One of the first things that struck me today was the overnight futures once again up as it's much easier to move futures on little volume which seems to have been the trend a good portion of this week, rather than show actual accumulation in futures and I don't mean the kind of accumulation that changes any outlook, it's just what I'd term minor accumulation along the lines of middle men like market makers/specialist/HFTs that are filling that role stocking up for an anticipated bounce.

However yesterday we had 3C closing divergences that were clearly negative with the 3C concept of "picking up where the divergence left off" on the next cash open, even over a 3-day weekend. You can see this in last night's Daily Wrap... As it turned out, 3C ended up being right on both points brought up last night...

"The 3C concept we have seen very often of charts/divergences picking up where they left off the next day in the cash market (even over a 3-day weekend), would suggest we are in for some ugliness tomorrow, however I suspect the Monthly Options max-pain pin will be the most influential variable as we most often see the pin right around Thursday's close."

We saw both as overnight strength in futures was faded early morning just after the European open and a new high for futures on the week, although it was overnight/or very early morning rather and did not hold.

ES futures (1m) made a new high on the week just before the European open and went negative after the European open with a price decline on the divergence in to the North American cash open (white arrow) which also confirmed the often seen Op-Ex Max Pain pin which tends to be near Thursday's closing prices.

The SPY showing Thursday's closing price at the red hash line and Today's open at the white hash line and prices just after the open declining right to the Thursday close level. Volume the last 2 days has been very poor.

In the end, both concepts were right.

The op-ex pin seemed to last all day with the SPX only up +0.08%, the Dow +0.11%, the NDX down -0.02% and the Russell 2000 -0.09%, almost EXACTLY where they closed Thursday as has been our experience with the max-pain pin.

However Transports which are a Trade-Set-up today as they finally start to give us something to work with, outperformed on the day.

The major averages on the week showing the early week weakness in to Tuesday morning when we took the action of Closing May VXX $20 Calls From Friday at 10:18 for a +57% gain, near perfect timing as the puts lost significant value just an hour later. While the market did follow the forecast of a bounce later in the week, it didn't do it in a way that I would have traded even knowing what I know now. If the objective evidence for the trade is not there, it's not there. When we start going by gut feeling we turn trading in to a subjective affair no different than gambling. In any case, the gains were far from worth the risk.

Transports in salmon were the laggard on the week.

However today as the averages hovered around unchanged on the day, Transports outperformed with a +0.96% gain.

Transports which have seen the worst start for the year since 2009, look like they are finally going to give us the opening we have been looking for as these are a long time core short favorite for a trending trade. See today's Transports Trade Set Up for the particulars...

US Macro Data which is on a tear near new 6 year lows was not helped today by the 3 major macro data misses. The Empire State Manufacturing Survey came in at 3.09 which was lower than the already very weak consensus of 5.0. Industrial Production also missed at -0.3% for a 5th straight week of contraction vs. consensus of 0.0. This morning's data shows that the typical Springtime bounce we normally see in the Industrial economy remains flat at best. Finally Consumer Sentiment missed at 88.6 on consensus of 95.8, the actual print was even lower than the lowest consensus forecast in the range.

However the market neither treated this as the typical "Good news is bad news" or the much more rare, "Bad news is bad news", instead it seem the Options Expiration Max-Pain market Pin ruled the day allowing Wall St. to keep the gulf of premiums on contracts they had written.

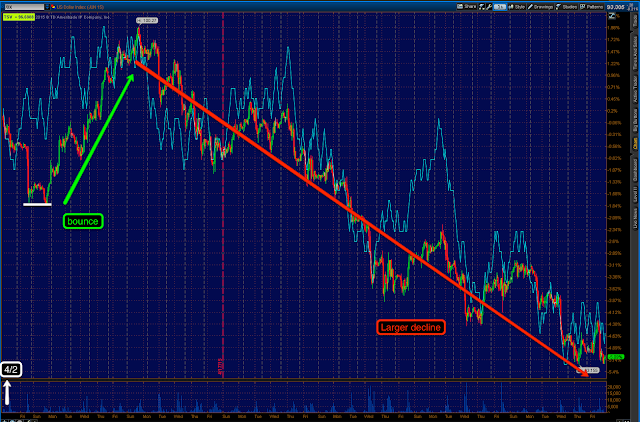

The $USD has now posted the worst 5 weeks in 4.5 years, interestingly remember our April 2nd $USD forecast for a bounce and then larger decline? That larger decline has been those "worst 5 weeks" since 2010.

Our 4/2 forecast is all the way to the far left-Monday it will fall off the chart. First a bounce followed by a much larger decline.

As you know I have been calling for a "Counter trend bounce" in the $USD, the 60 min chart above this one rules out anything stronger, but this 15 min chart (as well as 30 min) shows a "W" base in place with a stable divergence to bounce from.

This should lead to both our GLD/gold trades working out. The first one already entered Wednesday and Thursday, Trade Idea: GLD FADE- HIGHLY SPECULATIVE and it's add to, GLD Follow Up Add to yesterday which are both June monthly puts with plenty of time.

This is the $USD (candlesticks) vs Gold Futures in purple. Note the inverse relationship here. Thus the expected counter trend bounce in the $USD should put the GLD puts at a nice gain as they have a short term inverse relationship and that should set up the longer term trade set-up from this week which we are yet to enter. The trade Set-up was posted Tuesday, GLD / Gold Long Trade Set-Up and what we were looking for before entering is a decline, accumulation of that decline and then a move higher in GLD on at least a swing trade basis, but I suspect even larger.

So the initial $USD bounce should trigger the legacy arbitrage correlation sending the parabolic move in gold lower, then as the $USD counter trend bounce ends and we move to a new lower low in the $USD, Gold should see a nice rip higher.

This is the odd correlation between gold futures (purple) and the $USDX on a longer term basis. They still have the swing inversion on small moves, but have largely been trending lower together until this week. We'll confirm the trade idea before entering, first thing's first though and that's the GLD June 19th Puts...

This is a 15 min chart of GLD with several smaller accumulation areas and a large leading negative divergence in to the parabolic move which as most of you know, I never trust parabolic moves whether up or down as they tend to reverse and see the same kind of momentum in the opposite direction.

The Treasury/Bond trade that we have already started a partial position, Trade Idea: Long Bonds / TLT and are looking to fill it out, TLT Position Management / Trade Set-up looks like they have finally put in the pullback expected on the entry of the first half of the trade (see the first link) and I believe will see some sort of shakeout as the contrarian nature of the trade seems to have attracted a few too many retail traders. While I suspect they'll be shaken out giving us the opportunity to open the second half of the trade, even if they aren't, we are still in an excellent area for an add-to or even a new entry. Just remember, this is expected to be a counter trend trade/rally, you may need more time than normal and we don't want to chase. In any case, the move got started today as I took a calculated risk yesterday looking for a head fake move, Quick TLT Update.

TLT 30 min chart with an impressive leading positive divergence. However, the major concept of this trade that I'm looking to can be found in the original trade entry post, Trade Idea: Long Bonds / TLT ; it's the Channel Buster/Volatility Shakeout similar to the same concept we use to determine the 3 areas we will short a H&S top and the one area we WILL NOT, unlike the teachings of Technical Analysis.

As for Leading Indicators, the distribution I mentioned and posted earlier today in the A.M. Update seems to be taking its toll on the market. I can only assume the market was flat today and poor volume yesterday and today based on the op-ex pin, but in fact it seems that Leading Indicators are not all that excited about the market either like our Index Futures charts and the growing 3C charts of the averages mentioned in the The Week Ahead explaining what we needed to see and about where I think we are in that process. One of the possibilities if not probabilities is the reversal process finishes up in a flat range, although this would be the biggest head fake set-up I can recall seeing that "may" be ignored although hard to imagine...

Just looking at the market's price trued over the last ,month, it's not hard to imagine the market range bound near current levels while the reversal process (see The Week Ahead for details) finishes up.

However knowing what we know (and if you haven't and have the chance, please read the two links above, "Understanding the Head Fake Move parts 1 and 2) this would be the juiciest head fake set-up in the most popular asset (most closely watched) with the most identifiable technical price pattern I think I've seen during this entire episode since 2009. Those three elements, visibility, price pattern identifiability and popularity are the 3 variables that increase the probabilities of a head fake move which I have estimated as being at roughly 80% in any asset reversal and in any timeframe. Those 3 variables just make it that much more likely.

The S&P 500 with what traders would identify as a bullish ascending triangle which is a consolidation/continuation pattern, although this is too big, the volume is off and the placement is off. More often than not, triangles this size are tops or bottoms depending on the preceding trend. As much as I talk about and make use of the head fake move for entries, exits and forecasts, it would be near inconceivable that this pattern breaks down without one, however there's a first for everything. In any case, in my estimation, unless the F_E_D introduced QE 4, the probabilities of it being a head fake and failed move are 99.5% which would make it useful as a short entry move.

Interestingly because I had not looked at this before, our custom DeMark inspired Buy/Sell Indicator on a quarterly basis shows something pretty interesting...

On a quarterly basis (look at as many things as you can, you're looking for things the crowd missed) the orange sell signal was given 3 times, at the 2000 Tech Bubble, a very accurate 2007 Financial Crisis and currently.

In any case, the point I was trying to make was the straining in the market that Leading Indicators are reflecting...

This is our SPX:RUT Ratio which should move with the green SPX above, however it was negatively dislocated at the left leading to a top and decline, then positive last week around mid-week, which is the same time our other indicators went positive, thus the bounce this week in last Friday's "Week Ahead" forecast. However through this entire week the indicator has remained dead flat rather than follow price higher, a negative dislocation.

For the second day in a row our Pro Sentiment Indicators fell out with the market.

Here's the second one used for confirmation with the failure to confirm at all 4 sewing pivot tops.

Interestingly, HYG (High Yield Corporate Credit) of which I had this to say of last night in the Daily Wrap,

"High Yield Corporate Credit wasn't as fond of following along either, where it has recently been pretty closely following the SPX very near term as it is often the first lever they'll employ when trying to manipulate the market short term."

I hope my highlight stood out. Today looks EXACTLY like one of those days, but why would the market need HYG as a short term support/manipulation lever to close essentially unchanged? Was it that necessary to use it to keep the market within the Op-Ex Max Pain Pin? Because they don't use HYG to manipulate the market lower, they use it to support or lift the market. HYG divergences are often the first place I'll look when expecting a move to the upside that is light on strength.

However as I went on, HYG is severely dislocated on the daily chart and already in a primary downtrend having made several lower highs and lower lows. This is important because of the Wall St. maxim, "Credit leads, stocks follow". This isn't only because HY Credit is a professional risk asset (few retail traders trade HY credit), but also because there's a relationship that's complicated and no market can stay up for long without the support of HY Credit.

Then I saw this...

Remember yesterday VXX outperformed the SPX, refusing to make lower lows when it should have? Today was the exact opposite with it significantly underperforming its normal correlation.

Taken with HYG, 2 of the 3 SPY Arbitrage assets used to manipulate the market higher (VXX down, TLT down and HYG up) it seemed to me given the move up in TLT (not what should happen in the SPY Arbitrage scheme), they pumped the heck out of the other two just to hold the market in place at a neutral pin!

I took a look at the 3C charts for HYG and sure enough...

HYG's move relative to the SPX, uncanny symmetry as a ramming lever.

However I'd expect some kind of small accumulation to push it higher..

And I found it near perfectly in line with HYG's move, the problem is, this is the weakest underlying signal possible, the 1 min chart.

As you know, once a divergence gets stronger it migrates to longer timeframes and 1-3 min charts are very close and often share the same signals, 5 min charts are where the big difference comes in to play. So seeing this confirmed what I suspected...

The 2 min chart that had already been under distribution didn't see a divergence strong enough to even move this 2nd weakest intraday timeframe. In other words, they used such minimal investment to move HYG which fools the algos in to thinking that there's an institutional risk on sentiment and get them to buy, yet the investment to move HYG was so minimal it did nothing at all to change the distribution(larger trend) that had been underway already. This is intraday "steering" at its finest...

In addition, just look at the trend of the next strongest and 3rd weakest underlying trade timeframe -3 min. 3C is in near perfect confirmation of the downtrend in HYG/Selling and upon this most recent move up, was not phased in the least as the 1 min timeframes investment was so minimal, just enough to move HYG which tells you something about the confidence of those buying HYG to hold the market in place today on what is otherwise manipulation through 2 of 3 SPY Arbitrage assets.

Spot VIX showed the same relative underperformance today, the notorious VIS whack-a-mole to lift the market. Although not 1 single standout event in VIX today, it was sharply underperforming all day relative to yesterday and the normal correlation.

This got me thinking about the SPY arbitrage model from Capital Context, it was not activated in their model, but that's because the 3rd asset, TLT had such a monster day up over 2% which is a huge move for TLT. For the SPY Arbitrage model to me flashing on, TLT and VXX must be down and HYG up, instead we had 2 of the 3 with TLT diverging. Yet the effect and attempt to manipulate what they could was obvious.

While I was there, I took a look at their Context Model for ES on the day which is made up of a bunch of risk assets, yields/rates, credit, etc. and found it severely dislocated with he model showing ES should be about 35 points lower on the day today alone.

CONTEXT for ES (model in green/ES in red).

Also remember yesterday's strange dislocation of bonds and stocks, actually the dislocation is normal, the relationship recently except for yesterday is what is strange and indicative of the carry trade unwind...

In any case, here it was yesterday as shown in last night's Daily Wrap The white area is yesterday's reversal of the recent correlation back to the old correlation that is normal, rotation out of bonds goes in to stocks or out of stocks goes to the flight to safety bond trade. That hasn't been the correlation as of recent, it has been bonds and stocks trading together (remember Bonds down, USD down, Stocks down and commodities seeing inflation are all signs of the carry trade unwind)...

This is easier to see if I invert the red 30 year yields which essentially gives you the 30 year Treasury as yields move opposite treasuries, this is probably easier to see and understand...

To the left, Treasuries and the SPX are moving together, this is not normal, normal is the inverse correlation in which they move opposite each other. This has screwed up more than 1 managers asset allocation and views of money rotation,

When I invert Yields to create a Treasury model you see yesterday they went back to the old correlation, the one we used as a Leading Indicator as Yields would almost always pull equities toward them like a magnet. Six months ago a char like yesterday would have told us that the SPX was about to fall and revert down to yields reality (lower), however the carry trade unwind has created a new dynamic, yesterday's brief interruption back to normal reality was ran off today as we moved back to yields moving against stocks/bonds moving with them. Interesting, I'm not quite sure what yesterday's flop or flip was about, but it has flipped back.

Finally High Yield Credit (not HYG which is specifically used to manipulate the market short term) has seen its second day of selling, not willing to chase equities or risk.

Finally internals,

Today's internals were so dull they were nearly useless for channels. I'd say it's fair to estimate the TICK today was a VERY mellow -500 to +750 with only a couple brief forays in to the +/- 1000 area which isn't all that extreme. All in all, a very dull day that fits nearly perfectly with the major averages coming percentage moves.

The Dominant Price/Volume Relationship was as close to equally divided among the 4 possible relationships in every one of the major averages (this is a measure of the price/volume relationship for all of the component stocks that make up the average so we can see extremes in overbought/oversold). I don't think there was one relationship of the 16 possibilities (4 possibilities for each average x 4 major averages) That was more than 15% above the other 3 relationships, FAR from dominant and probably the closest I have ever seen all 4 averages to equally divided. This tells us for today, there was no internal domination among the component stocks that make up each of the averages, for instance if we had seen a dominant Price Up/Volume Up in the NASDAQ 100 we'd know that it is likely Tech made a strong move.

As for the S&P sectors...Likewise, dull with 6 of 9 in the green. The only standout was the leader, the defensive Utilities up an unusual +1.30% with the laggard being Financials down -.44%.

Of the 238 Morningstar groups I track, again a mellow 144 of 238 green. No real tensions in internals at all, but I wouldn't expect it based on the closing prices.

I am noticing an increased upside rate of change in the SKEW Index (Black Swan Index). It's not at red flashing levels, but the recent change in price is increased to the upside, we might see something there next week.

All breadth indicators which I updated last night, Market Breadth stopped dead in their tracks and ticked to the downside. Again not any significant daily move, but a hint of a change in an already badly damaged set of breadth indicators.

As for futures, they are closed, but in the little time after the cash market close as well as their afternoon action, I got from it the Index futures were flat, the $USD looks like it is itching to make its move higher and I expect we'll see it early next week, likely Monday. 30 year treasury futures (which are important because of our TLT trade and the pullback would help) ended with a significant negative divergence suggesting a pullback off today's +2% TLT gains and perhaps a gap fill, either way, our entry for the second half of the position looks probable. Gold Futures had a clear leading negative divergence suggesting not only a decline based on the GLD 3C charts and the gold futures 3C charts, but the $USD bounce and finally Crude oil futures also had a strong negative divergence , again suggesting what we already expect with high probabilities.

In addition to this morning's A.M. Update Futures charts, here are some more that I think are relevant to near term market activity as well as trades or trade set ups. I didn't include intraday 1 min as I have posted them today and just described them, as well as the fact that the longer charts are more reliable over a weekend.

For some I didn't annote them, I figured it would be interesting to let you pick out the divergences with a few notated as examples.

TF/Russell 2000 Futures 3 min

30 Year Treasury Futures- Think TLT pullback

ES/ SPX E-mini futures 5 min

YG/Gold Futures 7 min

NQ/NASDAQ 100 futures 10 min

DX/$USD Futures 15 min

NQ/NASDAQ 100 futures 15 min

ES/SPX Futures 30 min.

If you emailed me and I haven't gotten back to you yet, I will over the weekend. Have a great weekend everyone!

Is interest rates about to start going up?

-

Yes, I know - it does not make any sense - FED is about to cut

rates...but....real world interest rates are not always what FED wants it

to be.

6 years ago