In the equities model portfolio, UNG is the only Primary trend long position and is one of the few stocks I like for a long term long position. However if we look at the 4 stages of a price trend (this can be applied to 1 minute charts or 5 day charts), UNG would technically be considered to still be in a stage 1 base. If we consider the trend from the low to the high, approximately 60% of the trend is what we would call the easy money which consists of stage 2 markup and very early stage 3 distribution. The stage 1 base and stage 3 top are the most volatile parts of the trend and typically account for 40% of the trend from low to high, for instance, the base may account for 15%, the actual trend may account for 60% and the top which is typically the most volatile, may account for 25% of the move from low to high.

Thus I consider UNG to still be in the base and the second most volatile part of a move from base to top, the top being the most volatile and the easiest money being that 60% or so in between.

UNG looks to me as if it wants to pullback in the near term. I have about a 9% profit in UNG right now. How you choose to deal with a pullback will depend largely on your trading style, while some may choose just to ride it out, others may want to move out of the position and try to buy back at a lower price.

One caveat to the % trend estimations above, UNG is in my view a unique case. I believe it is looking at a secular change in trend and as such may offer much more upside than you might calculate using my estimations of the cycles of a trend vs. how big the UNG base is. A secular trend is bigger than a primary trend or what we commonly call a bull market. For example, from 2002-2007 the SPX was in a bull market, from 1980 -2007 the SPX was in a secular bull trend. I can't say UNG will see a 27 year trend develop, but I do believe it will be bigger than a stock's average primary trend.

The charts...

UNG's long term 5 day chart, volume alone shows a recent change in character, in the past I have outlined a number of reasons why Natural Gas may be ready to enter a new bull market.

This is what I view to be the approximate base in UNG with a break out above the red trendline sending UNG in to stage 2 mark up.

Rate of change also shows a recent change in character in UNG.

The 60 min chart shows a very positive looking base area

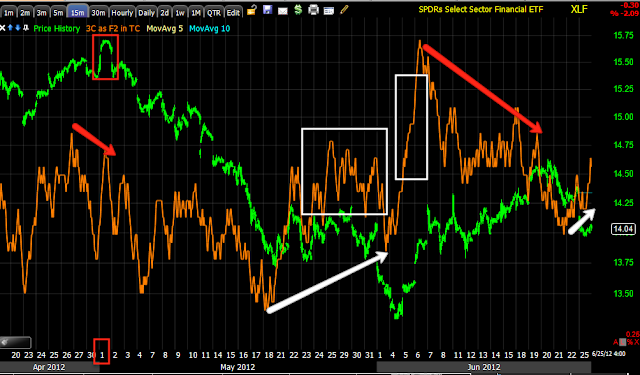

However the 15 min chart looks like UNG is ready to pullback, this is not unusual volatility for base building.

As for timing, the 2 min chart looks like a pullback will start very soon.

I can only guess at a pullback target at this point, I would think the $16.50-$16.75 area would be reasonable.

The Trend Channel would suggest $15.75 would be on the extreme end of a pullback.

Is interest rates about to start going up?

-

Yes, I know - it does not make any sense - FED is about to cut

rates...but....real world interest rates are not always what FED wants it

to be.

6 years ago