Early there was some support from JPY crosses, they have lost momentum and are pretty much lateral, I'm suspecting that's what the SPY Arb is about, but it too is now getting interesting and potentially some trade opportunities.

This is why I try to be patient, the first thing you see is usually far from the last during the trading day.

So we know about the JPY Crosses, for now they are no longer of any help. What will be interesting or valuable is to see how they and the Yen react as the day moves along.

SPY arb is pretty darn obvious and running at a +$.60 differential which is carrying about 2/3rds of it's movement today. VIX short term futures held up amazingly well this morning while HYG was moving up, it seems like an HYG Arb alone was being tried, it wasn't getting the job doen (TLT looks pretty strong in here, very good confirmation so I doubt it could be used in the SPY Arb), then suddenly as if out of nowhere, VIX short term futures drop EXACTLY to reversion to the mean of their correlation with the SPX.

However, there's movement in HYG already on the negative side in a flat range.

The trade that looks like it might have the best chance is VXX calls or long equity in that or UVXY, but I would wait and let them give their own strong signals and not just depend on the HYG signal.

For a quick explanation of how algos create this arbitrage trade, when HYG (High Yield credit, an institutional risk on position as opposed to Investment grade credit which is risk off or flight to safety)rises, algos simply look at it and say, "Smart money is buying" and the algos buy. There are 3 assets that make up the model that Capital Context uses, HYG, VXX and TLT. For a positive arbitrage (supporting market upside), HYG must go up, VXX and/or TLT go down. If one, like TLT is pretty flat as it is today, then the movement of the other two will determine the Arb.

For VXX the algos see the short term VIX futures as a flight to safety or reach for protection, so if VXX is moving up they algos interpret that as risk off and a flight to safety, they act in the same manner, sell, but if VXX drops, the algos interpret that as money flowing out of the safety trade and in to the risk on trade.

Bottom line, when HYG moves up combined with either VXX and/or TLT moving down, you have a positive Arbitrage that is market supportive. If HYG moves down and VXX and/or TLT move up, you have a flight to safety Arbitrage that is not supportive of market gains, but losses so keep that in mind when looking at the charts.

Remember, TLT is out of the game as it is flat and it doesn't look like it's going anywhere except maybe up as it has good confirmation, that would be a market negative as it looks like a run toward safety and away from risk.

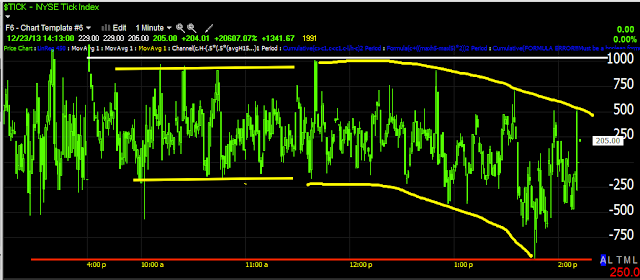

This is VXX vs an inverted SPX price in green so you can see the correlation which iss normally 1.0 meaning in a perfect world they'd move exactly opposite each other and when I invert the SPX's price as I have done above, they'd move exactly the same.

Early on today VXX would not move down as SPX moved up (seen as down here in green because I inverted price to make the correlation easier to see). Then all of the sudden VXX moves down quickly and right to the "reversion to the mean" or correlation (green box).

This helps move the Arbitrage positive, especially if TLT is down and/or HYG is up. HYG seems to have the most Arbitrage influence lately, but big picture for the year and especially since May, HYG is deeply dislocated from the market, in other words credit ha not bought this rally, they don't trust it.

This is HYG (blue) High Yield Corporate Credit, a popular Smart Money risk on asset, notice the last several days it has been almost perfectly inverse or opposite the market, that is strange, it shows Credit is again, not buying or excited like equities, but this morning we have a very fast move nearly vertical in HYG which can be manipulated pretty easily for short bursts of time, not in the long run though as I mentioned it's already well below the SPX for the year which is a leading indication.

Here's where several different trade possibilities open up or start to... This is why we are patient, let it come to you.

This is HYG intraday, you can see it moved up just like I showed you above vs the SPX which is market positive as the computers interpret that as smart money buying and follow along,

but we already have a well developed intraday 1 min negative divegrence, this is where the new negative divergence would start, on the 1 minute chart and it is leading negative so pretty strong and also there's a flat area in price which is also where we typically see divergences.

To show it's strong or strengthening, it needs to migrate to longer timeframes, that shows there's heavier distribution (in this case), that's migration of the divergence and that's how we know the probability is the divergence is stronger and will effect price.

Ideally HYG would start making a decent short candidate or puts, but I don't like trading it for a couple of reasons, 1 is the beta is too low.

The HYG 2 min chart, notice the divergence starts at the same area, that flat price range, so we have the first step of migration which also confirms the divergence as being stronger and not just a passing signal.

Now it's also making its way to the 3 min chart, so migration of the divergence is in effect and HYG is likely to come down if this keeps up

.

That means VXX is likely to stabilize and start moving up and the Arbitrage is flipped on its head and the market loses support and has a good chance of losing ground.

This is where the trades are, especially for options because of the deeper moves which reduce the premium.

This is the delayed SPY Arb, it was activated around 10 with HYG, you can see it grew as VXX fell, it's worth about $.60 of the SPY's gains today, meaning it created about $.60 of the SPY's gains today.

From here the "possible trade" would be in VXX or UVXY, they can be equity, but because of the way it set up, I prefer options.

Or it can be as simple as a short Market ETF like long SDS or SPXU, but we want to wait and let VXX also give strong intraday confirmation along with HYG and ideally the intraday averages should as well.

I already see it in a few areas including Index futures.

Like ES/SPX futures intraday and around the same time as HYG going negative.

In fact VXX is now going positive, but the signal needs to JUMP off the chart, which I suspect it will.

We also see it here as the SPY cannot confirm the upside on even a 2 min chart by this time in the day, so it seems the intraday support for this move is skin deep and without the Arbitrage to help, it could get in trouble quick, which makes for a nice options trade or you can go with an equity position,

patience is still key here, we have a set up, but let it set up.

This is the SPY 5 min, this could have easily confirmed by now, it hasn't. The positive is RIGHT before the F_O_M_C, you may recall

, this is why we entered longs an hour before the FOMC as well as held a full portfolio of trading longs.

Since then, not good and it gets worse after Friday's WQuad witching as did a number of assets and indicators as shown last night.

Not only are HYG and VXX important to watch for the set up, but probably the most important is the IWM, this was one average that did confirm on intraday charts in the morning as mentioned, this is the 2 min chart, no confirmation here, so again the move is pretty skin deep with only 1 min intraday charts in line, that's not much support.

However, this 1 min intraday chart in line with IWM is an excellent barometer of what's going on, when this goes negative along with the other assets mentioned, probabilities for a number of trades sky-rocket.

We have a start and a set up, we also have time so I say just keep being patient, let these charts jump off the screen and tell us to make a move.