The August F_E_D POMO (

Permanent Open Market Operations) in which they monetize the debt by buying treasuries from Primary dealers

(since the F_E_D is not allowed to "monetize the debt" and therefore cannot take part in the outright initial auctions, but must buy these assets on the secondary market) had the schedule released several days ago, it turns out that TODAY, is the biggest POMO operation of August...

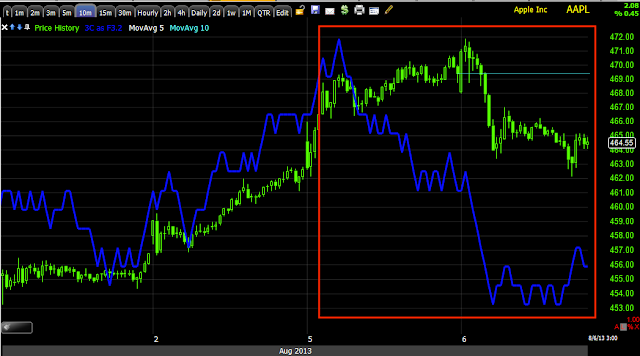

At the top in red you see Tuesday August 6th with an expected $4.75-$5.75 bn in expected purchases.

Just to be clear for newer members who don't understand the process...

As I said, the F_E_D, like most central bancs, is prohibited from taking place (buying) at Treasury oferings of debt (Treasuries) so the F_E_D buys the treasuries (and MBS) from what are called "Primary Dealers", like Goldman Sachs and believe it or not the now defunct and "seemingly" criminally negligent MF Global are and were a part of.

The PD's buy the Treasuries at the primary offering, in the past they have held certain offerings for less than a week before they were snatched up from the PD's by the F_E_D in these Open Market Operations.

The trick and why QE is stock market positive and has carried this market since QE1 started in late 2008 (but didn't take off until the MBS that were being bought were supplemented with Treasuries at the 2009 market lows) is because the Primary Dealers (big institutions like Goldman Sachs-I believe 42 in all) are paid rates higher than what they paid for the T's, essentially they hold them for a period (sometimes less then a week) and offload them to the F_E_D in POMO operations like today's for a large profit.

That money the Primary Dealers make is leveraged up (because money sitting idle is going to remain idle) by buying stocks and their very demand of several billion dollars sends the market higher, that has been the sole driving force of this market since the 2009 lows, not economic recovery, not better company fundamentals, pure cash pumped in to the market that benefits the banks, I suppose the F_E_D would rather give it to them than have to bailout these banks later (which they likely will any way).

Typically operations are over by 11 a.m. and the money starts filtering through the market, retail front runs QE days, buying in advance of the completion of the operation.

So it's a good time to do a market update and see what we have. First the SPY and the

Arbitrage Assets so we know where, "What" is coming from, QE cash or simple "Lever Pulling".

*I'm not including Index Futures because they are almost all in line, there's nothing much to see, they are moving with the market as would be expected.

First the SPY and other assets that are arbitrage in nature, but could be used to make it look like POMO is pumping the market.

***I Know there are a lot of charts, but I'm trying to share a concept with you and show you how the market is truly working and engineered to give false indications of strength,

if you want the quick and skinny:

Essentially we have short term positive divergences in the market averages intraday, it's very clear to see that these are engineered to either look like POMO money is entering the market or perhaps POMO money is really being used to pull the levers that need to be pulled to create a market positive arbitrage and the illusion of market strength, however I can say with a fairly high degree of confidence, any POMO monies entering the market today are manipulative only,

they are not being used to buy risk assets by professionals or in this case the primary banks.

SPY

1 min shows a positive divergence developing as early as 10:45 to 11 a.m. intraday and small here.

If we look at

HYG Above, we can see that money entered HYG first and around 10 to 10:30, this gave HYG a positive arbitrage position as it moved up in price by 10:45 and price is what moves the arbitrage,

they can't see 3C charts.

HYG IS being used to make the market look stronger as it was yesterday, remember it gave out at the EOD because they apparently didn't want to hold HYG long overnight for downside market risk.

HYG 10 mins shows clear distribution and EVERYTHING is in line so there's no sign of any real or strong accumulation in HYG,

thus far it looks like arbitrage lever pulling for the HFTs.

The VXX is the second of the 3 arbitrage assets, this 1 min VXX chart shows a slight intraday negative divergence, enough to turn it down and at 11 a.m., this helps build a more positive SPT Arbitrage and "appearance " of a stronger market.

However, a quick look at VXX's 5 min chart reveals no such distribution and only a very strong leading positive divergence so, once again all of the indications thus far point to an intraday bounce.

THIS IS THE EXACT REASON I SAID THAT THIS BOUNCE IS A GIFT AS IT IS SHORT TERM AND WEAK, HIGHER PRICES CAN BE USED TO ENTER KNOWING THAT THE MORE IMPORTANT UNDERLYING TRADE IS NEGATIVE.

TLT IS THE 3RD OF THE 3 "LEVERS OF MANIPULATION" OR HFT ALGO DRIVEN SPY ARBITRAGE.

Here we see a 1 min TLT chart, it has a positive divergence at the opening lows and remains fairly positive, TLT's price itself being lower than yesterday's close helps the arbitrage as it relies on price only, but we can see that even on the shortest timeframe, underlying trade is positive suggesting a flow toward or a flight to safety in underlying trade.

The SPY Arbitrage Model from Capital Context

Look at the model and when the model went positive, right around 10:30 which is when HYG had already started moving t the upside, TLT was already down on the day from the open, the arbitrage as of this capture is positive about +$.30 SPY.

SPY 2 min shows no divergence at all as of the capture, just downside confirmation, thus not a strong divergence and VERY unlikely that POMO money is flowing in to risk assets.

SPY 10 min shows the damage of this week, it's already significant, that makes short term upside useful to enter longer term weakness via short positions.

DIA

DIA has seen some ugly downside as did Industrial sectors, there's a decent intraday positive divergence this morning on a 2 min chart.

Also out as far as 5 mins.

At 10 mins the DIA is negative as we'd expect from other signals.

The 30 min shows 6/21 when we called for an upside reversal 1 day before the ultimate bottom and distribution on a larger scale since.

IWM

IWM 1 min has an intraday positive

the 2 min has one as well, less developed.

At 3 mins though, there's no migration at all, thus again we are seeing that there's not huge sums of POMO money flowing in to the market for any other reason, as it appears right now, other than to create an image of intraday market strength which they would probably do the same thing as I would and be a seller in to that strength or short seller.

IWM 5 min confirms there's no strength beyond intraday timeframes.

The 60 min is giving us the big picture and illustrating that fragility I mentioned yesterday apparent through July as 3C dives to lower leading negative readings.

QQQ

QQQ 3 min is about as far as we go with any intraday positive and this must be almost entirely based on asset arbitrage.

At 5 mins, the Q's show

no strength at all, in fact quite the opposite.

And the 60 min chart, again with 6/21 highlighted as you can read the archives for that day, we called a bottom reversal and had been moving positions around for such an eventuality that took place off the lows of the very next day.

We know that HYG must be manipulated and some money MUST flow in to HYG TO do that, but what about other forms of credit THAT ARE NOT PART OF MARKET MANIPULATION AND THEREFORE HAVE NO REASON TO ACT IN A MANNER OTHER THAN WHAT IS TRULY HAPPENING ?

JUNK CREDIT (Remember, typically Junk credit trades almost identical to the High Yielding HYG as Junk is High Yield because of its rating).

We see very little on the 1 min JNK chart, nothing positive, in line at best so far today.

The Junk hourly chart makes clear this has been under distribution, some very recent and its prognosis is not "looking up" so to speak.

High Yield Credit

Thus far intraday HY Credit is in line with 3C moving down, kit's not leading the market.

If there were a risk on move by smart money, it wouldn't just be in HYG credit, it would be in Junk and high yield which it is not.

The longer term 60 min chart of High Yield Credit looks just like Junk, it has seen VERY recent and strong distribution.

SO, IT LOOKS LIKE THE MARKET IS GIVING US A GIFT HERE.