Earlier before the F_O_M_C minutes came out, I warned as I always do about the knee-jerk f-e-d effect and the market's seeming indecision. What I find a little surprising in retrospect is the market's volatility in both directions, apparently the two F_E_D presidents speaking last week and this week (Plosser and Fisher) both raining on the hopes of QE3 weren't enough to dampen the blow of the F_E_D minutes which did nothing for those hoping for more QE. CNBC's talking points about how the market mis-read what Bernie said pre-market last Monday were also interesting, the fact is, Bernie was ambiguous enough that he could claim plausible deniability, we addressed this that same day, but Bernie's intensions were clear, he threw out the statement and knew how the market would "choose" to interpret it, then sent out some regional presidents to let the market know they got it wrong (at least this is the facade put up for retail investors). CNBC came in to the fray today saying the market got it wrong too, but I wish I had heard CNBC on that morning just after Bernie made his speech, I wonder if they were preaching the same back then?

The late day bounce in the market had almost no correlation to anything, certainly not the dollar...

Being UUP (intraday ETF for the dollar) has poor volume and a spotty chart it's just as easy to look at the EUR/USD pair that accounts for 50% of the Dollar Index. You can see clearly at 2 p.m. the Euro plummet and the Dollar sky-rocket, this is market negative and stocks did roughly the same, the extent of the pullback in the dollar was quite mild compared to the intraday bounce late in the day, so the dollar wasn't the correlation, in fact the market moved against the correlation.

Here's the same comparing the Euro to the SPX, since the $USD has an inverse relationship with the market, the EUR has a correlation with the market and that correlation looked right on the way down, but certainly doesn't look right on the way back up. There simply wasn't enough of a dollar pullback to warrant the second knee-jerk reaction in stocks.

If we look at other $USD correlated assets, we didn't see the same move that we saw in equities...

GLD is perfectly in line with the EUR which is to say that GLD is trading the way it should be trading considering what the $USD was doing.

SLV had the same correlation

Copper didn't rally away from its correlation with the $USD

Lumber didn't either

Nor did miners

USO was a little sharper then the correlation, but nothing like stocks.

In fact looking at Credit which sold-off and wasn't interested in following the market from 2:45 on, looking at the $AUD, it wasn't interested, there was no real correlated driver for stocks' move.

So what was it?

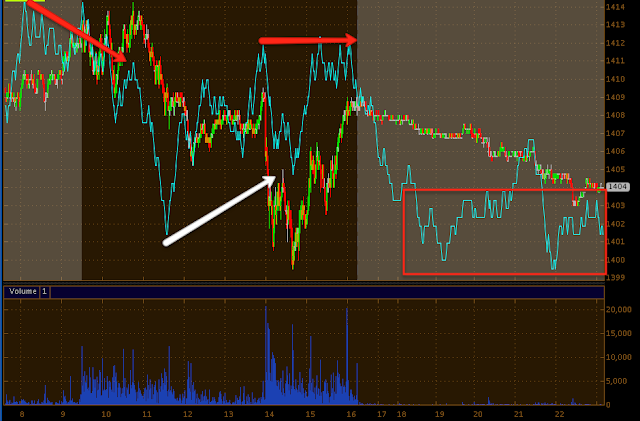

I find this chart interesting...

This is ES (The S&P E-Mini Futures) which are a strong influence on the market, the Channel is ES's VWAP, Volume Weighted Average Price. It seems if there was any reason for the move, it can be found right here on the ES chart trying and finally succeeding in making it back to its VWAP. The VWAP is the area in which institutional selling would occur (it's used as a measure to see how well a market market or specialist fills an institutional order). This is the only real correlation that explains the move, a flight/fight to get back to ES's VWAP and note both times ES was near or at VWAP, the trade size picked up/volume.

As for ES's implied value...

ES is clearly very extended away from the implied fair value of the CONTEXT model, this is what you'd consider a rather large divergence in ES and again it seems like it pretty much has everything to do with making it back to the VWAP.

These knee jerk movements often seem without reason, the financial media will always have some reason why the market did what it did (again for retail consumption), but after looking at all the correlations VWAP is the clear winner. Now what actually happened as the trade size and volume picked up at VWAP, well after a big parabolic move down like that, I'll let you decide why the smart money players, market makers and specialists out there might want to get back to VWAP.

As for the $AUD which has been doing a great job on an intraday basis as a leading indicator...

Every time the SPX is moving up and the $AUD is moving down, there's a divergence that takes the market lower. If you compare the first peak in the $AUD and SPX to the second (middle) peak in both, there's a relative negative divergence there as the SPX is higher and the $AUD is lower compared to the first peak, that middle peak was a much sharper sell-off then the first which stair-stepped down. Now look at the first peak in $AUD/SPX compared to this week's, that's a significantly larger divergence and one of the reasons I said "I wouldn't be long anything in this market right now". If the 1.7% pullback in the Dow can put a month of longs underwater, what would happen on a real crack, especially considering the market is much more lateral then it was back then?

Example:

The pullback is to the far right of the red rectangle and the market was trending up, any trade in or above that red triangle would be at a loss on a -1.7% move.

That same -1.7% move from today's close would look like this...

It would take out just over 3 weeks of longs, however, the difference now is we are not trending up, we are trending sideways and volatility is not low like it was through the entire move up, it's higher (both characteristics of a top). With al of the indicators from Credit to rates, to currencies and more going negative in the March area, I don't think it's a coincidence the market has chopped sideways in fairly large swings.

There are so many different ways to represent volatility, for me the easiest is just to eyeball the chart, but here's a more scientific approach. Bollinger Bands won't due as they are based on the standard deviation of closing prices over a set period of time. This is a Volatility Channel that uses the daily range instead and thus is a better indication of volatility.

In February the channel had about 1.9% of volatility, now it's at nearly 3%, in fact the upped band is off the chart. This is about a 52% change in volatility (1.9*1.52=2.88). At the pullback I mentioned, the volatility range was even less, only 1.7%. However lets just use the figures above as an example.

If we were to consider the same pullback (and that was just pullback) at today's volatility, this is what it would look like on the Dow-30

Instead of taking out 3 weeks of longs, it would put everything in or above the rectangle at a loss. It's a pretty well known fact that fear is stronger then greed and markets fall a lot faster then they rise.

Case in point...

It took 5 years for the S&P to complete its bull market and less then 18 months to tear it all down and then some.

Here's ES since the close...

3C is at new leading lows for the day and quite a bit longer actually.

As for internals, the action today was on

higher than avg. volume (NYSE 817 mln, vs. 805 mln avg; Nasdaq 1750 mln, vs. 1710 mln avg) with decliners outpacing advancers (NYSE 1048/1957 Nasdaq 759/1779).

The larger then average size volume should be noted came on the post minutes decline.

The ratio between advancers/decliners wasn't too extreme to indicate a 1 day oversold event. However the Dominant Price/Volume relationship was closer to a 1-day oversold event in the Dow with a dominance in Close Down/Volume Up-over half the stocks. However this may be offset by the P/V in the R2K Which indicates the market is not in a 1 day oversold condition with Close Down/Volume Down (this is also the most common relationship during a bear market decline). The NASDAQ and SPX weren't dominant.

Dow-30

NASDAQ 100

R2K

SPX

It should also be noted that the bounce in the European market seems to have ended, last week as the European markets declined to support, I expected a bounce there, this is strictly technical as the fundamental situation there is deteriorating fast.

In addition, the European Top 100 Index has not only closed below the 50 day moving average, but the X-Over Custom Crossover screen is showing a sell/sell short signal as the 10 day crosses below the 22 and the custom indicator crossed below its moving average and RSI is moving below the Zero line.

I should also mention the EU 100 rallied about the same as the SPX, (SPX +22.5% since 11/25 and the EU 100 +21.5%)

So to summarize, the knee jerk reaction and volatility is quite common after anything F_E_D related. The most likely reason for the rally at the end of the day had nothing to do with any correlations (algo arbitrage) and looked a whole lot more like a run for ES's VWAP. I wouldn't think the larger trade size at the VWAP would have been buying as the average trade size during the move up in ES was smaller.

7:00 AM ET

7:00 AM ET 7:30 AM ET

7:30 AM ET![[Report]](https://lh3.googleusercontent.com/blogger_img_proxy/AEn0k_skIOxF0s0CsRJyiE-QqDZZItxv9mYelw21WEdcPKeAuN8X-i4YvZ57mZnXsnsaAs5wWaO_Fr9R5-aJc1H-HFrX2_KCOwkWsqYc6ZipLeLD-ZgIn6dSSk6qGENVyoHH2IyAo43l2sY=s0-d)

![[djStar]](https://lh3.googleusercontent.com/blogger_img_proxy/AEn0k_s4tw9ELIQssq2PRxianSPVgm5YRi0LjJF4s0QlnRRTW98PmtMrEJrt-yWsyi82naduiL52cS-_Bs2Il6OLNWKqTAQMvp6mgNwpPuw8GkGuy7pa3JS3eKYV5KhF=s0-d) 8:15 AM ET

8:15 AM ET![[Report]](https://lh3.googleusercontent.com/blogger_img_proxy/AEn0k_skIOxF0s0CsRJyiE-QqDZZItxv9mYelw21WEdcPKeAuN8X-i4YvZ57mZnXsnsaAs5wWaO_Fr9R5-aJc1H-HFrX2_KCOwkWsqYc6ZipLeLD-ZgIn6dSSk6qGENVyoHH2IyAo43l2sY=s0-d)

![[djStar]](https://lh3.googleusercontent.com/blogger_img_proxy/AEn0k_s4tw9ELIQssq2PRxianSPVgm5YRi0LjJF4s0QlnRRTW98PmtMrEJrt-yWsyi82naduiL52cS-_Bs2Il6OLNWKqTAQMvp6mgNwpPuw8GkGuy7pa3JS3eKYV5KhF=s0-d) 10:00 AM ET

10:00 AM ET![[djStar]](https://lh3.googleusercontent.com/blogger_img_proxy/AEn0k_s4tw9ELIQssq2PRxianSPVgm5YRi0LjJF4s0QlnRRTW98PmtMrEJrt-yWsyi82naduiL52cS-_Bs2Il6OLNWKqTAQMvp6mgNwpPuw8GkGuy7pa3JS3eKYV5KhF=s0-d) 10:30 AM ET

10:30 AM ET