By my count that's 4 days of red closes with transports, the Dow-30 and the S&P-500 all red on the year. It seems like I've said that numerous times this year, without even looking at a chart that means we've experienced pretty decent volatility, but not much movement through the year which if we were to apply to a stock on a shorter timeframe (as the concept is the same), we might call it bearish "churning".

There seem to be two distinct concepts we are dealing with right now, first is the concept of fear being a lot stronger than greed, if you don't believe me see how long it took the last bull market to run up from the 2002/2003 base to the 2007 top and then how long it took the market to erase all of those gains plus another -15%, by my count it's about 5 years vs 18 months with most of the downside damage in 8 months. It's just human nature, shockingly, Fear is a more powerful emotion than greed.

Thus our nascent divergence forming the last 2-days which I warned several times because of where we wherein the market cycle, stood a higher than average chance of being run right over. This typically occurs on fundamental news that the market wasn't aware of and therefore has to discount on the fly like this morning's (or rather the overnight) start to the Yemen invasion by 9 MENA countries led by Saudi Arabia. Thus it seems that divergence was run over as it was not well formed and in an area (stage 4 decline) in which fear dominates and easily runs over divergences much more often than in any other part of the cycle, although I wouldn't say it's common.

The second concept is, :Once Wall Street starts a cycle no matter how big or small, they almost always see it through and I'm sure there are good reasons for that. In our particular case right now we are at the end of Q1 so firms will be engaging in Window Dressing or the "Art of Looking Smart" in which they dump their losers, buy the stocks that were the hottest on the quarter and when they come out with their holdings for the quarter or prospectus, they look like they picked all the winners, although it's a thin veil of deception, they do engage in it.

Whether Window Dressing is a factor, I don't really know, I didn't think it would be a factor at the end of the year and it wasn't, not on the upside as both the taken for granted Santa Rally and January Effect both failed to materialize. In fact what we do know from Q4 filings from some of the big guys like Soros or the top paid hedge fund manager over the last 4 years, Appaloosa's David Tepper, they sold a lot of stock and/or increased their puts and bearish bets, Soros by 600% in SPY puts, Tepper reduced equity exposure selling companies like AAPL and FB by 60% for Q4 2014 alone.

However, I'm not making the longer term/bigger picture case right now, I'm looking at the most probable outcome and that was as we said early in the week, increasing volatility both up and down. We've obviously seen that increase in volatility on the Downside as more than half the major averages are red year to date and the largest Index, the NYSE is red since the end of QE 3 back from Oct. 31st. Hopefully you understand very clearly why I wouldn't consider trading the market long for a bounce, the unlikely fundamental event that can roll over a divergence actually occurred (Yemen).

Picking up with the second concept, "Once Wall St. decides on a cycle, they rarely abandon it". today's candlestick closes on daily charts would seem to suggest that this is exactly what's going on, however we have to consider a 3rd concept and that's maximum pain on options expiration Friday and the pin that is usually right around Thursday's close and generally holds until about 2 p.m. at which time the market can jiggle all it wants, but the 3C data of the last 2 hours is some of the best of the week.

Today's daily candlestick close in most of the averages was a Star, a loss of downside momentum which could be related to a bounce , leading indicators and 3C charts suggest that although these are far from the strongest looking 3C charts or it could have to do with tomorrow's options expiration maximum pain pin to cause the highest dollar value of options to expire worthless since smart money generally writes them and is able to keep the premium which is generally where the juice is in options.

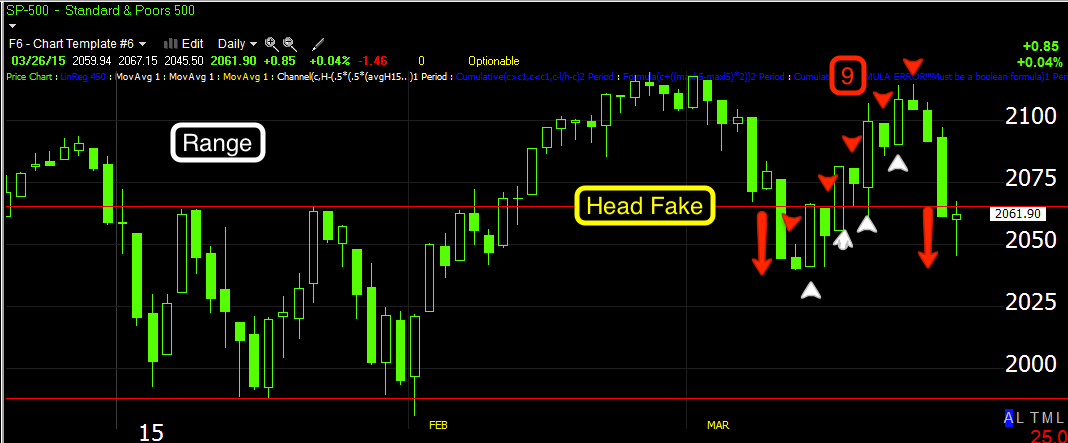

The SPX provides a decent model for most of the other averages' close today...

After 9 consecutive days of volatility and on and off closes, volatility dies at the top as indecision set in as usual and increased on the downside with it falling off today as we have a Star candle in almost all of the averages which is an indecision candle opening the door to a short term change in trend as we have been examining.

This is why I said I believe that just standing by and being patient is a win/win scenario right now as the shorts that have recently been opened or have been open a while work for us on a move to the downside, a bounce allows us to short some assets that have recently broken down and are providing interesting opportunities on a short term move to the upside, take NASDAQ Biotechs for example which closed with a Star (probable reversal candlestick)on increasing volume. We recently picked up on biotechs again as they started giving signals, BioTechs Head's Up, NASDAQ BIOTECHS / IBB and Quick Biotech (NASDAQ) Follow Up .

We are close to our long term Trend Channel stop out and they look quite a bit like a blow-off top.

The near term charts suggest a bounce as does the daily closing candlestik...

The short term 2 min chart shows distribution at a recent possible blow-off top and a recent small positive divegrence for a minor bounce.

The longer 30 min chart which carries a much more important longer term trend is leading negative suggesting smart money has been selling in to this parabolic possible blow off top for some time. So IBB/NASDAQ Biotechs would be high on my list of potential candidates for short sale set-ups.

Transports on a bounce or Financials would also be of high interest to me. These are weak groups that I'd like to short in to price strength , however brief it may be. While it may be brief, I would not expect it to be mild. Increasing volatility is the one thing we were looking for this week which means whether on the downside or the upside, it's really the increase in volatility that matters as to the transition to stage 4 decline with moves to the downside that stick.

If Wall St. is going to make the effort to move an asset or the market, you can be sure they aren't going to settle on half measures and make it easy for anyone who wants to jump in short. No, they will make it looks as strong as they can to scare as many people out of their positions as they slide in to them. Or make it look as strong as possible so they have someone to sell to or sell short to, both trades come across the tape as a sale, so demand is what is needed and after the last 4 days, traders aren't going to just step up and start buying on a half a percent gain, as always, emotions need to be pushed to extremes to create the kind of movement their position sizes require.

It's my opinion based on the information gathered, that the market intends to bounce, so far we are not talking about a bounce like the February cycle or even the 3/11-3/13 bounce cycle, I mean a quite normal counter trend bounce within the last 4-days of decline, like if you were to look at the volatility around the September highs leading to the October lows, for example...

This is the SPX from the September 2014 highs to the October lows, the example I meant was perhaps something along the lines of the yellow box or the yellow arrow, but note by the yellow arrow volatility had increased by a lot and the downside from there got serious. While I wouldn't say this is the exact model, the point is, a "bounce within the already started downtrend". The yellow arrow is a +1.75% day, not even including the rally off the intraday lows. How much more volatile should we expect the present to be? I'd say quite a bit.

You've seen the Leading Indicators, you've seen the charts as they are. Here's an example using Index futures of how I would trade this and why...

I typically like to work from the long term probabilities to the short term probabilities. The fact is, the market needs to be analyzed in multiple timeframes as multiple trends all exist at once. If I ask you if you made money long or short on any given day, each of you could have a different answer and all be correct, it depends on the timeframe you are dealing with. For example if the market has lost -10% over the last week and one of you has been short the market over that period, you made money. However if within that -10% loss, say today saw a +1.5% gain and someone bought at the close yesterday, they are long and also made money. Thus multiple timeframe analysis is about finding the right tool for the job, the right trade for the trend.

The concept is, the longer the chart, the stronger the 3C trend so this 1 day chart of ES/S&P E-mini Futures that shows a leading negative divegrence (light blue=3C) at the very area we said had to be broken so smart money could sell in to, which was the 2015 range. Traders will buy a breakout of a range, especially at new highs and that's what smart money needs to sell positions as large as theirs without turning the market against their position because of its size and predatory HFTs and traders front running.

Since this is the worst this chart has looked, it tells me the big picture is very bearish.

A Very strong chart of NQ/NASDAQ 100 futures, but not quite as strong, the 4 hour shows the same area that needed to be broken on the upside before we'd see any real downside (yellow line) also shows strong 3C leading negative divergences. The point is to get multiple timeframe confirmation through multiple assets as most will move together (about 2/3rds).

And a still very strong, but not quite as strong, but more detailed 60 min chart of TF/Russell 2000 futures shows the accumulation or stage 1 of the base we predicted when we closed our AAPL and QQQ puts on March 10th, expecting a bounce and expecting to see strong distribution in to it. This chart is also leading negative and it included the F_O_M_C knee jerk reaction, which I always warn, is almost always there and almost always wrong.

We've retraced the knee jerk move since the F_O_M_C, thus the knee jerk reaction or anyone who bought it is at a loss.

Now shorter term charts which show us shorter term trend like this 5 min NQ/NASDAQ 100 futures has the negative divegrence that sent prices lower this week and a small positive divergence now. This suggests a short term bounce, nothing much more as the 60 min, 4 hour and daily chart are all negative.

The 15 min ES/ S&P futures is a stronger timeframe and chart, it also shows the negative divergence at the highs that sent the market lower and a recent positive divegrence confirming the 5 min chart and telling us it's a bit stronger than just an intraday bounce.

Thus we take it all together and we get a near term bounce , one that will look powerful as Wall Street doesn't do anything in half measures, they have to cause movement and to do that they have to hit upon emotional extremes of fear and greed.

The longer term charts are the highest probability so they already tell us even before a bounce has begun, that the highest probabilities are that it will fail.

Thus I want to wait for the bounce and trade with the probabilities meaning wait until the bounce is looking extreme and showing short term negative divergences on these shorter charts that are now positive, I want to then short in to that strength or sell any longs I might want to be rid of.

In this way I let the trade come to me on my terms rather than chase it and I can confirm by the shorter term chart divergences that there is distribution in to higher prices, that smart money is selling or shorting and then I simply want to be doing what they are doing as money moves the market. These are among my favorite trades, I don't have to do anything until and unless the market proves my theory was correct, the trade comes to me on my terms at the time and place of my choosing rather than chasing it. The only thing this takes is the ability to be a little patient and a little patience can go a long way.

As for some assets we have recently talked about, we have a half size long in oil/USO, I intended to add the other half on a decline in USO near it's regional lows. I still believe this is a probability, although obviously the War in Yemen has changed the landscape for the present, thus I'll be patient and keep my eye on oil for the right opportunity.

Gold I have also expected to pull back a bit. Gold has gained as a flight to safety asset during the recent days of trouble in Yemen, but I believe it still has more basing work to be done before it can truly hold a trend reversal which I'm very interested in. Today's gap up in gold and lack of any further gains, leaving the daily chart with a Star on higher volume, possibly churning and negative divergences suggests I stay the course and wait for the anticipated pullback in gold.

Of course I mentioned a couple of assets on the short side I'm interested in, Biotechs, Transports and Financials, but there are numerous other stocks and a few groups that have caught my eye as well. Biotechs just didn't have the charts to consider a new short 2 weeks ago, as of last week, they started to change in character, thus if I can get a bounce there, I'd be interested in a short.

I think we pretty well covered leading indicators, bond yields, credit, etc. as well as the 3

C charts as far as what we have right now. If something else develops in futures, I'll update it as I usually do so long as my eyes are open.

That leaves us with internals and breadth.

Honestly I was a bit surprised by internals although perhaps I shouldn't have been. The Dominant Price/Volume Relationship among the component stocks that make up each of the averages was dominant in all but the Russell 2000 once again, the R2KL has been missing a Dominant P/V theme nearly 75% of the time over the last couple of weeks which is strange.

As for everything else, the Dow came in with a Dominant P/V with 16 stocks, the NASDAQ 100, 56 stocks anf the S&P 500, 188 stocks. The theme of the 4 possible scenarios was Close Down/Volume Down.

This is the theme that has the least next day bias, the most common theme in a bear market and the one I've nick-named, "Carry on" as in keep doing what you were doing as it doesn't have a strong next day bias so I take that as meaning keep building that base that I suspected needed to be widened out, thus is may look something like this...

Note the "W" shaped base I mentioned as a probability earlier today and note the new lows as a run on stops before any bounce.

The S&P sectors came in with 87 of 9 in the red led by Materials at +.23% and lagging with Utilities at -.84%.

The Morningstar groups were similar with only 175 of 238 in the red. This is a fairly dominant and close to oversold on a short term basis, condition, but the Dominant P/V relationship isn't there. This is another reason I suspect some more base building tomorrow during options expiration (weeklies).

A one day oversold P/V relationship would be something like Close Up/Volume Up or even Close Up/Volume Down if it were near the end of an uptrend on something like a bearish candlestick, like a star or hanging man.

As for breadth indicators they took a hit this week. Of all the NYSE stocks (the largest index), only 44% are above their 40 day moving average. Only 48.7% are above their 200-day moving average.

Viewed as a market of stocks rather than a falsely weighted stock market, we're pretty much already in a bear trend.

finally as for futures, there are some negative divergences starting for the overnight session, perhaps this brings us down to the base area proposed...

ES/SPX futures leading negative since the cash close.

1 min NASDAQ futures doing the same.

Remember in multiple timeframe analysis the positive 7 and 10 min charts would suggest that any short term move lower be met with a bounce higher and since we need to move lower anyway to broaden out the base, it would make some sense.

There are hints of a slight positive in EUR/USD.

That will do it for tonight, I suspect tomorrow we'll have time to look at numerous trade set ups as I suspect things will be dull unless there's more unexpected news out of Yemen or some other corner of the world. Just watch, if we have the bounce I suspect, the media will call it a relief rally over Yemen and that the war or operation progressed so nicely, even though we have the signs well before that has happened. It's just the human mind needing to feel in control of something so out of control.

Have a great night!

Is interest rates about to start going up?

-

Yes, I know - it does not make any sense - FED is about to cut

rates...but....real world interest rates are not always what FED wants it

to be.

6 years ago