Always keeping an eye on those things that others ignore, here's the Risk Asset Layout close and some bonus charts

Here's USO vs the SPX

USO volume was quite high today, also note the churning candle at the red arrow which was on the EIA Petroleum release with a heavy draw this week of -7.4mm barrels, although I would have thought USO would have behaved the exact opposite. This churning on very heavy volume could very well have been retail stepping in on the buy side given the heavy draw and smart money using that demand to move a lot of shares quickly. I feel good about the USO position as well as the XOM, although with IOC as well, there's a bit too much exposure to energy.

While the SPR rumors may be an added benefit to the USO core short, the primary reason for the trade is here and unless the SPR rumors were known and taken very seriously a while ago, I doubt they have much to do with this chart.

4 hour accumulation/distribution cycle, this is the most common Wall Street behavior, buy cheap, mark up price, sell in to demand and then short, knowing there's little institutional support, a classic cycle and a great example of how cycles work (buying in to continued weakness as their positions are quite large and then selling after a mark up period, in to strength).

The 5 min chart shows an unusually sharp negative divergence so I don't doubt the churning was real on the EIA report.

GLD, another recent short position on a move above $162.50 also looks like it should be paying off soon, the 30 min negative in to this week's price strength looks great for me.

On a tighter basis,

The 5 min chart is showing great distribution in to this move.

The Dj-30 vs Copper on an hourly chart is a clear divergence, Dr. Copper. While this has been a good leading signal, it probably has a lot to do with 80% of manufacturing across the globe in recession.

The Dow Industrials (green) vs the Dow-20 transports, another clear divergence as the manufacturing cycle accelerates in to contraction.

The Dow 60 min vs Transports, this is a reasonable long term divergence, if yo see how well they have tracked in the past, it's clear there's something not right here.

HY Credit selling off at the end of the day as the SPX makes a minor move out of the 4 hour range.

Yields as you have seen before, once in line and confirming the uptrend, now negatively divergence, the SPX almost always reverts to yields, the question is how much further they drop on the way to reversion to the mean.

The $AUD with horrible performance today, it's clear that today was not enough to encourage any kind of carry trade activity, thus this move today makes sense as the "buy the rumor/sell the news" I mentioned yesterday and which we saw evidence of in overnight trade.

$AUD with a longer term divergence, I can't recall a serious divergence in the $AUD with the SPX that has failed to bring a reversal. There have been some reversals without divergences, but not the other way around that I have seen.

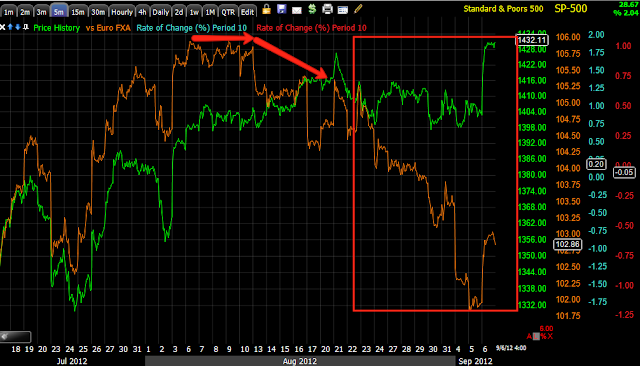

The Euro, still close to resistance and still at 2012 record lows on short interest, there isn't much of a catalyst to move the Euro higher. The fact we saw short term reversion to the mean has me very interested as to whether we now see a move lower in both.

Energy in the afternoon performed badly vs the SPX as seen above.

Longer term Energy is dislocated with the SPX, the three most important rally sustaining sectors in my opinion are energy, financials and Tech, this isn't a good sign except maybe for our USO shorts. I mentioned ERY today as a leveraged short play on Energy, it's worth a look.

Financials saw some late day pressure as the SPX tried to make a move, the SPX has the most exposure to financials of the averages at about 22%.

Tech also saw some late day weakness as the SPX tried to get something together.

I'll be positing more, I will look at Treasuries, Volatility, FB, BIDU, currencies and several internals/breadth I'm interested in after seeing today's weakness in breadth, it's actually rather amazing the market made this kind of move on such poor breadth including AAPL (relatively speaking).