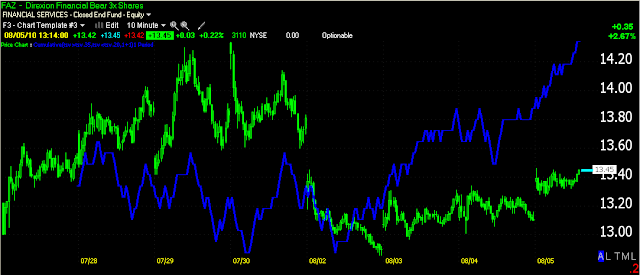

So everything that I said, rather that 3C implied yesterday, came true today. The question is, what happens at 8:30 Friday a.m.? I have a sneaking suspicion... If you are new to the site, WELCOME! Also please read tonight's post at Trade-Guild and last night's, and that should clear things up in a hurry. If I'm wrong, which of course is always a possibility, fear not, I've compiled a list of over 200 longs and shorts for either scenario.

We have been using limit orders because of the uncertainty, they have been triggering everyday-today there were a couple, CAM was one and although it didn't fall apart, it's still good positioning as this one at least is a position trade in which we expect to see a trend develop and that's where the solid money is. If things look bad by 8:35, then I complied a list of short ETFs that give pretty decent market coverage without too much overlap and they are all leveraged. You can find these trades on the June list at June 3rd. If you are new and don't have a short position and need one after the report, then I personally would mix it up between the ETF's and real shorts-there are advantages to real shorts that inverse ETF's can not offer-mainly that you can use profits from the trade without closing the position unlike longs, which the inverse ETF's would be. As for limit orders, there are too many to remember, so go to www.FreeStockCharts.com and put them in an alert list-plus it's free real-time charting, no exchange data delay!

Interestingly, there are still some decent looking longs in the market and a subscriber threw this on out today (Thank you).

RINO

The daily chart is a stage 1 base, it came right after a stage 4 decline so it is where it is suppose to be. MACD which is exceptionally long in the settings (52/104/9-if you want to make money, you have to see what the crowd missed) is positive. The ascending triangle makes for a nice base and volume is correct for the pattern. Today it just broke out on HUGE volume. The effect of this volume is a teaser, an attention getter and that which attracts retail buyers to move this from a stage 1 base to stage 2 mark up or more commonly known as "the rally" where smart money will sell into rising prices.

Speaking of smart money, this daily 3C chart shows everything-the stage 3 top with the red arrows pointing out distribution, the blue arrows point out areas of accumulation-the first led to a 2.5 month rally-a bear market rally, much like I believe we are in now in the broader market, but to the historic extreme. Then we see the accumulation forming a base and then 3C is in a leading positive divergence that led to today's breakout. This is how it happens, quietly they accumulate, they do a little selling in the base to keep prices in their target range (usually around a VWAP) and when their done accumulating, they ring the bell and let everyone know that RINO is open for business.

This 15 min 3C chart illustrates all of the above. Red=distribution-knocking prices back down to cheaper levels and the white is accumulation. The last arrow points out a leading divergence-oooh, I wish I saw this a few days ago!

And this is the 3C 1 min chart where market makers and specialists primarily operate; it calls intraday moves exceptionally well. Did you know that up to 30% of the volume in any one stock is due to market makers trading their own accounts? And they have the advantage... if you put in an order on the books, they get to see your cards. Clearly they stocked up for today. Note the blue square where prices pulled back-this is not a negative divergence, it is in line with price so it's simple confirmation. I don't know why, maybe nervousness about tomorrow or simple profit taking. In any case, after a 1-day run like that, a pullback can be a good thing to clear away the dead leaves and underbrush.The only thing I don't like about the chart is it's too perfect-no false breakouts? In any case, my plan would be this, if it is showing positive pre-market indications or opens on a gap up, I'd take maybe 50% of my intended position. A close below $15 and I'm out and fast. I'd then wait for the first pullback close to the 10 day moving average and add the rest of the position and use a 22-30 day moving average as a stop or email me for a Trend Channel stop. The main thing is this, any indication of a false breakout, you want to be out, but this has so much accumulation, I think they need to run it up to sell their inventory. Look for follow through, hopefully tomorrow.

As for other trades, I personally would go through the July/August list and set limit orders on all the limit trades that haven't triggered-those can be bought intraday or on the close, but we try to stop out on the close, not intraday unless something like I described above were to happen. Any of the longs or shorts that are trending for you, email me and I'll update you with Trend Channel stops. I simply can't keep up with all the trades, updating every stop every night.

Over the weekend we'll know what is what and there will be a batch of new trades for you, plus whatever I see intraday. Depending on what happens, they may be limit order trades or my favorite, on the open trades as those make so much more money when 3C hits them. The last week has been difficult because although it seems like we've been rallying, the SPY is only up .08 % and that doesn't make for a good trading environment. Remember, patience is our edge over Wall Street-they have to be in the market. Also remember that we have the Holy Grail of trading-no not 3C, Risk Management and the article is linked at the top right of the site. You should know that inside and out and if you have questions, as always, email me.

If you are not using some sort of robust risk management, I don't want to hear about losses-I say it EVERY NIGHT-RISK MANAGEMENT!

Now, lets see what tomorrow brings. As I have said, we are facing a potential opportunity not seen in over a generation. If I'm right, the sheep will lose their coats and we will be making nice new wool coats for ourselves. Hey, it's a zero sum game, you're with us or against us.