It seems the ECB is trying to pressure Greece in to making changes, but when has Greece ever made changes? The new government ran on principles they simply can't deliver on, thus yesterday's talk of the ECB looking to cut the value of Greek Central Bank collateral and essentially severely limit access to the ELA ECB Emergency funding (only a week after having increased it by $800 million euros), which is the ONLY thing keeping the Greek banking sector from all out collapse.

This morning's futures reflected the panic of that scenario about an hour after the European open when it was said the ECB would place a 50% haircut on Greek central bank collateral, effectively killing the Greek financial sector...

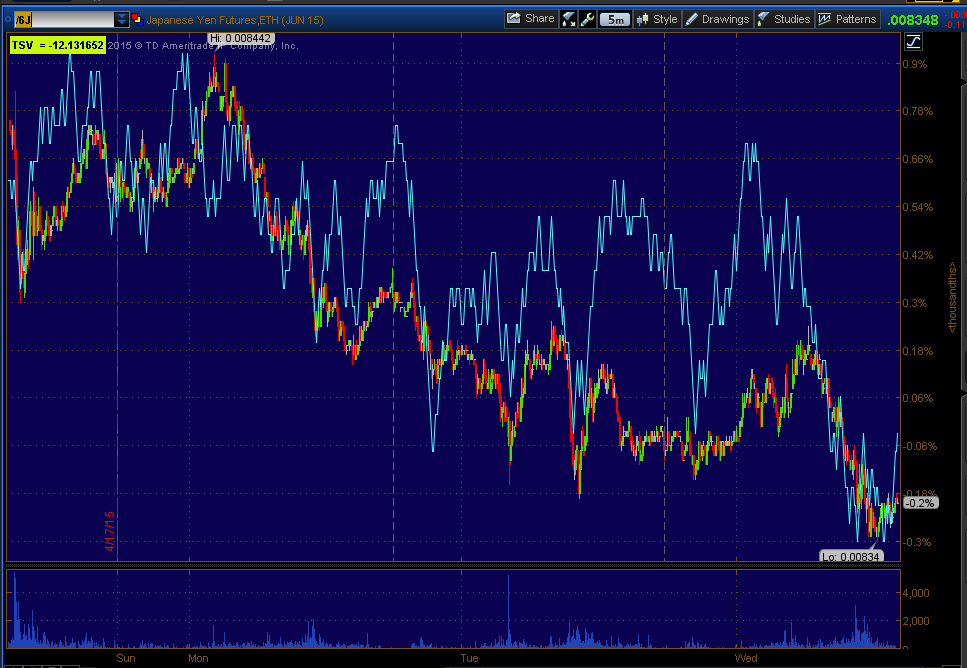

At #1, ECB reports of cutting the value of Greek Central bank collateral sends futures plummeting, only official ECB denials shortly thereafter and the USD/JPY (positive divergences in both USD/JPY and ES) lifted futures at #2. Not to be a dooms-dayer, but even when they had a deal they didn't have a deal, I think this is a self-fulfilling prophecy and Germany is far more worried about it than they let on according to plans to fund Greece after defaults or transition them back to the Drachma. If you thought Lehman was bad....

It would seem to me that the gut feeling of a head fake move above a well known average and a VERY visible resistance trendline (SPX) based on numerous examples of the concept taking place approx. 80% of the time, that a head fake move was and is the most likely course of action as I said last night, although unlike past head fake moves, there have been no divergences to support the theory beyond the probabilities of concept...thus the strange action in 3C charts today off no significant divergences at all, just as we have thought the last several days...It would take some other lever.

I hope you had an opportunity to read the 2 posts I wrote and have linked at the top right of the members site (all the time), "Understanding the Head Fake Move" parts 1 and 2.

However there is another psychological factor in play, that of the attraction to whole numbers as the Dow regained 18,000, the SPX regained 2100 and the NASDAQ maintained +5000. I personally don't think this is the end game, but it is interesting that they keep reaching for those areas.

As for the averages, you might recall some ugly intraday IWM charts and our recent thoughts that transports would make an excellent second chance shorting opportunity if they'd bounce. Well as both situations would have it, the performance of the major averages intraday was interesting given the charts and the Transports trade set up (let the trade come to you).

The major averages intraday are within a fraction of each other, that's some of the best relative performance stability we have seen recently with Transports in salmon leading and the IWM/Russell 2000 lagging (interesting considering the IWM's charts from earlier which can be seen here, Market Update).

Volatility (up or down) is another one of the big things we have been looking for as this seems to always be the transitioning environment from one stage to another and 2015 can easily be called stage 3 top as flat as it has been and as I've pointed out, as many times as I have written that this or that average is green YTD or red YTD over and over again. The large triangles that are way too big to be consolidation/continuation triangles don't help, nor do larger topping patterns like the SPX's Broadening top which is much larger than just 2015.

As for volatility, I posted a chart the other day to show how extreme it has been on a day to day and intraday basis so that even with decent swings, it makes it VERY difficult for traders to hold positions for more than a day or so without some serious emotional dis-connectivity from the market.

Hows this for volatility, since 1 a.m. 750 points in swing in Dow Futures!

I believe I posted an example in last night's Daily Wrap or sometime yesterday (if you need the post email me and I'll get it for you) of the increases in volatility at each and every of the 4 stages of a cycle. This is why in addition to the 3 things I've been looking for since we made the April second forecast of a move higher have included : the 3C charts out to 15 mins going negative, which they have. The Index Futures charts from 7-15 minutes going negative which is more of a timing thing as the 60 min/4 hour charts are leading negative. Still the 7-15 min charts should not just be negative as they were in last night's Daily Wrap, but they should scream for the best timing. The 3rd thing was Leading Indicators, one of the last holdouts despite horribly negative 3C charts has been High Yield Corporate Credit (professional risk asset) it seems that this may have taken a turn toward our direction not only once but again today and likely more significantly as the charts are horrendous.

HYG (blue) vs the SPX intraday, it seems the lever of choice wanted nothing to do with following or leading the SPX any longer and I suspect the late day weakness in the averages that likely prevented them from a breakout (SPX head fake) may have had roots in the collapse of HY Corp. Credit as a short term ramping lever as it gave out.

Note the positive HYG leading signal vs the SPX (green) around the 8th/9th and then negative dislocations at each of the highs and an overall rounding reversal process in both assets.

As for the charts, the trend of this 2 min chart should be very obvious as to distribution in HYG, it can't hold itself up with sellers pounding it like this which has gone from a large relative negative divegrence to a recent leading negative divegrence.

As mentioned, HYG is already in a primary downtrend and here you can see each of the negative 3C divergenceS sending it lower, the most recent is by far the largest and this is a very strong 60 min chart. Remember the general concept is, "CREDIT LEADS, EQUITIES FOLLOW".

There were some short term leading indicators as posted last night and again today , being careful to make sure you see the larger picture in them too, Yields for example have been supportive locally, but dislocated negatively on a big picture basis. They still seem to be offering support, thus I still suspect a head fake move is in the cards, but today's market action just wreaked of struggling to swim against the tide.

As shown several times yesterday and today, it looks like 5 year yields were supportive as the market found footing at the 2 pm lows which I suspected would play a near term role and then again, look at yields leading as the market makes intraday lows this morning.

As for other Leading Indicators, our custom SPX:RUT Ratio...

shows non-confirmation vs the SPX today...

Specifically in the afternoon it got more ugly than you realize looking at the chart above this one.

And since the April 2nd forecast, the leading designation in to early April was a big part of the analysis for the April 2nd forecast, but since it has failed to confirm and this has been an exceptionally effective indicator for us both intraday, next day and longer term like this in a cycle.

Commodities look like they are turning as well as mentioned last night...

Commodities which have started working again as a leading indicator since the end of QE and the last couple of days dislocating vs the SPX.

On a larger scale trend through this year, you can see the signals and the current negative dislocation, thank you China!

HY credit was in line as it should have been after the 4/2 forecast at the mark-up stage, but turned down at the reversal process (stage 3) area and continues to move lower.

Interestingly for a day when levers are applied to the market, the VIX is often one of the first to be whacked, but as shown yesterday, unusually strong positive 3C signals have been gathering the last 2-3 days in VIX futures as well as VXX/UVXY.

VIX futures intraday.

Migration to a stronger 5 min chart and this goes on all the way out to 60 min charts in a mere 2-3 days which is impressive and looks like deep pockets bidding protection.

As for the averages, I showed and mentioned above the IWM's intraday negative divegrence/distribution...

After an early morning selling event/capitulation short term, IWM saw accumulation at the level and then saw distribution in to the afternoon.

However, although it was the poorest relative performer, it was not the only average to show this behavior in to strange divergences today that just looked like money being thrown at the market to push it above resistance rather than the normal accumulation process, very odd.

SPY saw intraday distribution in to the close

As did the Q's.

You already saw the VIX futures accumulation during the same time.

As for USO, you may recall yesterday's update, USO Update-Swing Position, looking for a near term bounce as a second chance position for those interested, I think that's still in play.

The shorter term 5 min chart suggests we have seen near term accumulation yesterday and mostly today, however this is subordinate to the stronger 10 min chart with a larger divergence...

10 min USO leading negative, Translation: Short term bounce, larger move to the downside.

As for Internals today...

The Dominant Price/Volume Relationship among the component stocks of the major averages were all dominant today unlike yesterday, the Dow had 14, the NDX 51, the SPX 198 and the R2K didn't have a relationship.

Once again it was Close Up /Volume Down, the most bearish of the 4 relationships and as a 1-day bias event, usually the next day closes lower, but in this case it could be as I said Monday, reflecting the weakening market as it tries to break resistance.

S&P Sectors saw 9 of 9 green which argues for a 1-day overbought event, similar to the Dominant P/V relationship. The leader was Tech at +1.02 and Consumer Staples at +0.06%.

As for the 238 Morningstar groups, they too are near a 1-day overbought event, but not quite there with 174 of 238 closing green. The market still feels like it's not done and in looking at watchlist trade set-ups, many of them feel like they are not done so I think my overall feeling is the same as yesterday, even though there's not strong 3C evidence for the set up of a head fake breakout move and there's very strong evidence for the failure of one, I believe the probabilities of the concept are very high and this situation makes them even higher with such defined resistance that traders will chase in such a well known index as the SPX. Mean time, protection continues to be bid, I'll try to get a VXX/UVXY update out tomorrow as you'll see it there too and Leading Indicators like HY Corp. Credit which have been the last to diverge are doing so now, if there were to be a head fake breakout and HYG continued to diverge, that would be the typical strong Leading Indicator signal that we have in so many other indicators, Yield need to turn as well in my view. Until then, I think patience is still the best policy lest you get chopped up in a wave of large swinging volatility. Let the trade come to you, let it be on your terms at the time of your choosing with the confirmation that gives you a real edge. BELIEVE ME, I'M MORE ANXIOUS THAN ANYONE FOR THE NEXT PIVOT AND POSITIONING, BUT KNOWING WHEN AND WHERE TO PICK YOUR BATTLES IS MANY TIMES THE BIGGEST EDGE YOU HAVE.

As for futures, as always I'll check them again later tonight, but the USD/JPY more or less did what was expected on a negative divegrence and pulled back a bit, then added some additional gains and is still negative or showing distributive signals.

USD/JPY 1 min. Although negative, it's not screaming negative and after looking at near term $USD and Yen, I think it can hold up overnight, maybe lift the market tomorrow for another shot at the SPX's resistance?

It does matter as you see...

ES in purple vs USD/JPY in candlesticks, the white box is the European open, USD/JPY virtually rescued Index futures.

As I mentioned last night, the process of migration is still a concept that we should see, so considering I'm looking for strong Index future negative signals in the 7-15 min timeframes, tonight's 5 min charts in ES and NQ are very interesting...

ES 5 min with previous negative signals sending it lower, but this leading negative is the kind of signal that I would call "Screaming" or jumping off the chart.

NQ/NASDAQ futures are similar.

TF/Russell 2000 don't look as extreme, but there was little to sell in to in the R2K today as well. These signals have migrated to longer charts as posted last night, although they can develop pretty quickly in these timeframes. When the 7, 10 and 15 min charts look like this, I'd have no choice but to call the pivot.

All of the averages are right there at their respective head fake breakout points, all of the indications point to a false breakout and excellent positioning, it just needs to get done, set the positions and move to the next swing.

Have a great night.