At the September F_O_M_C meeting the crowd was convinced a taper was coming wither then or October, the crowd was massively wrong. This week (and quite a while before) the crowd thought the F_E_D couldn't taper until 2014-2015 and even went so far as to say an extra $15 billion in bond buying would be announced, again they were dead wrong as the money is now on a December taper, how fickle the crowd is, how massively wrong. Even the once wonder-woman Meredith Whitney has lost her luster and predictive capabilities after being touted as the Nostradamus of the Financial markets, it's all "What have you done for me lately".

I suspect we have more surprises in store coming from China as they battle the QE/Hot Money bubbles from the world over, even though they had a solid manufacturing print and the official version agreed with the HSBC version, well close enough and seasonally this is even more impressive.

It's here in the US that macro-data is getting unpredictable with yesterday's strong Chicago PMI (As we know, all things Chicago are trustworthy- I'm not talking about the good people of course), then this morning comes the Markit manufacturing PMI absolutely contradicting yesterday's strong print (highest in 2.5 years) vs Markit's "lowest in a year". The fun didn't stop there though, the Institute for Supply-Chain Management (ISM) came out with its highest print in 2.5 years confirming yesterday's data, disagreeing with Markits and that was also the 5th consecutive beat for ISM.

So...?

The NASDAQ's OMX options platform went light's out around 10:30 this morning (isn't that the second time this week for NASDAQ?) There has been an unsettling trend of market's just shutting down on otherwise slow days. Of course NASDAQ pretty much blamed it on HFT quote stuffing, shut the market and left it shut the rest of the day.

I have a serious question that should be considered. I'm guessing most of us know the role of a market maker (NASDAQ) and a specialist (NYSE), if you don't for certain privileges they receive for making a market (middle man) for a stock or stocks, they are the liquidity provider of last resort by law in exchange for their privileges and the nice spread they collect on every buy/sell. We also know that HFTs now trading in micro-seconds are front running these middle men to become the default liquidity provider and essentially make that spread between the bid and ask, but HFT's that are responsible for roughly 70% of the market's liquidity are not bond by law to buy your stock at market price when the market is crashing 1987 style, the middle men are bound by law, the HFTs can just shut down.

How seriously has a middle man's ability to facilitate an orderly market actually been degraded by HFTs and why should we think HFTs wouldn't exacerbate the situation like the bear raids of old?

Next, if the markets are breaking almost (it seems) every week and declaring "Self Help" on a rather dull, low volume market, what happens when things heat up as they will? I know about the circuit breakers, but can you imagine the panic if the exchange breaks and you are stuck holding an asset while the market carries on and you have no recourse as the exchange is terminally broken?

If I kept on this line of reasoning I might site all of the major market players who have called the market a bubble in the last two weeks and I mean major, you don't get much bigger than these guys, as I said last night, I'd prefer they were saying the opposite, but it is what it is.

If you look at F_E_D interest rate policy and tightening episodes, the markets have never reacted well to the "Business cycle" as it has been named, but how in the world do you account for the effects of unwinding what will likely be a $trillion dollar balance sheet and raising rates in an economy this globally connected?

I think we saw our first glimpse of the downside of a globally connected economy after Lehman and I believe the effects went straight to the EU.

What happens with the next crash as many believe, we never finished the 2008 crash, the F_E_D artificially stopped it, but with a balance sheet that large, what tricks do they have left when the next crash that many believe will be much worse comes knocking? It could be as a direct result of their eventual tightening phase.

OK, I'm way off subject, but once you start thinking about some of these things it leads you to other areas and I barely scratched the surface, I probably did so just because of the overwhelming chorus line of major market players saying, "Watch-out below, this market is a bubble"

As to the market's the avera

ges themselves have been dispersed in an unusual way as of late, for example, today a n afternoon ramp (not uncommon after 2 pm on options expiration) brought most of the averages in to the green, but the Russell 2000 remained in the red and not by a tenth of a percent, but 0.45%, the same amount the Dow was up, the NDX was barely up at 0.07%.

If this market dispersion is strange, asset class performance since the F_O_M_C has been even stranger next to equities. Taper on, or what the market doesn't want results in higher $USD, lower gold, lower treasuries, the QE sensitive assets; you'd think stocks as well.

Since the F_O_M_C the $USD has been up (our expected $USD bounce), Treasuries have taken a beating (our TLT pullback) and gold has dropped (our expected gold pullback)...In fact, we had these expectations (TLT down, $USD up and a gold pullback BEFORE the F_O_M_C and they were all based on signals, I can't claim a leak, but how is it I wonder that 3C and smart money knew something about their reaction before the F_O_M_C?)

In short, QE sensitive assets are acting like the F_E_D burst the QE bubble, at least since (or before) this week's F_O_M_C, take a look for yourself.

As for assets today

I decided I would show any leading indicators and related charts after the close since they have a tendency to change so why post them twice. There were a few surprises by the close...

Commodities intraday as a leading indicator

Commodities as a leading indicator on a larger timeframe.

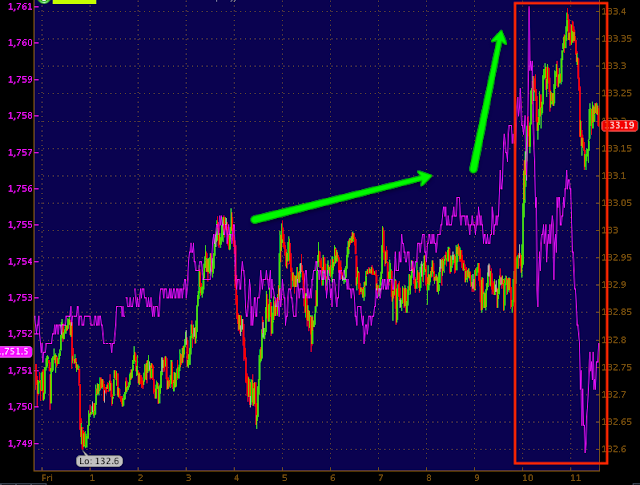

Sentiment going south at the market top

Our second and original sentiment indicator giving very clear warning and continues to.

Yields up is usually bullish and short term it may be, but they are rising because of falling treasuries because of a "Taper On" view in treasuries, $USD and gold so in perspective, it may not be as bullish as it looks.

Yields long term warning of the cycle's bottom and top.

VXX a bit weaker today than yesterday vs inverted SPX in green...

However longer term no matter how many higher highs the SPX made since the 18th, the VXX hasn't made a single lower low, again big picture not good for the market.

Intraday HY Credit is down, generally not a good sign.

This is where it gets interesting as HYG is used to manipulate the market.

Earlier today HYG was in line with the SPX and was showing a positive divegrence, then I looked and it underperformed at the afternoon ramp, went the opposite direction, I figured maybe 3C accumulation at cheaper prices, no 3C fell apart too from a short term positive divegrence.

And HYG credit warning severely as it is at 10/19 lows where we first noticed a problem with the market and in HYG first.

I might get in to some other things later, but even some of the short term positive signals for early next week turned ugly toward the close, HYG was the biggest surprise because it had short term "bounce" accumulation and that fell off as did price.

Have a great weekend, I may get a breadth post out if I have time, my mother is having back surgery next week so we're going through everything I need to do to take care of her animals and place.

Enjoy your weekend.