""Finally, as I said in the week ahead forecast, I think early Monday we'll see some weakness, perhaps in to a bounce later in the day and maybe in to Tuesday, I expect HYG to decline from there as it has already started falling apart. If the 3C charts don't put together an intraday positive after Monday morning, the market will be in big trouble fast, however based on breadth like the S&P and Morningstar sectors, I'd expect at least 1 day of correction to allow them to try to work off some of that oversold tension, but oversold can quickly turn in to bear material, that's how this market will end.

Have a great weekend."

And more specifically...

"If the 3C charts don't put together an intraday positive after Monday morning, the market will be in big trouble fast...

oversold can quickly turn in to bear material, that's how this market will end."

Specifically today, all 4 major averages are now below their F_O_M_C Knee-jerk move from last week as the Dow loses all of its gains today on a -.68% decline, this is the concept of the F_E_D / F_O_M_C knee jerk reaction and how it's almost always wrong.

The Russell 2000 added to its July highs loss now at -7.5% and its year to date loss of -3%.

Interestingly, some of the financial sites are now picking up on the elevated SKEW we have pointed out since Friday, which started Wednesday after the F_O_M_C. Friday's SKEW reading was the highest in almost 16 years, just 1 month shy (15 years 11 months), so there's definitely something to the smart money bid for deep out of the money puts that can only be worth something if the market essentially crashes, thus the SKEW is often called the "Black Swan Index".

I had to dig deep today to find hints of expectations in the near term as they dictate what we'll do with the rest of the week, but those two sentences from Friday's Daily Wrap are the KEY to this market and just how bad off we are.

I looked at ES/VWAP, the area market makers and specialists try to fill an order to sell or buy for an institutional client in stocks they make a market in, in this case sell as institutions use the Volume Weighted Average Price as a report card on the effectiveness of the fill the specialist (NYSE) or market maker (NASDAQ) end up filling their order. Today looked desperate which has me a little on the fence regarding yesterday's divergence and today's possible head fake move to set the divegrence in motion. This is what we forecast on Friday in the week ahead and the Daily Wrap, front end of the week bounce based on a deep (now much deeper) oversold breadth condition which means oversold market of stocks while the stock market's facade hides the deterioration below the thin veneer. If I have to call one or the other reality, the number of stocks in decline vs new all time (recent ) highs in the market is much stronger evidence of the overall market's position which I think I have been appropriately comparing to a ginger bread house.

Today's VWAP action in ES looked more like desperate selling than accumulation or a head fake move off yesterday's divergences, this is why the sentence from Friday is so important..."

VWAP applied to ES/SPX Futures today...

During the cash market there were 4 attempts to hit WVAP, the sell area for middle men, the last 3 failed before price broke below VWAP's lower standard deviation. This has a distinctly different feel than the possible 1-day divegrence and head fake move just before it launches...

Since HYG failed so miserably today as expected Friday, it seems the USD/JPY was the only support and that failed just after the European close with ES ([purple) dislocating to the downside something fierce.

Speaking of HYG, it was not without its gravitational pull as HYG has been forecasted to lead the market lower just as it has led every stage over the last 2 months.

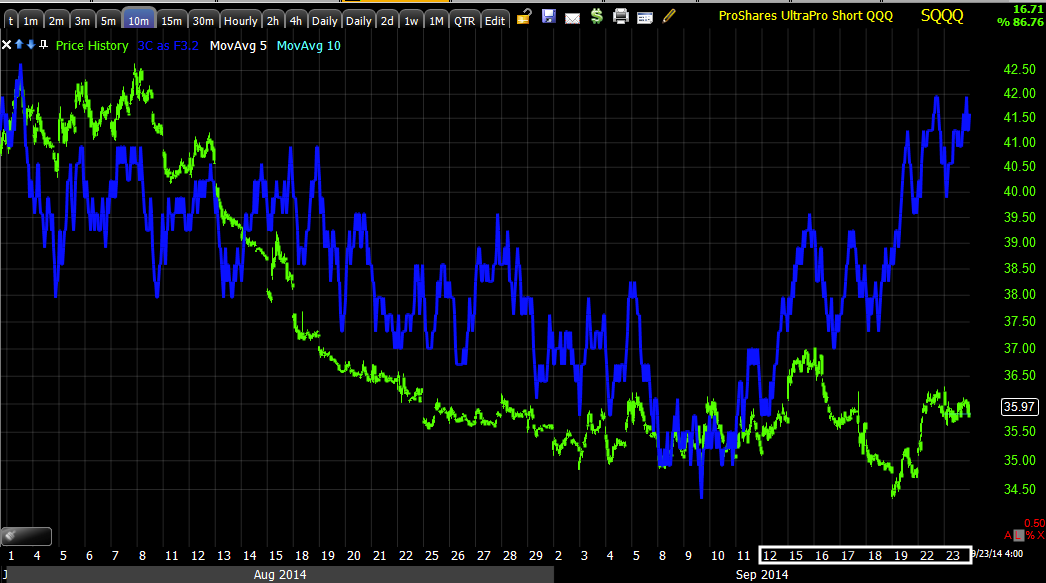

HYG (blue) vs SPX (green ) intraday today

And HYG vs SPX for the entire August cycle in which it led by 4-7 days.

After the close, the SPX broke its 5-day moving average, I'd expect that as a head fake move during regular hours as it would be very effective, maybe it will have some effect tomorrow on the open, but here's what happened shortly after the close.

The red arrow points to the after hours bid/ask (blue hash marks) and the SPY broke below its 50-day moving average.

Another interesting correlation today was yields, we know they tend to act as a magnet which is why we have long used them as a leading indicator, for instance 5 year yields as a leading indicator...

The 5 year yield tends to pull the marke toward it and acts as a good divergence indicator as seen above, the SPX in green nearly perfectly in line with Yields.Interestingly today, the market could not escape the pull of 30 year yields as we recently posted TLT's pullback is over...

30 year yields in blue today vs the SPX, each stab at VWAP seemed to be pulled down by yields making TLT's 3C charts of interest.

TLT's shorter term probabilities still favor a minor pullback, but as far as the pullback from August 26th (when we posted the signals of it), that pullback appears to be complete and higher prices look to be in TLT's futures, thus any short term pullback would make a nice entry and judging by the action in 30 y yields vs the SPX, maybe a necessity for the market to bounce at all even for a day.

The leading indicators signaling a positive divegrence/head fake move today were largely in Professional sentiment, let me emphasize that these are weak, short term signals only, the larger trend signals are also provided and that gives you more evidence of the massive market failure we're expecting, actually already in if you are in one of the 47% of NASDAQ composite stocks already in a bear market or 1 of the 40% of Russell 200 stocks in a bear market or even RUT short as my SRTY long keeps moving my portfolio's equity line higher and higher every day.

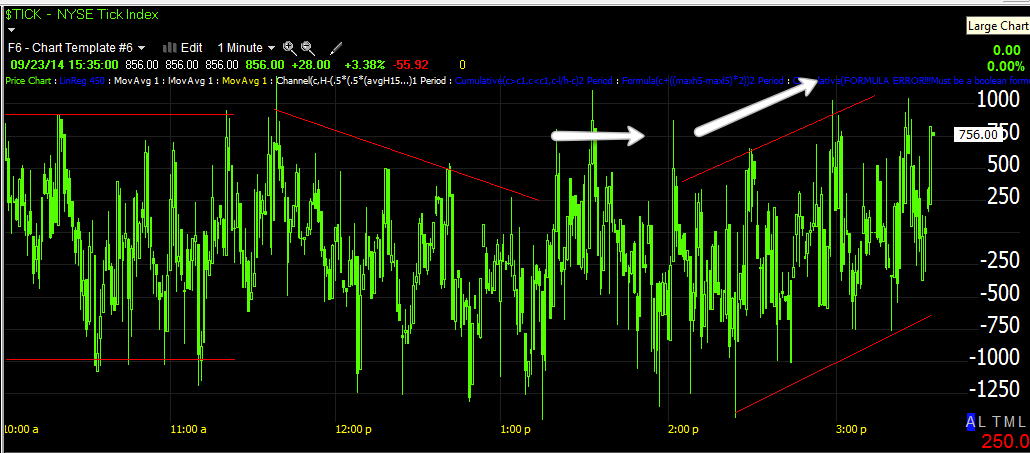

This is the second one today.

However as mentioned, as just another piece of the puzzle for the primary trend's resolution to the downside, look at their longer term signals in the August rally which was all based on oversold breadth...

The first is leading negative like HYG.

As is the second and you can see how effective they were in leading and confirming the market in the earlier stages of the August cycle.

So while it's VERY borderline, we have several short term indications that the early week divegrence and bounce can still get off the ground, although intraday trade such as ES/VWAP looks pretty darn bad.

I dug extra deep in breadth indicators today to try to get a feel. Normally at any other time over the past 10 years or more, these indications would lead to a next day bounce, this is what I've feared for the market itself (good for me and most of you), as I wrote Friday, the second sentence...

"oversold can quickly turn in to bear material, that's how this market will end."

Since we are not up against Quad witching like yesterday, today's Dominant Price/Volume Relationship is of more use, however it was a dual dominance, but still oversold. 16 of 30 Dow stocks were Close Down/Volume Down, like I said yesterday as this was the dominant theme, I call it "Carry on" and that's what the market did today. However the second place theme was Price Down/Volume Up, it's still bearish as price is down, but the volume up usually signals a short term mini capitulation event or bottom short term, there were 13 stocks oin this DOW category.

The same is true for all the other averages, the dual dominant relationship will show Close Down/Volume Down first and second, Close Down and Volume Up (both close down though showing extreme weakness in the market). The relationships in the other averages goes as follows keeping in mind which theme . For the NDX, 42 to 37; the R2K 735 vs 784 , The SPX 206 vs 125.

although not a singular dominant theme as I usually look for, the oversold breadth is obvious, it's just a matter if it works like it has for over a decade or if something is really broke in the market as warned Friday (in red)...

I decided to look at more of my scans to get a better feel, I found of my DeMark buy and sell signals, the buys were 146 and sells only 17, this leans toward short term oversold and a bounce.

The S&P sectors saw 9 of 9 red for a second day, extremely oversold, but yesterday should have produced a bounce today, if we don't see something tomorrow, I fear that warning above in red may be reality. On a 5 day basis, 8 of 9 are red for the week, materials leading, Energy lagging. On a 2 week basis, 2 of 9 are green, 6 of 9 red with Financials leading and Energy lagging and on a 21 day basis (still in our stage 3 top for the August cycle), 6 of 9 are red with health care leading and Energy lagging.

Amazingly like yesterday's absolute dominance of sellers, of the 239 Morningstar groups, 215 of 239 were red, almost the entire market across the board. On a 5-day basis, 216 of 239 are red.

Interestingly, considering how bad breadth deteriorated yesterday, several of the indicators posted made almost no move today which would be bullish considering market action. The New High/New Low Ratios for multiple periods (in terms of weeks) barely budged today whereas yesterday they saw huge deterioration. Apparently there weren't a great number of multi-week new high/lows, however as that breadth indication saw some neutrality which can only be bullish in this market, others saw continuing deterioration like the Advance/Decline lines, take the NASDAQ Composite's for instance..

NASDAQ Composite (all NASDAQ stocks) saw the A/D decline deteriorate even more...

And the Percentage of Stocks Above or below certain moving averages, deteriorated again today, for example, the percentage of stocks above their 200-day moving average...

Hit a new all time cycle low today, meaning there are now only 48% of all NYSE stocks still holding their 200-day moving average, widely considered the demarcation between bull and bear market on a primary trend basis while a mere 2 months ago this average remained around 80-85%.

If you're a long term trend trader then the MCO's signal not only below its averages, but below zero and near -1500, would have you on a long term trend short.

There's very little in the way of a silver lining except how oversold the market is and yesterday's divegrence, meanwhile at the same time, before all of this happened, I posted Friday that...oversold can quickly turn in to bear material, that's how this market will end."

We may be headed for that ending, in which case, you'll be glad you have shorts in place as markets fall about 5 times faster than they rise and tend to give back more than they gained. For now though, I'll stick with this week's forecast.