It's been a long day for me and my wife starting at 4 a.m. with 11 hours at the hospital for a surgery that was supposed to be done at 11:30 a.m. As I mentioned, the surgeons who used a literal robot to do this high tech surgery, removing a cancerous tumor from her kidney, in the end-spent more time looking for a small clamp they lost in the surgery.

Anyway, besides all of us being beat, she came through well and appreciate all the thoughtful emails today. Luckily the hospital had Wi-fi which makes sense when you think about it. I can't tell you how many times I heard "so and so did great" in their surgery. I couldn't help but think, "what? all they did was sleep?"

OK, onto the SPY which is another issue that seems to make some sense.

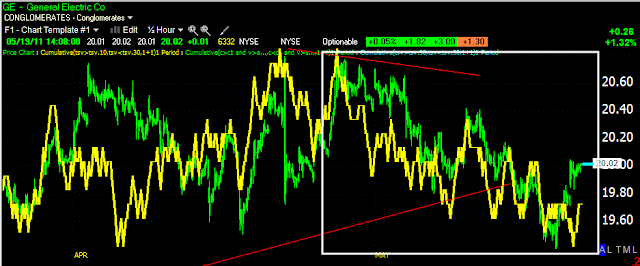

Here the SPY threatened to do what I've thought it would do since before it broke below the triangle4 days ago, to cause a Crazy Ivan upside shakeout.

Intraday the SPY made 4 attempts to break through, but it really seems like it was more about killing time.

A look at 1 min 3C reveals today that every touch of the trendline was met by distributive selling. It seems like they wanted to keep it close, but not let it break $135.

The 10 min chart is falling apart so if /when we do get an upside shakeout, I am just as certain now as I was then that this would be a head fake.

Below is the options chain, so there's two scenarios for tomorrow, our H&S pattern that I showed you today, pins the calls from $134, maybe even $133, but almost certainly the higher open interest at $135 (they didn't allow the SPY to spend very much time above $135 today and certainly not to let tit close, as well as the high interest at $140.

So it seems likely if, and I would be surprised to see a reversal without it, they push through the upside head fake, it'll have to wait until after options expiration tomorrow.

This is all short term maneuvering for us and hopefully getting a little better positioning and timing on short positions and inverse ETFs., but still the bigger picture for now is the sad state the market is in and the very likely and ugly decline which should make us some quick short side money.

Again, thank you all for you support, understanding and well wishes and for not teasing me too hard about my "other life". You all are great!

Is interest rates about to start going up?

-

Yes, I know - it does not make any sense - FED is about to cut

rates...but....real world interest rates are not always what FED wants it

to be.

6 years ago