took the SPY from $132.50 to $110 in 9 days. The entire Head fake snowballed and dropped the SPY by 18% from head fake high to the lows-that's the point of a head fake.

Turning points are always times of increased pressure, tonight I'm feeling very relieved and happy that I had faith in my system today and posted what I did about being short here, it wasn't an easy limb to climb out on. So lets see what happens overnight, lets see if the market can muster a final pop and more then anything, lets make some money.

Is interest rates about to start going up?

-

Yes, I know - it does not make any sense - FED is about to cut

rates...but....real world interest rates are not always what FED wants it

to be.

6 years ago