I'll be honest with you right up front, I'm not really excited about the market today. Even with a knee jerk reaction, the averages closed mixed with small caps taking the worst of it pretty close to in line with yesterday's P/V Dominant relationship, after all had it not been for the knee jerk reaction, all of the averages would have closed red as internals suggested yesterday.

Transports were the worst, the Russell closed red swell. If not for the knee jerk reaction so common to F_E_D events, the other averages were well on their way to a red close.

I think what is really tiring about today is the F_E_D itself, it may be listening to Yellen drone on for so long that did it to me, but I think it's more about the ambiguity in the F_O_M_C itself. A red-line comparison of the April statement vs the June statement will make you believe that the F_E_D is still very much trying to sell the "Transitory weakness" rap for Q1 and is otherwise telling us that things are progressing nicely toward their goals for a rate hike, but not quite there, certainly a more upbeat general assessment, but when you get in to details, it's all over the place. The economic forecast for 2015 GDP and 2016 were brought down, as well as the unemployment rate was adjusted slightly higher.

Then there's the 15 members of 17 that are for rate hikes in 2015, 10 of 17 calling for 2, 15 of 17 calling for at least 1, but their projection of where interest rates are at the end of 2015 fell from the April meeting, so there's point/counterpoint all throughout the statement and accompanying forecasts and projections. Perhaps I'm best served just ignoring all of it as it changes with the wind and the F_E_D is still obviously playing economic cheerleader to justify something they know they shouldn't be doing right now or perhaps should have done sooner or even better, perhaps shouldn't have done at all, like going to ZIRP and boxing themselves in.

I think the market grasped this too, but it wasn't the knee jerk move that's almost obligatory for a F_E_D related event that told the story, it was in the sharp intraday decline in the $USD- that's where the pros are and where they were expressing their opinion of the F_O_M_C today, not in equities.

$USD sharp intraday decline on the release of the F_O_M_C

I think a line a member sent me best described the entire scenario, economic projections fell while rate hike probabilities increased, which should just make it that much more entertaining to watch the F_E_D talk the economy up, while forgetting that the census/projections sheet they filled out shot the economy down. In other words, the F_E_D knows the economy is in poor condition, they also know something we don't that makes the economy irrelevant and the need to hike rates imperative, we can all guess what that is, but somehow I think we might be surprised.

My own take was that we'd likely have had a rate hike today if the Greek situation were not fluid and a deal had been clenched. To hike today just to have a Greek/Lehman weekend would have been tough to explain when the cows start coming home. Speaking of which, we should see that being discounted in the market shortly, I'm sure you've heard the talk of a Lehman weekend just about as often as rate hikes being referred to as "Lift off".

As to today's move and when it will be run out, it was a knee jerk reaction ad as I said earlier, not the most impressive one I've seen by far. Here are several non-confirming indications...

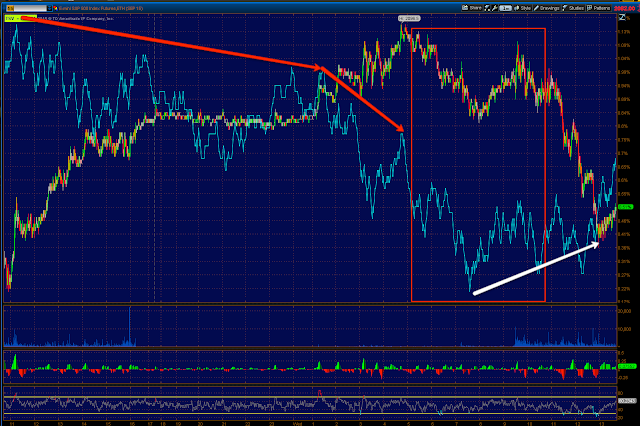

Our custom SPX:RUT Ratio Indicator that often leads or confirms as it was doing mostly yesterday, fell apart completely right around the set-up for the knee jerk bounce, around the time I posted some of the evidence of it, Market Update and Initial Trade Plan

This divergence isn't just non-confirming for today''s knee jerk, but looks a bit sharp going forward, I'll keep an eye on it, it may be the start of the next move leading lower through all of this SPX 150-sma support.

I am showing this to you a different way. All this week I have inverted SPX prices so you can see the out-performance of VIX and VIX short term futures. I decided to present it a different way today.

We all know that VIX/VIX futures should trade opposite the market, yet from Friday's close (where the green and blue trend lines start) through this week, both the SPX and VIX are higher than their Friday close, VIX should not be there under normal circumstances, translation: PROTECTION IS BID.

Again with VXX this time, compared to Friday's close the SPX is higher and so are short term VIX futures, an unusual sight that doesn't need me to invert prices to see. AGAIN, PROTECTION IS SERIOUSLY BID.

YIELDS WHICH HAVE BEEN LEADING THE SPX RECENTLY GOT A LITTLE SLOPPY TODAY WITH A PULLBACK IN TLT SENDING THEM HIGHER, BUT TO THE FAR RIGHT IN TO THE KNEE JERK REACTION NOTE THEIR MOVE LOWER.

Remember as a leading indicator, yields tend to pull stocks toward them, in this case down.

The exact same concept holds true for commodities as a leading indicator and again, they are in a negative position relative to the SPX.

Then there's HY credit, it was NOT buying the move today and hasn't been since the May head fake/false breakout divergence with HY Credit.

Today just made it worse. So the last 3 days pros haven't been buying this market tells us what about the last 3-days?

Or we can just look at our Pro sentiment Leading Indicator...

It has been selling off throughout, especially this week.

Of course it has been selling off since exactly where we expect it would, right at the false breakout at the SPX triangle head fake move in May. Note the deep divergence between it and the SPX this week to the far right.

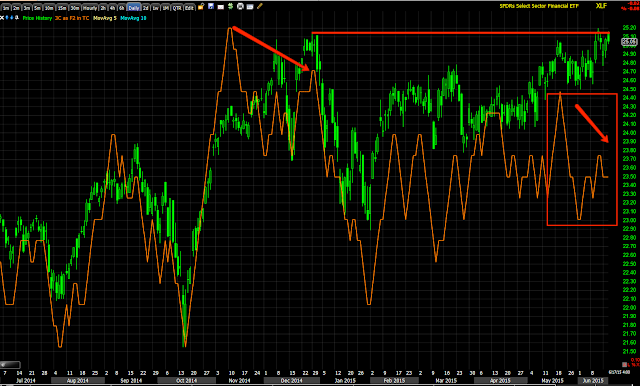

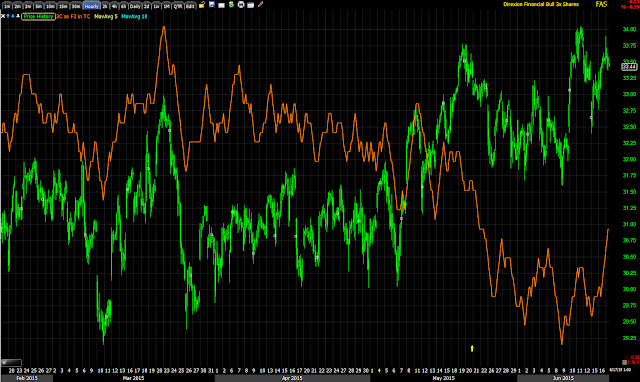

Finally I want to look ay High Yield Corp. Credit seeing as it was used yesterday to help ramp the market on an oversold condition which should have been enough to move it up as well as a short squeeze, but still needed HYG yesterday and today, look at the near perfect alignment the last 2-days, this is why they use HYG for short term manipulation.

Longer term like HY Credit, although much worse, HYG is deeply leading negative and like yields, except much more powerfully, it tends to pull equities to it (credit), thus the saying, "Credit leads, stocks follow" as you see on both the very short term and longer term charts above.

I just wanted to make sure there was no accumulation of HYG for a move anything beyond a knee jerk reaction, this is the 3C chart of HYG and it has been selling off the last two days in to the highs, it seems they're willing to use it for a couple of days, but don't want to be caught holding it any longer than that.

Note the special weakness in to the knee jerk today.

So the market hasn't been all that surprising this week, but I am hoping prices can hold in place right in this area for a day or so and let the charts give us some high probability, low risk signals for new trades.

As for the ES/SPX E-mini futures divergence shown this morning in the A.M. Update which looked like this...

ES 15 min from this morning leading negative in to overnight price action.

I can't say it has improved much on our "Knee jerk" pop...

No response from the indicator at all at the Knee jerk pop this afternoon.

On a near term basis, as in Index futures right now, they did show the same intraday positive divergence at the lows which I posted as part of the examples pre-F_O_M_C in this post, Market Update and Initial Trade Plan

It's a little sloppy looking from all the movement, but...

Overnight ES bounce from a very far range earlier sees a negative divergence and send ES/SPX futures lower until just before the 2 pm F_O_M_C, see the same positive divergence posted this afternoon in the Market Update and Initial Trade Plan post.

The difference now is the knee jerk reaction saw a negative divergence which also brought it down off its highs and 3C is sitting near the intraday lows going in to the overnight session.

There's a pretty big mess of short term indications in the area, that's why I'm hoping for prices to trend flat or even just trend and let the signals all untangle from intraday charts. When we are ready to break this SPX 150 sma support, I want to be in place and have a high probability/low risk and most importantly as the other two are really already there, well timed execution.

This week I expected support to be formed or perceived support at the 150-ma of the daily SPX chart, as I said, "Where do you think all of the stops will be lined up?".

Note the candlesticks with the reversal candle in yellow and the confirmation candle in red, today's closing SPX candle is beautiful in that sense. The next move I'm looking for is taking out all the BTD traders who bought in to the 150-day m.a. support.

As for a Greek Debt solution before this weekend, I doubt that the ?Greek Debt Committee declaring all debt owed to the Troika being "Illegal, Illegitimate and Odious" is helping much. In addition as mentioned earlier, there is a huge rally in Athens, the people supporting their Anti-Troika/Anti-austerity government, so whatever political concerns Tsipras may have had in not reaching a debt deal, seemed to just melt-away. There's not a whole lot of motivation it seems on the Greek side at the 11th, 11th hour to get a deal done before they default and exit the Euro seeing off who knows what around the globe.

This week promises to get more and more interesting with every passing hour.

Is interest rates about to start going up?

-

Yes, I know - it does not make any sense - FED is about to cut

rates...but....real world interest rates are not always what FED wants it

to be.

6 years ago