Today was interesting for a myriad of details, but not too far removed from the The Week Ahead forecast. Early weakness was not as weak as I expected, but then again I don't believe it is done.

The VXX Call position opened Friday after Taking Both VIX Puts off the Table and opening Trade Idea-EXCEPTIONALLY SPECULATIVE...VXX Short Term Calls, worked well and was well timed. The VIX call trade which was meant to be a very short term trade, essentially taking advantage of any weakness early in the week, actually ended up (with the May 22nd expiration rather than the intended May 15th expiration) closing at a gain of +.22% for the day. That is what the trade was essentially meant for, although I decided to leave it open as I believe we have more downside. See today's VXX / VIX Futures Update.

Interestingly the TLT long (call options or because I could not get calls, I used TBT short to create a 2x leveraged long TLT position) position from Thursday, Trade Idea: Long Bonds / TLT was put on at half size as a counter trend trade/swing+ trade as posted in Bond Rally / Swing as well as Friday's The Treasury Counter Trend Trade which said the same thing as both posts on Thursday...

"This tells us that a near term pullback is likely even though the position entered yesterday went green today. I left room specifically to add based on expectations we'd see a pullback as the chart above indicates."

So weakness in the market early in the week, VXX bouncing and TLT / Treasuries coming down to build out a wider base were all expected today and for the most part, were all exactly on target except I expect a bit more weakness from the market which we'll get in to below.

There's also the question of oil/USO which is getting to be interesting. Who knows what happens with Greece tomorrow.

Despite what we saw as of last week and forecast, it "seemed" like stocks were holding up early on what "seemed" to be considered a rotational move from bonds to stocks or some trepidation waiting to see if that theme caught a toehold. As you can see small caps (yellow) and transports (salmon) were the best performers on the day, still the Russell 2000 only closed up +0.07% on the day. Everything else was down about half a percent.

Above we have 30 year yields in red intraday versus the SPX in green and just as 30 year yields which move opposite treasuries, broke 3% the market hit another leg down. So much for any rotation perceived or otherwise.

This is TLT in red as the bond market closes at 3 PM. Note how the SPX tries to bounce after the bond market closed, but new highs in yields (via futures) killed that move.

Remember our treasury trade, rather countertrend trade. I only opened a half position as I suspected treasuries would come down to form a larger base before moving higher.

Shorts in treasuries are near their extreme range so there is a lot of fuel for a short squeeze and the perfect place for it.

There's little doubt in my mind that treasuries continue lower on a primary trend basis as the 60 minute chart shows with 3C downside confirmation.

However near-term, this 10 minute chart moves from in-line to a positive divergence and a wider base running additional stops today. This is along the lines of what was expected on Thursday and Friday, thus the half-size position which can be filled out.

The five minute chart shows more detail and a stronger looking divergence in TLT (20+ year treasuries).

And the two minute chart shows a change in trend as well.

Here's a closer look with a negative divergence on Friday as was suspected. I would wait until we have better short term chart confirmation of accumulation before entering the second half of TLT long/ calls. However, There was already evidence of that process beginning and across the entire yield curve.

30 year treasury futures on a one minute chart intraday with a positive divergence as prices come down below Thursday's low, exactly what we would want to see when we suspect a base is being built.

This even migrated to the five minutes chart.

The five and 10 year treasury futures are also showing positive divergences intraday. I suspect we're going to see a nice countertrend short squeeze but I do not see this as a trend reversal.

As for the averages and my belief we will see more weakness…

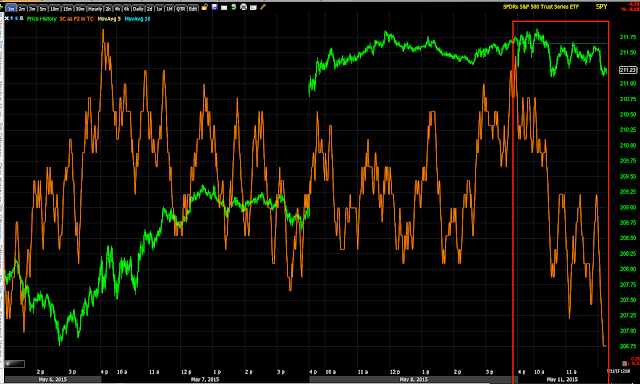

SPY 2 min leading negative

SPY 3 min leading negative

IWM 2 min leading negative

IWM 3 min leading negative, However as I've already made clear, I suspect we may see a bounce attempt but we will only know what the probabilities are once we see price come down some more and determine whether or not it is being accumulated short-term.

The QQQ 10 minute chart would exemplify this bounce, with Price coming down forming a wider base than simply the "V" from last week.

Futures have something say as well...

The five minute ES chart suggesting more downside near-term

The five minute TF chart suggesting the same.

Bounce or not it doesn't change the big picture...

Four hour ES

Four hour TF/ Russell 2000 futures.

We may see a little bit of strength early in the morning, recall my comments regarding NFLX trade set up. This is based on some one minute charts.

SPY 1 min with a very minor positive divergence. The two and three minute charts above are the highest probability near-term, but this may be the start of accumulation into a move lower as I just mentioned above in determining probabilities of a market bounce or attempt.

As for oil...Timing wise this seems to make sense. The wall street journal reports that OPEC could consider production quotas at the June meeting. If oil/ USO make the move lower as I suspect and gather a head of steam, the June OPEC meeting could be the catalyst for USO to break out to stage 2.

Right now only Kuwait and Qatar can meet their budget at $76 a barrel oil according to the IMF, that means OPEC members can't afford prices this low much longer.

The Dominant price volume relationship today was in all of the averages except for the Russell 2000 and it was closed down / volume down, which I have nicknamed, "carry-on" as in keep doing what you're doing, meaning the market is likely to move down tomorrow as it did today as there are no short-term internal imbalances.

I'll check on the futures later to see if anything interesting is developing but as of now I don't have anything to add to what has already been published late last week and today. If I do see something in futures tonight, I will post it.

I think we'll have some nice opportunities over the next few days for both short-term leveraged trades and longer-term trending trade entries as well as seeing some current positions post gains like VXX.

Have a great night

Is interest rates about to start going up?

-

Yes, I know - it does not make any sense - FED is about to cut

rates...but....real world interest rates are not always what FED wants it

to be.

6 years ago