I provided a list of quite a few stocks on my short watchlist, I want to take a look at AAPL and give you some ideas of how and when you can enter a short trade with AAPL as an example.

AAPL is turning in to an ideal short candidate. First we have a major top, it's difficult to short in the top as trade is choppy and you are likely to get stopped out unless you have a very long term perspective and wide stops. The fact AAPL has broken below the top is good and it's something you should look for in your short trades. Next it has seen the typical bounce into resistance, often breaking above resistance shaking out weak shorts and generating buying interest which Wall Street can short in to.

A simple indicator like ROC (Rate of Change) can be used similar to 3C, looking for negative divergences that show momentum is fading. Stocks only have 3 directions, up, down or sideways. Since we have an uptrend in the bounce, the next likely move is down.

3C closely mirrors ROC in this instance. Note as well that AAPL has underperformed the broad market on a relative basis the last 3 days.

This is a Swing type entry that I favor. The last green candlestick I drew in, as an example. When looking at the daily trend, we see an uptrend, which is comprised of higher highs and higher lows, other candles within the trend not making higher highs and higher lows are essentially noise in the trend. We want to focus on what I call the signal candle. Right now the signal candle is at the red arrow, it is the last daily candle to make a higher high and higher low, the candle after made a lower low so it's noise and today's candle made a higher low, but not a higher high, so the candle with the red arrow remains the signal candle, this could change tomorrow if we get a candle making a higher high and higher low, that would then be your signal candle, but for now, lets work with what has happened.

I want to go short when the trend has shown a high probability of reversing, we don't want to play guessing games. What I look for is a daily candle, it doesn't have to be tomorrow's, but what is important is that the high of the candle is lower the the low of the signal candle, as you can see, the candle I drew in as an example has its high lower then the low of the signal candle, this is an ideal spot to enter AAPL short. A stop can be placed above the highs of the signal candle or you can use the Trend Channel, resistance or any number of other stops, but my example stop will likely have very little risk.

You may have to read this several times and always feel free to email me with questions, but it will eventually make sense.

ADM provides us with another common market event that offers a high probability entry, that of the false breakout.

ADM shows 2 false breakouts, the first makes a slightly higher higher then local resistance, the more important the resistance level, the better the opportunity. At the first arrow ADM broke resistance, but closed below it on the same day, this s a high probability entry and a stop can be put just above the day's high. The second example ADM broke down below the top, an ideal situation, then rallied to resistance and broke above, the close was very poor, near the lows of the day, but didn't break support. The second day it did break support confirming the breakout as a false breakout and offering a high probability entry. A stop should be placed above the high of the first candle to break through resistance as it's a bit higher.

Here's another example using ADM, this is meant for longer term traders. Our entry is the same, a false breakout at the white arrow, even though it doesn't look as impressive on this 5-day chart, it still qualifies and you can use the 1 day chart to verify a false breakout. A down trend is a series of lower highs/lower lows, in this case, ADM would still be an open short position since the entry. While there are numerous stops we can use, and you can blend strategies like using a 1-day stop, but for the sake of explanation, will stick with the 5 day chart. Within the trend, the last candle to make a lower low/ lower high is our signal candle, we get a lot of noise and don't want to be stopped out on meaningless noise. In this case, we reverse the AAPL entry for the stop. Out signal candle s in yellow as it was the last to make a lower low/lower high, we would only stop out if a new candle, like the one to the far right that I drew in were to occur. What shows us a change in trend and therefore stops us out is when we get a price candle that has its low higher then our signal candle's high, like the candle I drew in at the red arrow. Again, only when we have a bounce that forms a candle in which the low of the current candle is HGHER then the high of the signal candle (the high is drawn in as a yellow trendline).

Not to be too confusing, but we can enter and maintain a longer term position and still use a tighter daily stop, there are many blended approaches, but I wanted to show you a few examples of entries and exits as you watch the stocks in your watchlist.

You may want to bookmark this post to come back to the concepts until you understand them well enough, they take a little time to understand, but once you do, you will see the logic in these high probability/low risk set ups.

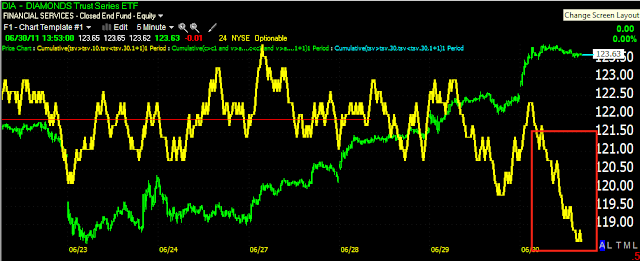

As for the market, it's doing what we expected, we'll see if we get a false breakout which would be nice or a reversal of the trend. The last 3 days have looked strong as far as price, but internals including volume, Price/Volume relationships, breadth and 3C have shown them to be significantly weak in the underlying technicals.

I'm always here for questions and I have thrown enough at you tonght to probably generate some questions, but these are some effective ways to enter a trade, manage a trade and exit when the tme s right. At this point on a 5-day chart, ADM would still be a short and have you at a 19% profit.

Is interest rates about to start going up?

-

Yes, I know - it does not make any sense - FED is about to cut

rates...but....real world interest rates are not always what FED wants it

to be.

6 years ago