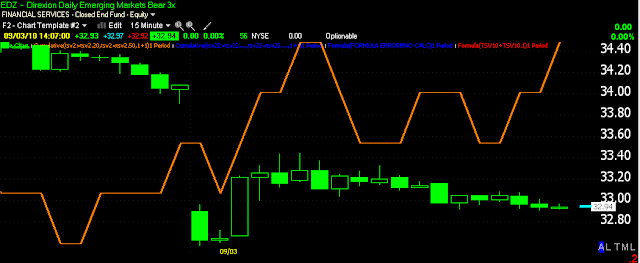

Fell flat, below in the square is the time he was speaking

The most probable reason it fell flat was because all of the ideas he mentioned had already made their rounds through Wall Street, no surprise, so no surprise.

This isn't to knock anything he said, just to point out that Wall Street was already aware of all of this and it has been priced in. I feel there may be some things in the unemployment report that may be not so great aside from the headline number, I'm looking for a link now to look at the U6 data, I feel the market is more interested in that then the headline number which is largely for public consumption.

Remember, there are almost always revisions.

What took the wind out of the sails of the employment number was the ISM Index. A Reading of 50 is stagnation, below 50 is contraction. The number came in at 51.5 from a consensus of 53.5 which was down from July's number of 54.3, so it was quite a disappointing number and you can see a direct correlation between it and oil, look at what USO did at 10 a.m. when ISM was released. Yesterday I showed you the negative divergence in USO.

So it's back to watching 3C.

I think it's interesting, the charts I showed of Gold yesterday breaking down toward the end of the day and the heavy negative divergences there-another coincidence? I even posted an update "This may be it for gold".

Finally, recall the "Friendly Market Conditions" I mentioned and wrote about yesterday. I think today we are seeing why, yesterday was easy for smart money to sell into higher prices, this morning, other then the gap up, it's not been so easy, they'd be selling into consecutively lower prices.

As I try to point out, we can see the what, we just don't know the why until later. Some of the questions of yesterday have been answered today.