I told you I'd dig, these are the futures for the Euro and the USD, although they tend to move opposite each other as the Euro by far has the most influence on the U.S. Dollar Index, accounting for half of it's weight, the $USD doesn't have to move exactly opposite the Euro. The Euro makes a good proxy, but the $USD is the ultimate source of stock movement as well as other risk assets and safe haven assets.

I looked extensively in to the Euro since Euro is what the entire market is obsessed with, there are some expectations there that match up with the expectations we have been tracking through signals in the market.

Just understand 3C is not like MACD or RSI where a divergence is an immediate signal, we are talking about large sums of money, huge positions and they take time to move so a divergence alone isn't a signal things are reversing, it's a signal that things aren't what they appear and be ready for a reversal.

So if you are working in the FX department of Goldman Sachs and are bearish the Euro next week, of course that information is going to be shared with the futures trading desk as well as the equities and fixed income. This is why we can find confirmation signals in wildly different assets.

So tracking the Euro through different timeframes, here's what we come up with (which are the same as the EUR/USD charts I posted). Just remember how the correlations work and you'll see a lot of themes that are exactly the same, not just in this post, but in posts from this week and even from mid September when we expected the next large cycle to begin accumulating (the same one that started 11/16).

Correlations: EUR/USD up means the Euro is up, the USD is down and this is bullish for stocks. The Euro is up on it's own absent the USD being down, not as bullish for stocks, the USD is what really counts, but the news flow is centered on Europe (a strange dichotomy, but not far from the correlations). No matter what the Euro does, generally the USD up, the market and commodities down and the opposite.

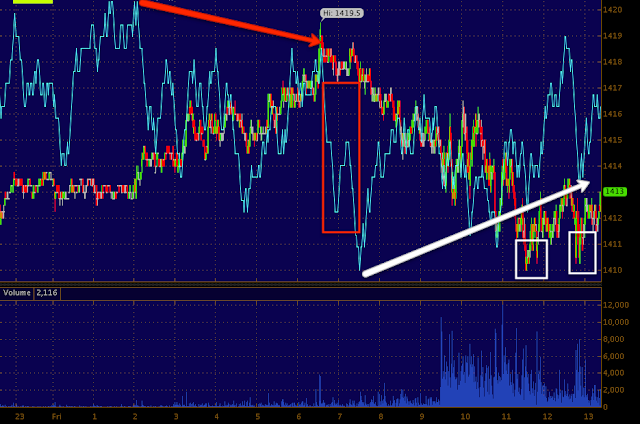

Euro Futures ONLY-no EUR/USD! 1 min chart, the Euro saw a small positive divergence just in time to send it higher before the US open at 9:30, since then no strong signals, mostly in line or confirmation.

Euro 5 min chart is where more institutional money flows are found, this week an initial backing off the $1.30 level on distribution, the green arrows are price confirmation and in to the end of the week, specifically today, a NASTY leading negative divergence, this suggests money is moving out of the Euro anticipating a move down either late today or sometime early next week I'm guessing.

Euro Futures 15 min chart (this shows stronger institutional money flows), price/trend confirmation at the green arrow, distribution at the red ones, recently the last 2 days very strong leading negative divergence.

Euro 30 min-even stronger institutional flow-also leading negative especially the last 2 days. This is the clearest trend of expectations in the Euro, generally speaking, not good for the market.

The USD Futures 1 min today saw accumulation in to the move down, as that reversed and moved up the contracts were sold in to higher prices, the rest of the day just in line for the most part.

The Dollar 30 min chart shows the exact opposite of the Euro which is confirmation, there's a leading positive divergence the last 2 days which means the dollar is expected to rise-a market negative and the Euro should fall.

The 60 min Dollar chart is the cleanest trend, distribution at Dollar highs on the 16th allowed the market to pop up strong on the 16th as the Dollar moved down, in closer term trade, the positive divergence that covers this entire week is bearish for the Euro and the market/commodities (I like SCO even more now.)