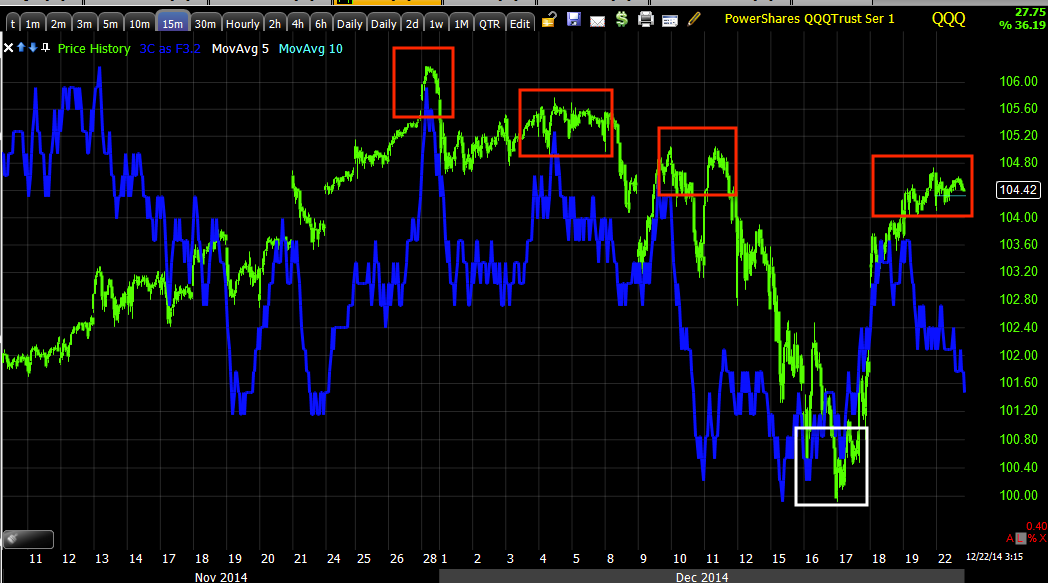

You saw what the Q's looked like in this update, MARKET UPDATE AND GLD P/L, they look bad and pretty darn close to a core short full house (multiple timeframes all consistent in signal).

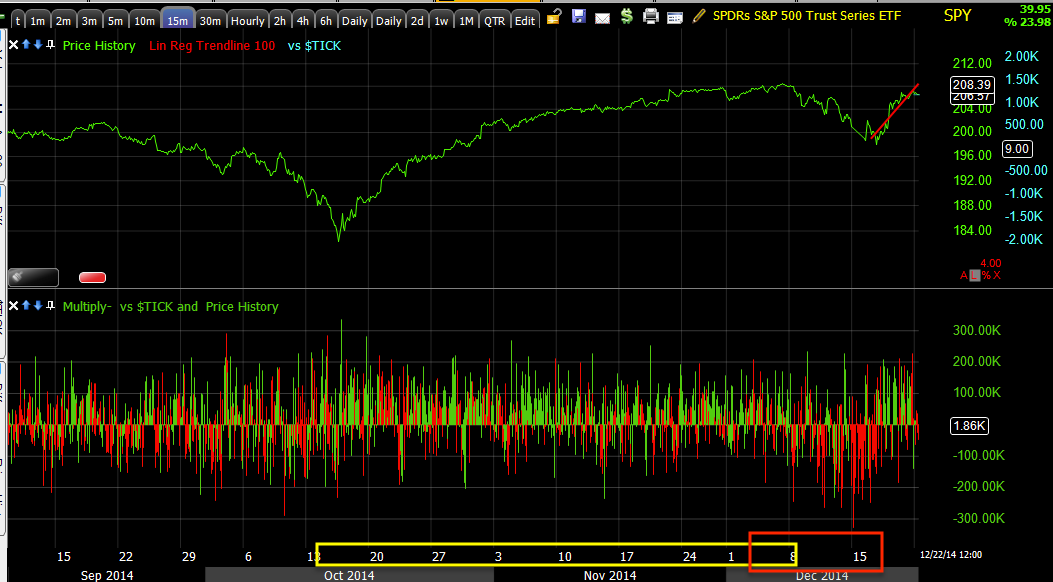

Even though we saw this move coming, (some of you decided to trade it and did very well), for me, even though I consider myself to have a high tolerance for risk, I would not trade this and rather decided to just be patient; the reason being is such a sharp "V" shape reversal can't be trusted in my view. These types of sharp bases can give spectacular gains one day and wipe you out the next, if you think about it, it's not very different from the market on a macro theme in which the Dow saw it's worst weekly performance in 3 years/the SPX worst weekly performance in 2.5 years the week ended December12th, that carried through the next Monday and Tuesday to some extent and then we get the best 3-day move in 3 years and I expect shortly we are about to get another headline move to add to this string of them as the 5 min charts turn negative.

I don't know how many of you recall the first half of the year in which the averages crept up to make all time new highs on +0.10% moves, there wasn't a single 1% move for months, a very low volatility melt-up. Contrast the change in character now vs. then in volatility alone. As I mentioned earlier and we have seen with many recent examples, volatility tends to be high between stages such as between stage 1 base and stage 2 break-out. The entire Channel Buster concept is a change in volatility between stage 2 mark-up and stage 3 top and probably more than anywhere except for capitulation at the end of stage 4, volatility is extremely high between stage 3 top and stage 4 decline.

In any case, this is about the NASDAQ/NQ and Tech.

This is the NQ/ NASDAQ Index Futures 7 min chart. This last move up that we forecast Friday December 12th, about 2.5 trading days ahead of time, mainly reached the 7 min chart, meaning it was a tradable divergence from my standard of needing the 5 min chart or higher in divergence, but again it was the base I didn't and still don't trust.

While it's easy to say, "I'l just trade this for a couple of days and then get out", people have a funny way of falling in love with assets which are the last thing you want to fall in love with which is why you see so many people who made so much money in a bull market lose it all in a bear market, AAPL was another good example or Gold until 2011, people had made so much money there, they couldn't believe it could be anything different than what they knew in the past and end up losing everything. I've read a lot on the psychology of bear markets and this subject and it's fascinating, but point made hopefully.

This 7 min chart is the worst looking of the Index futures.

Even on a 15 min chart you can see the leading positive divegrence before the F_O_M_C, it's not as clear as the 5 or 7 min charts were, especially as it was happening, but in retrospect it's clear and more so is the negative divegrence.

If you are wondering why the negative divegrence would be so much bigger and larger than the positive divegrence, the simple answer is it is being sold in to strength, whether short selling or selling of long positions. This is why, when I refer to this move, I say that the Crazy Ivan head fake BELOW the range that set the bear trap that led to the strongest small cap short squeezes in 3 years and pushed the IWM above the range around $118 was a means to an end, the distribution is the end, unfortunately for many that will only be clear in retrospect when it's too late to have used this set up to position yourself.

Here a 30 min leading negative divegrence in NQ as well as the positive divegrence is clear. While this looks like a longer positive divergence it started last Friday, the same time this move was set out as a theory with later confirmation Sunday, Monday and Tuesday. Again the negative divegrence is multiples stronger in leading position vs a relative positive divergence (the weaker form of the two divergence types).

This is NQ's 60 min chart. I want you to get use to seeing divergences because they are the best signal you will get no matter what indicator you use: MACD, RSI, Stochastics, simple Rate of Change in price, breadth readings, etc.

Divergence analysis is by far the strongest signal which Dr. Alexander Elder, Author of "Come Into My Trading Room", makes a great case for in MACD divergences, however few people have understood divergence analysis beyond what they have read or been taught with regard to a single indicator, you can use it on just about any indicator.

So the positive is smaller here as it should be on a stronger underlying flow chart, but it should be visible vs. price and yet the leading negative jumps off the chart with little need to look very hard.

We can go even further, but then we are getting in to MACRO analysis rather than the specific analysis tied to this specific move.

As you can see, EVERY timeframe from 7 to 60 minutes are all in line with the same divergences, this is very powerful confirmation and a very strong edge that you should always look for in positions and analysis.

This is also a core-type position because our 4 hour and daily charts are also leading negative which suggests that any move up is bound to be sold in to and resolve to the downside as the main flow of the largest force of the underlying flow is in one direction.

From here I'd have absolutely no problem with entering or holding core short positions, but I endeavor to give you the best timing possible as there are many different types of traders here from long term managers to short term day traders, thus what I consider an excellent overall entry right here and now, for someone day trading or using options needs the best timing possible which is not always easy, but it is what I try to provide.

Do not let the charts above escape your attention, they are showing overwhelming confirmation.

The one chart I'm still waiting for...

This 5 min chart of NQ is still not giving the leading negative divegrence that would give us one of the most sweeping full house of divergences we've had in Index futures (so far 7, 15, 30, 60 4 hour, daily, weekly and monthly all negative. If I were a money manager I'd be finished now with all of my short positions unless I had some cash laying around for playing options to juice returns, I'd be done considering these divergences. Personally in my own account, I am done. I am in position, as you know, even expecting this move I decided not to risk missing the downside where the real story is and gladly held my shorts knowing this would be a sharp move as my minimum target was $IWM $118, which means I knew (as did you) in advance what kind of sharp move this would be, but that doesn't dissuade me from keeping my positions aligned with the strongest probabilities. Had the base been different perhaps I would have traded it.

I have suspected the 5 min charts were not yet divergent because this IWM breakout was not as strong as I imagined (imagine two candles just like the first one moving up after the head fake shakeout below the range). I expected something more along the lines of 2 or 3 very strong candles slicing through the range's top, rather than these small stars sputtering through, but again, the percentage change in 3 days may be more than enough to create the psychological reaction that leads to the taking of action and creating the bull trap, that will be sorted out any moment. From here, the 5 min charts could go negative by midnight,

IWM Daily range, Crazy Ivan (dual shakeout on both sides of the range). Note the last 3-days small candles and diminishing volume, these are not what I expected for a move above $118, I was looking for something solid like what a 2-day chart might look like.

However as I have said, see the QQQ charts, don't let the NQ (NASDAQ 100 futures) charts above escape your memory, they are in rare formation with the kind of edge that we find only once in a great while.

As for Technology which the NASDAQ is heavy with...

XLK-Technology Sector...

This is a 1 min chart of XLK, I like these charts that show rough confirmation or the divergence to the far left with a clear positive standing out before the F_O_M_C and the leading negative, it's like they are calibrated and back-tested, the former signals were all good, I have no reason to doubt the current signals.

The 5 min XLKshows November highs divergent as well as early December, both lead to the forecasted downside and then the positive divegrence pre-F_O_M_C and a sharp leading negative divegrence since that is larger than anything since.

The stronger 10 min chart and the same findings. Multiple timeframe confirmation is not only strong because of numerous charts agreeing on the same events, but the signals they produce are stronger as there are numerous timeframes often reaching very long term.strong underlying flow, which makes these a very sharp edge to trade.

Here I didn't mark anything on the 30 min chart, but the early December divergence leading to downside should be very obvious, is you look close the positive of last week should be visible, although it looks smaller here because it was not as strong as the current divergences and the failure to confirm and leading negative current position should be apparent.

On a long term 2 hour macro trend chart the leading negative at the rally off the October lows is exactly what we forecast at least a week before the October lows were in and the upside rally started, this was the rally I said would be a face ripping move and to book mark the post.

Look at what has happened during that time, the exact thing we forecast to happen before the move up even started, distribution through a strong move in price.

I'm not a huge fan of TECS because of its liquidity, but if I were looking for a broad technology short with leverage and without the constraints and drawbacks of options, I'd consider TECS long (3x short Technology ETF).

As for broader coverage in the QQQ, I personally hold SQQQ long, it is a 3x leveraged inverse or 3x short QQQ.

The 1 min chart is leading, but looks a bit damages today. If we look at intraday trade of the 1 min chart, it's really not much damage.

1 min intraday today, it is largely in line with a slight negative bias, no major damage though at all.

2 min is leading positive, I suspect the 1 min charts are stalling so larger transactions can be wrapped up at these price levels because I'm consistently seeing charts beyond intraday steering (1 min), leading negative like this telling me they are pinning price in place and supporting it as you saw earlier with assets like short term intraday HYG support, to continue to sell/short sell into.

What I find interesting about this 5 min chart, as leveraged ETFs often give the earliest and cleanest signals, I suppose because of their leverage, is the fact it remains in leading positive position. It seems there are some large size traders who decided to do the same thing I did and simply leave the SQQQ long position open, waiting for the market to conclude this bounce.

The 10 and 15 min charts looks the same as well.

We have multiple timeframe confirmation that fits with NQ/NASDAQ futures as well as QQQ, now for another asset and more timeframes, TQQQ or the 3x leveraged long QQQ ETF which should show negative divergences for confirmation.

While I find certain assets in line on 1 min charts, assets that are leveraged long like TQQQ are not in line, there's apparently no reason to wait around any longer while the underlying QQQ must be pinned in place to allow exists from assets like 3x leveraged longs, this is what I suspect is going on today as TQQQ's 1 min chart looks very different.

The mid-term 15 min chart shows former divergence and price move as forecast as well as the positive we saw market wide with the price move as forecast and now a leading negative15 min.

I have no reason to believe, especially in light of leading indicators, credit, bonds/yields that this divegrence is any less real than the others. In fact it's more in line with the longer term macro trends than any.

Speaking of which, this TQQQ 60 min chart is a pretty serious macro trend, I trust I don't need to draw any notations on the chart.

Speaking of confirmation, here's the same chart in SQQQ, 3x short QQQ.

Again, they should give nearly directly opposite 3C signals and they should not be hard to see.

I'm going to give the market another couple of hours before concluding the Wrap as there are some movements on 5 min charts starting and I'd like to see where they go.

i'll also be updating UNG which has been slammed since the EIA Natural Gas inventories on Thursday morning 10:30, why they were slammed, and what the silver lining is that has been "seemingly" overlooked, although if I had a chance to accumulate an asset at much lower prices with a certain bit of knowledge that changes the game, I'd take it as low as I could get it too, "Buy low, sell high".

I'll be back with you shortly.