I'm not sure what the bigger story is today, the collapse of the yield curve (2y v 30 y spread) or the 4th consecutive new record low volume for 2014 excluding holidays? Neither bodes well for the market or show much confidence.

Yields were well in to it before the open in Europe this morning as was addressed in the A.M. Update.

Italian, Spanish and German yields were sent to record lows, everything out to 3 years in German notes is now at a negative yield, that's pretty interesting even if there is a strong expectation of ECB QE, IT'S NOT THE SAME AS US QE, it's ABS to compliment LTRO.

Then it's the US's turn, the 2year vs 30 year spread flattened to new leg lows.

The spread is now the flattest since December of 2012 as the yield curve flattens. While I don't subscribe to the idea the yield curve must invert for a recession, as Japan has proven wrong 6 of 7 times, over the last 50 years in the US, it has a perfect track record of 7 for 7 in predicting recessions.

Treasuries were bid today with the 10 and 30 year yields dropping to 2.36% and 3.10% respectively with the 5 year at 1.62%.

Either case, it would seem someone will be proven wrong here shortly even if the talking heads have accepted this and record low volume and no follow through as the "New Normal".

The 30 year yield just continues to diverge from the SPX negatively, typically if the market is rallying, treasuries are being sold and yields rise, this is a situation in which the market has been in a risk on rally mode while treasuries have been in rally mode, the "Flight to Safety Trade", which has been alive and well almost all of 2014, but is really getting out of hand now. Someone is wrong here and I'd prefer not to bet against the bond market.

The other story is today is the 4th consecutive day of "New record lowest volume of the year after having seen the market rally the prior week on 40-50% average volume. There's no follow through in the SPX, in fact, just as posted in last night's Daily Wrap...

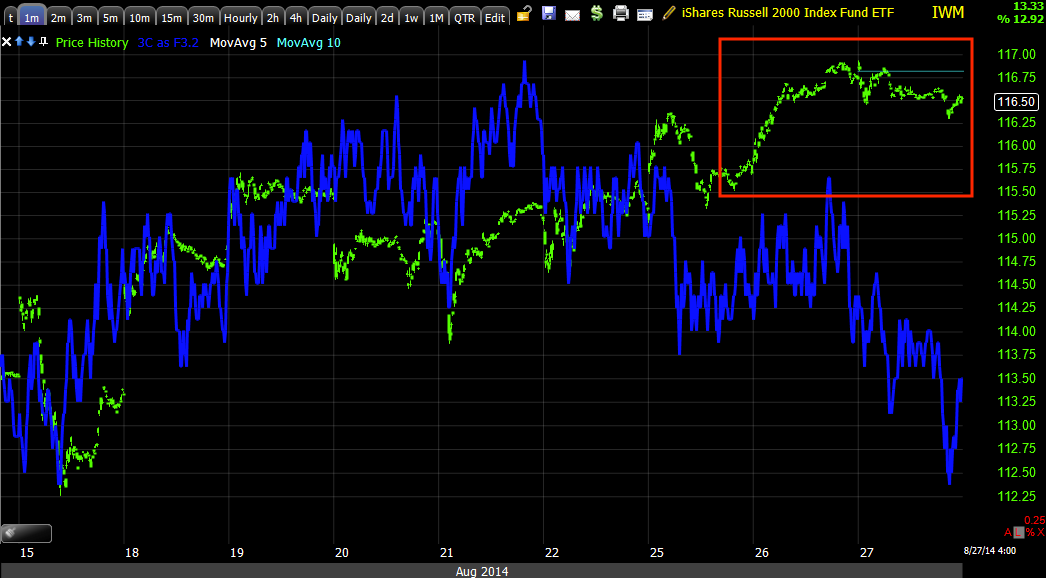

"There was only 1 Dominant Price Volume Relationship today which was the Russell 2000 at Close Up/Volume Up, the most bullish of the 4 relationships, but also the one with the highest probability of creating a 1-day overbought condition typically sending the average closing lower the next day."

And the IWM closed... LOWER today, in fact the worst performer on the day at -.21% with the Dow-30 the best at +0.09% or in other words, TOTALLY FLAT.

The SPX LOST 2000 today as the European close sell-off effect seems to continue...

IWM selling off in to the European close.

Here the SPX loses 2000 intraday, it's only some money stepping in creating the divegrence I talked about in the last post that sent the SPX back to VWAP and a +2000 close at $2000 and 12 cents.

ES/SPX futures bullied back up to VWAP right before the close to maintain the illusion of a strong market, that has essentially ZERO follow through and the worst volume of the year after three previous days of worst volume of the year.

High Yield Credit also diverged wider today from equities.

HYG as a manipulation lever is probably done and soon to roll over, it would seem there are some people there who don't want to be caught holding HY Credit that has seen massive outflows recently, when the music stops... FAVOR DONE YELLEN, they're taking their ball and going home.

The Dow-20/Transports is a position I'd like to add to, it is a current short from the last entry and looks good for a new entry as discuss

This 60 min 3C chart of Transports shows the last place we entered a partial short position looking for better prices to fill it out as 3C went negative, now we have slightly better prices and I think we get a bit more as 3C is in a worse divegrence as more transports are distributed making for an excellent entry in IYT short.

And the short term 2 min positive divegrence that should bounce Trannies and give us that entry we are looking for, much like the broad market today.

Of the 9 S&P sectors, only 3 closed green, a much different feel in internals than ever before since the bounce started, you might guess which group led with a +1.09% gain, the defensive Utilities; Financials came in last.

Utilities see a sharp upward move on volume and...

There's the divergence/accumulation responsible for it.

As for Morningstar Industries/Sub-industries, of 239, only 124 closed green (which can include 0.01% as green as many were).

We expected a move up in gold, but especially GDX (gold miners ) and NUGT (3x long gold miners) which we are long, yesterday we saw a +6.19% gain, I said I thought we were in for a little pullback, today GDX pulled back -0.31% and NUGT -0.97%, but there appears to be much more in the gas tank over coming days and weeks for both although I favor the miners.

GLD's 5 min 3C chart, accumulation at an island-like bottom and the push higher and consolidation today, it looks like we have a lot more room on the upside over the next week or two.

And the same for GDX/NUGT as the 10 min chart clearly shows, we have even stronger divegrences , but for now it's a minor consolidation.

We also expect to see some upside in USO, I'll take a closer look at indications tomorrow and decide whether it's worth the risk (risk/reward).

USO 60 min positive divegrence and base area.

There was only 1 Dominant Price/Volume relationship today, the same as yesterday, the Russell 2000, but this time it was Close Down/Volume Down which doesn't really have a next-day implication for short term overbought/oversold, I just kind of consider it, "Carry on doing what you were doing" which is ironic as the IWM was the only average not showing a positive divegrence intraday in to the close.

Just for future reference, CD/VD is the thematic relationship of a bear market. There were no other averages even close to a theme.

Finally and maybe most importantly, market breadth was TOTA::Y FLAT, yesterday was the exception with the R2K short squeeze, but before that we had 4 or 5 days of no breadth movement at all, today is another, none. It feels like we've reached the apex and stalled and are ready to roll back over as SKEW is back to elevated/red flag levels, breadth charts look the same, but I'm always looking for that last head fake move.

As I said last night,

"We're now no longer near that record oversold breadth condition which apparently was the cause of the base/bounce. However we have an all new set of weak conditions like the average volume being half of normal all last week and 3 consecutive new lows in volume the last 3 days with very weak market tone and right around the area of a reversal process.

The rest should be pretty evident just based on objective evidence."

Is interest rates about to start going up?

-

Yes, I know - it does not make any sense - FED is about to cut

rates...but....real world interest rates are not always what FED wants it

to be.

6 years ago