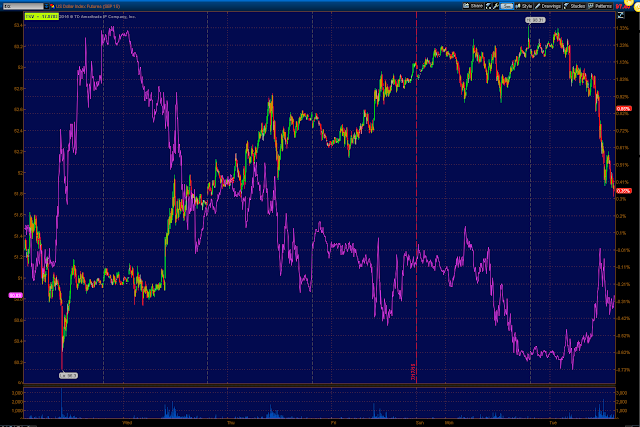

this was not short term analysis of the FX pairs, this was big picture and the charts and signals that we saw yesterday remain just as relevant if not more so today as we saw in today's Futures Update SO THIS WAS NO ONE HIT WONDER, ACTUALLY IT WAS A WARNING SHOT OVER THE BOW IF ANYTHING CONSIDERING THE DEPTH AND STRENGTH AS WELL AS CONSISTENCY OF THE CHARTS/DIVERGENCES.

I call these indications the shadows, they may not be the charts of the averages themselves (although those are not lacking in quality signals), but they are no less real. I think one of the main drawbacks of Technical Analysis is that technical traders have always tended to be lazy and look for the "Holy Grail" of indicators rather than just do the work and make the discoveries that no Technical Analysis book I've ever read has pointed out. If I can make the connection between the $USD/JPY and Es/SPX futures and then break down the currency futures to determine what the most probable course is, then how much more so do you think the traders who specialize in these markets and I believe it's because of this that we see such strong confirmation signals. The pros aren't reacting to one indicator or asset, but noting changes that are like a shadow of something very real that's just out of sight.

For at least a good week now I've been pointing out the strange relative weakness in the Dow as it is usually one of the last to give out and one of the best to hold up in a bear market, but compare the Dow to the NASDAQ since this bounce around 7/10 and as of the close the Dow has gained +.91%, lost .99% today alone as UTX and IBM accounted for nearly half the losses and compare that to the NDX which had a solid head fake move set up and has gained +5.75% over the same period down -.12% today. That's quite a difference in relative performance and we have been talking about the Dow's relative weakness in the charts for nearly a week now. The Russell 2000 which should lead a risk on move is only at a +.19% gain for the same bounce period. There's something obviously wrong in the major averages' relative performance alone without digging deep.

There has been ZERO improvement in market breadth, NASDAQ being the worst.

The earnings juggernaut of after hours has been one UGLY affair and this may change the very near term forecast for a bounce as I'm not seeing much on the earnings radar that is helpful. That includes GPRO, CMG, YHOO and MSFT and I just saw this in AAPL, note the 3C divergence...

Who knows though, by tomorrow morning some market makers and specialists may goose things to get out of inventory at higher levels.

Leading Indicators are worse than yesterday and yesterday was worse than the day/week before.

High Yield Corp. Credit which is a lever of market (short term) manipulation made a new low today after having led the bounce in the early part of it. This puts HYG just at the area where it was first tapped to support the bounce on 7/8, a break lower and we are heading to the December lower low.

Pro Sentiment made another lower low after having put in the first positive divergence at the bounce base since the May head fake when it went negative and has led lower ever since.

And 30 year yields which I suspect may sop acting as a leading indicator as thin liquidity seems to be hampering the Treasury market continues, but for now, Yields are acting like the typical leading indicator magnet for the SPX and should drag it lower.

And one of my favorites because of the lack of manipulation, High Yield Credit, which has hit another lower low today. Pro traders are in RISK OFF mode as you can see by the risk assets they made.

As I had said numerous times before the bounce even began, it would be a "Risk Off Bounce" , meaning smart money would be selling hot and heavy in to it and nothing we have seen contradicts that.

Speaking of which, we get another update from BofA/ML on market action by client type which we posted June, just about a month ago when there was $4.1 bn in institutional/hedge fund net sales in a single week, the largest amount on record according to BofA/ML's data tracking which looked like this at the time...

Again, for the week in June, the largest outflow or selling among institutional investors on BAC's data base.

BAC just released their latest update today and guess what, we were right, it was a RISK OFF bounce...

According to Bank of America/Merrill Lynch,

Year to date according to BAC, Institutional clients remain net sellers YTD and guess who's holding the bag?"Last week, the S&P 500 rallied 2.4%... as the situations in Greece and China turned seemingly less dire and 2Q earnings began to come in better than expected. Amid the rally, BofAML clients were small net buyers of $32mn in US stocks, led by private clients. (Private clients’ flows in recent weeks have suggested uncertainty over market direction, as they’ve alternated between buying and selling most weeks since May.) Institutional clients and hedge fund clients were both net sellers for the second consecutive week last week. "

Institutional and hedge fund clients are big net sellers while retail are the net buyers YTD 2015! As if this were news to us...

What I didn't know or at least had not confirmed was the biggest net buyers of stocks, corporations through buybacks are now starting to fall off. Again from BofA/ML,

"Buybacks by corporate clients were smaller than in the previous week, and the four-week average is now the lowest since January. Buybacks by our corporate clients have totaled $21bn YTD, which on an annualized basis would be slightly below last year’s record $45bn level (chart below). Given that valuations are more elevated vs. a year ago and investors have been agitating for companies to spend on growth, more selectivity in buybacks makes sense to us."

So it would seem that all of those easily swayed retail traders who will chase anything that moves, may just have been left holding the biggest bag of them all, oh would I hate to have been a buyer of the NDX at recent highs rather than adding to the put position yesterday. As I always say, "Price is deceiving".

While it's probably too early to gather much from futures after the earnings rock slide in after hours, I'll be checking in on them later tonight, but we didn't have any really strong indications for a bounce other than a few scattered charts like the Euro, and an excellent AAPL head fake set up which is now completely questionable.

I think I'm going to call it an early one tonight, be glad we got positions in place before the weekend and added some more yesterday. If we can get some additional positions, and I don't see any reason why not, I'll be on the hunt for them, but remember the market always is looking to make the greatest number of traders wrong at any one time, it would seem the momentum chasers of the last week are now remembering that, but despite all of the horrible charts, one day can make a lot of difference so no victory laps, just continue to do what we do.

Have a great night! You may hear back from me in a bit if futures get interesting. Until then, remember the NDX 5 min futures chart posted today in Futures Update and subsequently updated.. This is the reason I want the 5 min timing charts in the direction of any new trades...

NQ 5 min 3C chart, thus yesterday's TRADE IDEA: Adding to QQQ 8/21 $112 PUTS

See ya soon!