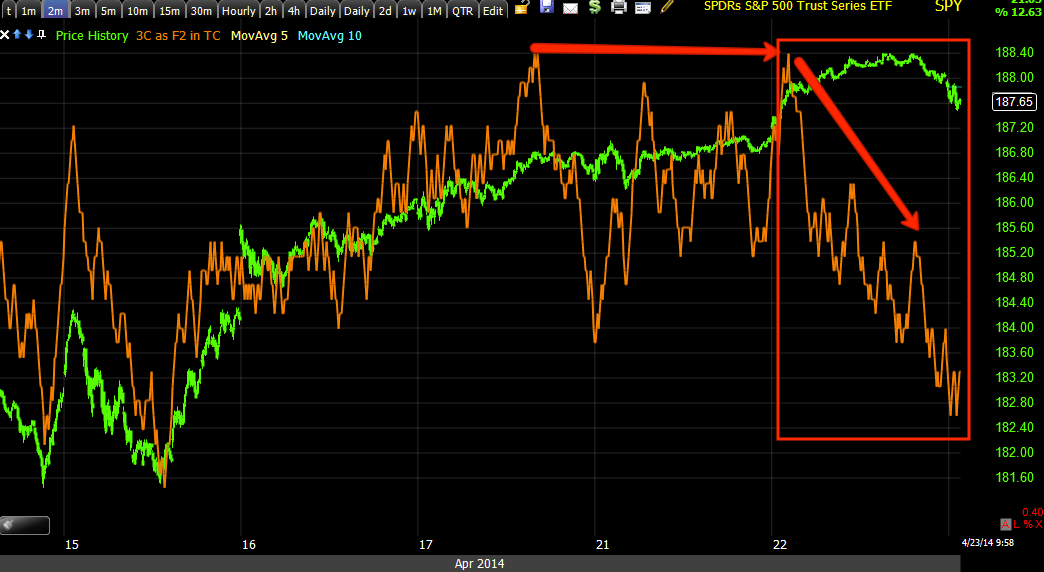

These are the charts that go along with the last post...

MAKE NIO MISTAKE, I LOVE NFLX AS A LONG TERM CORE SHORT POSITION, IF ENTERED AT THE RIGHT PLACE. This 4 hour chart of NFLX is more than enough to tell me which way I want to be trading this when it comes to longer term trend positions, the entry however is very important in getting a good position started and as such, any near term upside can be used for that purpose.

This 30 min chart is a good summary of why I have liked NFLX as a shorter term long for an upside move, not necessarily a new high, but a tradable move.

Recently the pullback signals have been clear such as this leading negative 5 min chart on the gap up.

However, as I posted near the end of day, NFLX looks like it is starting a reversal process from that gap pullback, I think it could come down a bit more and fill the gap as well as potentially put in a head fake move once a rounding bottom or some reversal process is a bit more mature, but I don't see that taking very long (it could be done in a day).

This 3 min chart shows the same negative distribution on the gap up, but take a closer look at intraday activity on the same chart below...

We have lateral price movement which is the first thing needed for an upside reversal and we are starting to see movement in 3C on 1-3 min charts that is positive, I wouldn't consider NFLX for even a short term long trade until at least the 5 min chart has a positive divegrence, but again, that can happen in as little as a day.

We'll keep an eye on this one, it may be a fun little trade for a quick $

Is interest rates about to start going up?

-

Yes, I know - it does not make any sense - FED is about to cut

rates...but....real world interest rates are not always what FED wants it

to be.

6 years ago