Whistling Past the Graveyard

What I'm going to discuss tonight is

not so much technical in nature as it is psychological. When I first

really dove in to the market during the mid to late 1990's, there

were really 3 major forms of analysis, Fundamental which was the

primary and just starting give way to the second, Technical and the

third which never garnered too much attention, Mass Psychology. I

dove in to all of them, but mass psychology didn't have the same

tools available in real time as it does now and as I said, never

really caught on like the other two.

Something recently has been causing me

more concern than I usually have (when I say, “concern” it's not

concern for myself, my analysis or my members, I mean for the market

in a general way). This week and last, I spoke quite a bit about the

Dow 14,000 hype, the way it is portrayed on CNBC in commercials like

an action movie trailer, the psychological allure and something I

didn't really think we'd see any time soon- retail investors coming

back in to the market after more than a year of nearly weekly

consecutive outflows. It seems things have changed and at the most

basic market behavioral level, there are two simple concepts:

- Wall Street and Main Street can't be on the same side of the boat too long in a zero-sum game

- You know this one... “What does Wall Street or someone like Dan Loeb who is selling 11 million shares of Yahoo in two days with an incredible 2 cent dspread on the fill NEED to get that done?” The answer of course is demand and it's behind numerous concepts that have served us well in positioning, knowing when and where to position with the highest probabilities and least risk and a whole host of other concepts all tie in to the simple fact that with the size Wall St. sells, they need demand, with the size in which they buy, they need supply and you can figure out what the actual market looks like when demand from dumb money is high and when supply from dumb money is high.

A few weeks ago a site called The Right Side of the Chart put out a great piece of analysis and went

through the painstaking task of taking all the historic AAII data,

looking for 18+ bullish/bearish spreads and placed them on a price

chart that looked like this...

Last week I told you the AAI Investor

sentiment survey, which has had a solid record of bullish and bearish

reversals when the survey has an 18 point spread between the Bulls

and the Bears (if the bearish sentiment is 18 points higher than the

bullish, there has historically been a bottom, when the bullish

sentiment is 18 or more points above the bearish sentiment,

historically it has been a top). Last week the AAII survey's bullish

over bearish sentiment survey had risen to a very high 28 point

spread in the bulls favor.

This week the AAII looks like this...

|

Survey

results:

Bullish: 48.0%, down 4.3 points

Neutral:

27.7%, up 4.3 points

Bearish: 24.3%, unchanged

Long-term

averages:

Bullish:

39.0%

Neutral: 30.5%

Bearish: 30.5% |

The bearish sentiment remains the same

and below the long term average, the bullish sentiment lost 4.3

points and the Neutral gained 4.3 points to leave the survey with a

24 point bullish spread, still well above the historic 18 point

spread that has been at market turning points; this is nearly 3 weeks

of 18+ point spreads whereas before the spreads were much more

moderate.

The sentiment data is interesting, it's

helpful, but it's not an exact pin point as extremes in sentiment can

last a fair amount of time as was pointed out on the chart above

(*Dual buy or sell signals in close proximity often result in major

market turns), which is something I find interesting when looking not

only at the usual data of 3C charts, the ever widening spread between

credit and stocks, but also on my custom DeMark inspired indicator.

I've found large sell or buy signals tend to correlate to the size of

the reversal. You may recall that the buy signal in the VIX on 1/23

through 1/25 was a beautiful buy on the VIX, however more interesting

is the large sell signal in many of the market averages.

The former buy and sell signals on the VIX were accurate with the custom indicator, I warned that the huge Bollinger band volatility (see long red vertical trend lines) which is squeezing, is priming the VIX for a highly directional move. Just based on common sense, there's not a lot of room on the downside for such a large directional move, plus we have the buy signal, but as I was saying and pointed out Friday, the VIX is in a perfect place for a little volatility head fake itself and that' what we saw Friday with a move below the 20 bar average, the market just is predictable in many ways like this.

While the Dow and S&P are better known, those in the know, know the Russell 2000 is one of the most important averages to follow as far as the health of a trend, its performance can tell you a lot about the market that may not be otherwise apparent. Ae have a HUGE sell signal on the same indicator in the R2K, past signals have worked beautifully, I've seen these large signals and they tend to be huge moves. Not only that, but the entire signal takes up just about all of trend #1, as do many of the 3C leading negative divergences, it's very much like Trend #1 is acting as predicted before it even started, as a primer to dovetail in to trend #2, which I'm starting to wonder if this is going to be even bigger than the larger trend we expected.

What may be

scarier for those who experienced it during the later half of Q1 2012

as we were setting up 9 core short positions, all of which were

sporting double digit returns using no leverage by early June, was

the economic data that was coming out with head line beats after

being heavily massaged with arbitrary seasonal adjustments, as soon

as the seasonal adjustment period ended, the market took a dive to

the early June 2012 lows. For ANYONE who was paying attention to the

details and not just the headline economic data, it was clear there

was major trouble and the headline was a cheap, thin facade masking

an economy that was considerably more rotten than the sheeple were

being led to believe.

Again we have a

similar situation at the same time of year that has even had a few of

our members thinking the U.S. economy was improving, of course it's

hard to blame them as they are being bombarded with propaganda day

and night on the Financial networks that are selling that bill of

goods. However if the 4 consecutive regional F_E_D economic activity

prints weren't enough to convince you that this propaganda was

another thin veneer of subterfuge, then the Q4 GDP that recently came

out with a consensus of 1.0 missed even that, which had been lowered

from the previous 3.1 because of “Super Storm Sandy”, GDP printed

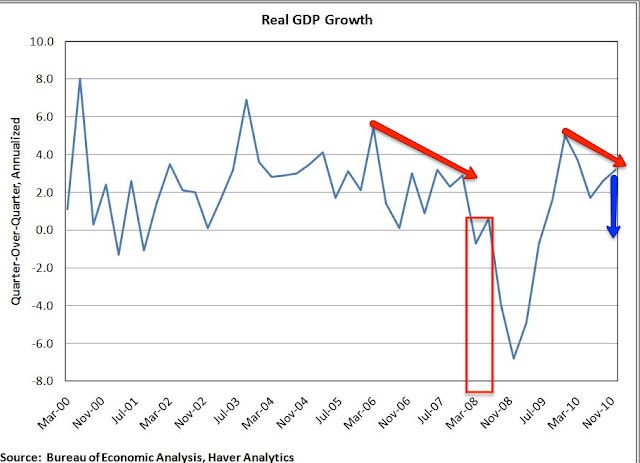

at -.1 to give the U.S the FIRST NEGATIVE GDP PRINT SICE 2009!

The definition of

recession is two consecutive quarters of negative GDP prints and it's hard to see how a recession is staved off with government spending

about to drop (which accounts for a large part of GDP) and taxes set

to go up for 80% of Americans. If there is a saving grace it will

likely be that Q4 GDP is revised 0.2% higher so there's no 2

consecutive quarters, but that's just more massaging of data, the

point to focus on is the “Improving Economy” being sold can't be

improving if we are printing negative GDP and a huge drop at that

from +3.1 to -.01 with consensus of +1.0!

GDP just saw the first negative print in 4 years and a lot of downside momentum as it is near the blue arrow I drew in, notice anything similar about the pattern now vs the pattern around the 2007 top?

With all the

government had done and kept doing (which will be scaled back very

shortly) and the extraordinary F_E_D accommodative policy, this print

has to be heart breaking for the kick the can policy makers, after al

that stimulus we get the first negative print in 4 years.

If that wasn't bad

enough, Germany just printed negative GDP as contagion in the EU

finally hit the only and real core, over the next couple of months

the market not only has to worry about the periphery of the EU

slipping in to a deeper decline (the PIIGS), but the core itself is 1

print away from recession and this as the latest LTRO 2 loan

repayment came in at about 1% of what was expected further giving

real reason for investors to worry that there really is something

still very wrong in the European banking system.

Sometimes you find

economic indictions in the most surprising places, but if the German

manufacturing powerhouse is truly slipping (as indications are

showing right down to port usage), this chart, as odd as it is, tells

us something...

This is multi-year so it's not seasonal, this looks a lot more like massive power consumption demand falling, like that of a manufacturing sector, we already know they also have a negative GDP print to everyone's horror.

Then add to that

the fears of the US slipping in to recession and the chances of

another round of downgrades as Congress makes another mess of the

debt ceiling, remember it wasn't so much the US economy as it was

Congressional inability to work together last time this topic came

up. Now instead of the market rotating between fears over the EU and

the US (both of which have been on the back-burner for the last

several months other than some political situations), the market may

have to worry about both at the same time with North American and

European recession, who knows what happens in China- yet dumb money

flocks back in to the market, whistling past the graveyard which

reminds me of a quote I saw today, “"The

wise man does at once what the fool does finally."

While

European Confidence Surveys like the German Zew poll show similar

attitudes in Europe as here in the U.S., consider the peripheral

markets there recently.

The

Spanish IBEX saw its biggest weekly drop of -6% in 6 months.

Italy's

FTSE MIB Index saw a drop of -3.36% Thursday, another “largest 6

month decline” except in a day.

Even

the FTSE saw some remarkable volatility that I haven't seen on this

chart, hitting a 40/40 Bollinger Band as we work toward the core.

That's a daily chart with huge 1 day volatility hitting a wider Bollinger Band that is hit maybe once or twice a year.

I

suppose the point I'm getting at, whether I post 1 sentiment

indicator or 10, is that the market behavior that first set up

followed by the accumulation to confirm what was predicted as a

strong move up, trend #1 which judging from the charts is set to

dovetail in to trend #2 (larger, longer and down) coincides with what

is becoming more than what I originally thought, it is taking on the

shape of a more definitive, larger, more important top and all of the

recent subterfuge about the economy getting better, the very low

volatility (investor friendly environment) with no pullbacks (making

any one feel like they are an absolute genius) is all too neat and

organized to lure retail back in to the market which brings us back

to the very simple concept of, “What do institutional trades,

moving tens of millions, hundreds of millions of shares-whether

selling them or building a short position need?” They need demand,

they need higher prices, they need someone dumb enough to hold the

bag as it is handed off to them.

I

mentioned rising volatility last week as it always accompanies

turning points, whether up or down and planned on spending a bit of

time in this post illustrating the rising volatility (a less investor

or dumb money friendly environment, but once you have them in the

door emotion and hope will keep them inside for longer than you might

think). I'll post this one chart showing trend #1 and the rising

volatility and you can keep in mind some of the PIIGS markets while

looking at this.

This is showing the volatility during all of Trend #1 moving from 0 to .28 as the high to low range, the last couple of days alone it went from 0 to +.59, more than double the month long range in a day. Why is this important? Not only is volatility a common occurrence before a trend change, but any significant change in character often leads to a change in tend, that's how the whole UNG trade started with us interested in buying it while it was still moving down, it had shown nothing in price, but in other places there were many significant changes in character.

If CNBC was really interested in helping their viewers make money, then they'd explain a chart that is far more important than earnings, P/E's, moving averages or any of that, but I suspect most people's eyes would glaze over...This is one of the scariest charts out there because this is a huge, leveraged market where big money and very smart money plays, if they felt ok about making money in this market, this chart wouldn't look like this...

High Yield Corporate Credit which is a huge, liquid market and credit is traded on massive margin so if the High Yield weren't enough, the size and leverage of the market makes it a playground and choice risk on asset for the smartest of smart money, thus the saying, "Credit leads, equities follow".

The plunge here has taken out the entire trend 1 range other than the first gap up day and did it in 1 week. This is a worrisome chart for the market, but you'd never her about it on CNBC, but I guarantee all the guys on Fast Money and Cramer are watching these charts like hawks.

As for early opening FX and Futures trade...

This is opening trade for the FX pair for the week thus far,

3C stayed very positive at the deep dive and then went negative, since the open for the new week, 3C is in a deep leading negative divergence. This will be an asset of great interest this week.

SPX futures (ES) opened at the green arrow, it doesn't look like much is going on here on the 1 min chart, but...

The 5 min chart has guided our 1 day options trades like the QQQ bought Thursday because of the positive divergence and sold Friday for a 50+% 1-day gain, it's leading negative here.

NASDAQ (NQ) 1 min futures on the open this week look a little more troublesome in 3C.

As does the 5 min chart.

We'll see how the tone of the market looks early this week, if there's significant increases in volatility, then we have some great opportunities for 1 day (give or take) trades like the last QQQ trade except with more potential gains. If things start slipping fast, like the EUR/USD, then it's back up the truck and fill it up.

Here's to a great week, it looks like they just paid the electric bill at the Super-Dome.