I can remember some of the big moves in the Dow that were on the news during my drive home and that's what first got me interested in the market. Under QE1, 2 and 3 there's been no shortage of news like "All time new highs", etc. to draw new market participants in to the market.

However there's a real danger this new generation of traders faces above and beyond the fact that they have no idea how Technical Ana;lysis is used against them every day because they don't have enough experience to remember what it was like when technical patterns and concepts actually worked well before T.A. drew such a large following after the Internet became a household item and online discount brokers put "Stock brokers" out of a job.

That danger is quite simply, "Expecting the market to act as if the Bernie Put was a regular and normal feature of the market". Things like "Buy the dip" have become nearly culturally iconic among the newest generation of traders, they've never experienced a real bull market, what the signs of a healthy bull market are. Perhaps most dangerously, they have no idea of what impact the decreased volume will have when High Frequency traders shut off all liquidity. I think if it weren't for High Frequency Trading in a low market volume environment as we have seen develop since 2009, liquidity would be much more scarce and price moves both up and down would be much more volatile.

There will come a time when HFTs essentially pull the plug and liquidity dries up as HFTs are the providers of liquidity and decent spreads in a market that otherwise has limited volume.

So today's little tidbit giving to us in the form of a 42 page report by the F_E_D should raise some eyebrows just by the name and timing alone,

"Are Leveraged and Inverse ETFs the New Portfolio Insurers?"

"Abstract: This paper studies Leveraged and Inverse Exchange Traded Funds (LETFs) from a financial stability perspective. Mechanical positive-feedback rebalancing of LETFs resembles the portfolio insurance strategies, which contributed to the stock market crash of October 19, 1987 (Brady Report, 1988). I show that a 1% increase in broad stock-market indexes induces LETFs to originate rebalancing flows equivalent to $1.04 billion worth of stock. Price-insensitive and concentrated trading of LETFs results in price reaction and extra volatility in underlying stocks. Implied price impact calculations and empirical results suggest that they contributed to the stock market volatility in the 2008-2009 financial crisis and in the second half of 2011 when the European sovereign debt crisis came to the forefront. Although LETFs are not as large as portfolio insurers of the 1980s and have not been proven to disrupt stock market activity, their large and concentrated trading could be destabilizing during periods of high volatility."

Comparing Leveraged ETFs to the Portfolio Insurance of the 1980's that contributed to the 1987 crash should raise some eyebrows, but the report gets much juicier.

Just look at the tag words (and this is ALL of them): Keywords: ETFs, price impact, financial stability, stock market crashes

Can anyone imagine the F_E_D putting out such a paper 2 years ago? As I spoke of earlier today, the F_E_D has already engaged in a number of face and legacy saving activities as they know full well and good what the result will be when the F_E_D announces the tapering and/or halt of QE with nothing to take its place and only more bad news to arrive sometime after in the form of rate hikes.

I think sometimes these things slide under the radar and they are meant to, but the F_E_D can always point back to this paper and say, "Well it wasn't because of the halt of QE, it was reduced market liquidity and the rebalancing of leveraged ETFs that created such downward volatility as we warned a month before the crash happened" as an example.

Again, just ask yourself if you can imagine the F_E_D releasing such a paper 2 years ago or even a year ago.

As far as today goes, I think my views are pretty clear on the subject, some other evidence that I think is worthy of consideration is the following...

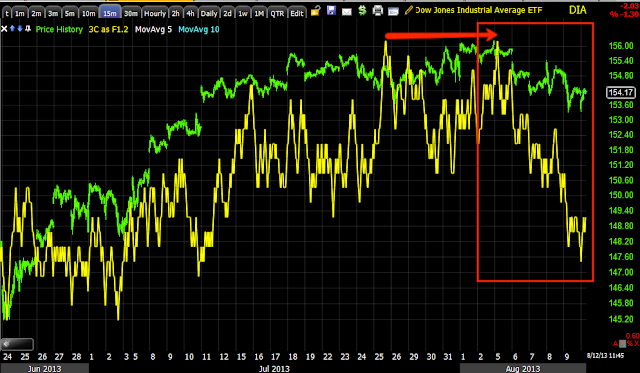

Sentiment among the more professional side of market participants held up well today, I believe this is evidence (not by itself) of our bounce occurring.

The longer version of the same chart shows how sentiment lead the SPX (green) in red as it turned down before the market and now it is turning up before the SPX.

The VXX did not perform as well as it should have today when compared to an inverted SPX (a normal correlation would see the two moving almost exactly together), instead the short term grab for protection was not as desperate today as we have seen it recently, this is evident in the spot VIX as well and its close today as well as VIX futures.

This is just a slightly longer view of the same VXX chart vs and inverted SPX

Yields move opposite treasury prices and they tend to act as a magnet for stock prices, today yields were slightly higher (vs the SPX in green).

You may recall that I've been expecting a pullback in TLT (20+ year treasuries) and looking at adding to a long TLT position when that happens.

TLT 15 min leading negative...

30 year Treasury futures, 60 min chart leading negaitve

10 year treasury 60 min chart also leading negative which means yields rise with falling treasury prices and yields act like a magnet for equities so that seems like additional evidence of a bounce.

The view of HY Credit shows how it has acted as a leading indicator vs the SPX and that it is leading positive right now.

Commodities vs the S{X and specifically how much worse they are on the second leg of the SPX move, this speaks more to the big picture, but in the near term...

Commodities have been acting better since last week when we first started seeing signs of a bounce, even as fractured and often weak as the signals have been.

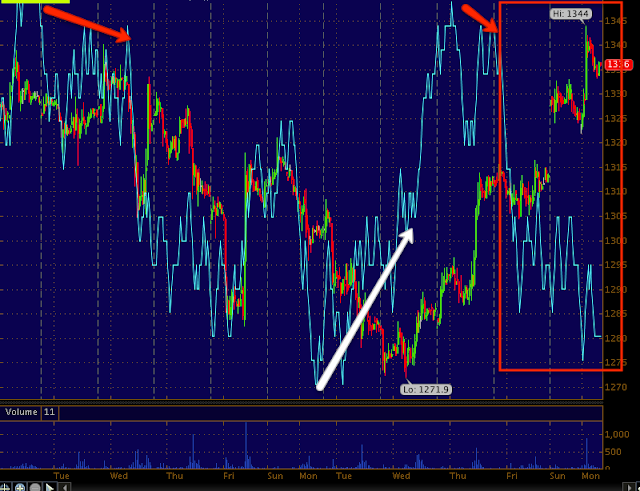

Finally all of the Index Futures have positive 5/15 min charts for a bounce, interestingly they all have negative 1 min charts which I don't usually pay attention to on an overnight basis, but I am looking for a quick pullback before any bounce and all the Index futures have this 1 min negative and it's pretty large.

ES 1 min is just a bit more intense than usual, maybe there's something to this overnight.

That's going to do it for now as there's nothing really new until we get some movement, then there are plenty of opportunities.

I'll report back if anything significant changes in futures tonight

Comparing Leveraged ETFs to the Portfolio Insurance of the 1980's that contributed to the 1987 crash should raise some eyebrows, but the report gets much juicier.

Just look at the tag words (and this is ALL of them): Keywords: ETFs, price impact, financial stability, stock market crashes

Can anyone imagine the F_E_D putting out such a paper 2 years ago? As I spoke of earlier today, the F_E_D has already engaged in a number of face and legacy saving activities as they know full well and good what the result will be when the F_E_D announces the tapering and/or halt of QE with nothing to take its place and only more bad news to arrive sometime after in the form of rate hikes.

I think sometimes these things slide under the radar and they are meant to, but the F_E_D can always point back to this paper and say, "Well it wasn't because of the halt of QE, it was reduced market liquidity and the rebalancing of leveraged ETFs that created such downward volatility as we warned a month before the crash happened" as an example.

Again, just ask yourself if you can imagine the F_E_D releasing such a paper 2 years ago or even a year ago.

As far as today goes, I think my views are pretty clear on the subject, some other evidence that I think is worthy of consideration is the following...

Sentiment among the more professional side of market participants held up well today, I believe this is evidence (not by itself) of our bounce occurring.

The longer version of the same chart shows how sentiment lead the SPX (green) in red as it turned down before the market and now it is turning up before the SPX.

The VXX did not perform as well as it should have today when compared to an inverted SPX (a normal correlation would see the two moving almost exactly together), instead the short term grab for protection was not as desperate today as we have seen it recently, this is evident in the spot VIX as well and its close today as well as VIX futures.

This is just a slightly longer view of the same VXX chart vs and inverted SPX

Yields move opposite treasury prices and they tend to act as a magnet for stock prices, today yields were slightly higher (vs the SPX in green).

You may recall that I've been expecting a pullback in TLT (20+ year treasuries) and looking at adding to a long TLT position when that happens.

TLT 15 min leading negative...

30 year Treasury futures, 60 min chart leading negaitve

10 year treasury 60 min chart also leading negative which means yields rise with falling treasury prices and yields act like a magnet for equities so that seems like additional evidence of a bounce.

The view of HY Credit shows how it has acted as a leading indicator vs the SPX and that it is leading positive right now.

Commodities vs the S{X and specifically how much worse they are on the second leg of the SPX move, this speaks more to the big picture, but in the near term...

Commodities have been acting better since last week when we first started seeing signs of a bounce, even as fractured and often weak as the signals have been.

Finally all of the Index Futures have positive 5/15 min charts for a bounce, interestingly they all have negative 1 min charts which I don't usually pay attention to on an overnight basis, but I am looking for a quick pullback before any bounce and all the Index futures have this 1 min negative and it's pretty large.

ES 1 min is just a bit more intense than usual, maybe there's something to this overnight.

That's going to do it for now as there's nothing really new until we get some movement, then there are plenty of opportunities.

I'll report back if anything significant changes in futures tonight