A choppy range as represented by the largest Index by component stocks, the Russell 2000. We were able to call both upside move reversals to the downside so if you were day trading which is about the only profitable trading in a choppy range like this, then you still had your signals, but entering long or short this kind of range is just an emotional nightmare in which you think you are at a gain on the open and by mid-day you are ready to stop out only to find the closing trade in your favor after a possible stop out and then just to do it all over again. Sometimes staying out of the fray is the best thing you can do; there are 3 positions- long , short or neutral/cash and each has their advantage at the appropriate time.

I hope I've been exceedingly clear about core short positions, they have all been left open.

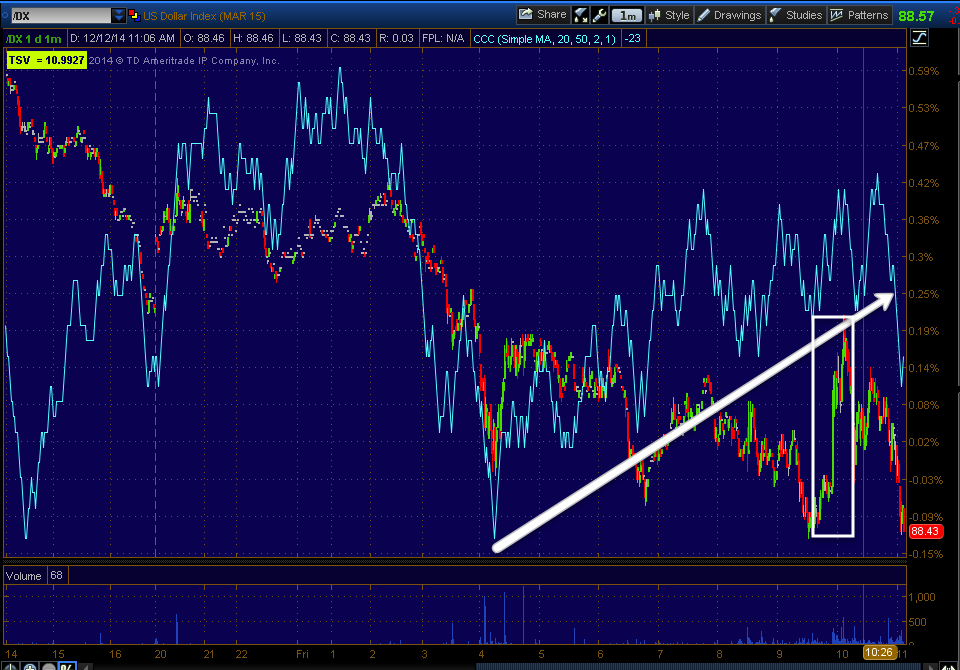

This is a few examples of one trend you not only don't want to mess with on the long side, but one you don't want to miss on the downside.

Comparing the daily 3C charts of the QQQ/NDX at the 2000 bubble top and now I think you'll see something rather amazing that I think few people alive if any have had such opportunity tight in front of them if they only knew what side of the market to be on...

Above is the 3C negative divegrence at the Tech Bubble top in the QQQ

Below...

Compare the same timeframe chart applied to the QQQ daily chart now.

Notice any differences between them? The increased ROC of 3C negative divergences through 2013 may seem "untimely", but I wonder what it will be viewed as 5 years from now?

While you may ask yourself, "How can that be right if the market is still rising after?" This is where retail investors don't understand the size that institutional investors trade in and why the must sell differently over a longer period in sections rather than close an entire trade all at once.

For instance, from May 2013, as proof positive that distribution as represented by 3C was well under way, Leon Black, chairman and Chief Executive of Apollo Global Management which is a private equity giant said in May of 2013 at the Milken Institute's Global Conference,

"It's almost biblical. There is a time to reap and there's a time to sow We are harvesting,"

"We think it's a fabulous environment to be selling," he says, noting Apollo has sold about $13 billion in assets in the past 15 months. "We're selling everything that's not nailed down. And if we're not selling, we're refinancing."

The story can be found at Barron's,

They obviously weren't the only ones using price strength and demand to sell in to as their size dictates selling in to strength over a longer period as to not crash their assets by putting out too much supply at once (basic supply and demand concepts).

The recently acceleration of an already historic divergence as you can see and as we predicted in October before the rally. The forecast was there would be a rally that would scare even members who knew about it a week before it started and that there would be a decline after that was even stronger than the rally. Look at the 3C chart in to the October rally at a new leading negative low just as we expected and this is a 2 hour chart.

The last major negative divegrence was at the September highs at the yellow arrow, which were a head fake move of 3 days, leading right to stage 4 decline and a -1200 point drop in the Dow, lifting bearish sentiment to near historic highs, which was one of the reasons we expected a shakeout rally to change sentiment from all out bearish everywhere you looked, back to believing in buy the dip, no matter how deep it is. Psychologically, it is a masterful play, teaching the "Buy the dip" crowd who was bearish at the October lows, that even a -10% decline is a buying opportunity, a very dangerous lesson.

Even the QQQ 60 min chart shows one of the sharpest leading negative divergences (at new lows vs price's relative area near new highs).

THIS IS WHAT I MEAN WHEN I SAY, "DON'T TRADE AGAINST THIS TREND AND DON'T MISS THIS OPPORTUNITY".

As for some of the other averages...

SPY 2 hour also showing the last negative divegrence at the Sept. head fake highs (yellow) and the monstrous divergence all the way out to multi-hour charts in addition to daily. The 3C trend tells us that at these price levels in SPY, there's less money flow that at the October lows. It would seem the rally was used exactly for what we expected in October, distribution and changing dumb money's sentiment.

Here's the Dow's 2 hour chart with a huge increase in the long term 3C leading negative divegrence at new leading negative lows-far less money supporting the market than ever before.

And the IWM's 2 hour chart during a large, choppy range lasting nearly a year, a definitive change in character, FLAT ON THE ENTIRE YEAR OF 2014- NO GAIN WHATSOEVER!

While the intraday trend of the IWM below (like the rest of the averages) looks horrible, something crept in this week when stepping back.

IWM intraday confirmation of a negative trend on this chart, but beyond the 1 min chart...

Since Black Friday's extremely negative tone, there has been a positive IWM divegrence develop which would be in line with a break above the 6 week range of resistance or trading range that is extremely obvious. While some may not like the sound of the possibility of the IWM breaking above the trading range, it's one of the best conceptual signals we have for timing, just look at the September head fake highs on 9/18, which led to an IWM loss of over 10% starting the very next day.

It seems the SPX, NDX and Dow have already made head fake highs and I'd expect them to be relative under-performers in any such move.

While the closing charts suggest Monday pick up with negative activity in the morning as a move below this week's range in the Q's and IWM would be helpful to such a bounce, this could be negated by a relief move if the Senate passes their $1.1 trillion dollar spending bill to finance the government for the next year to avoid a looming shut down, they have until Sunday as the House already passed it. In fact I may be misunderstanding the divegrence and perhaps it is there reflecting an end to the issue by the start of trade Monday morning rather than a head fake move, after all, Congressional staffers are some of the most profitable traders- I wonder why?

Whatever the outcome, I'm not worried about potential drawdown at all, in fact it's the last thing on my mind at a time like this.

Whether a reflection of relative underperformance in the averages that have already made their head fake move, QQQ, Dow and SPY or whether just a cap on any upside bounce, it's pretty clear it can't get far.

QQQ 2 min trend of the divegrence, not a strong timeframe, but a divergence nonetheless and...

The 10 min chart leading negative, capping any potential move as the divegrence isn't beyond a 2 min QQQ chart or 5 min IWM.

After the TLT post and expected pullback, this divergence in HYG was one of the signals that led me to believe probabilities are on the side of a bounce, one that seems has been trying all week to pull off, but has failed day after day.

Then in addition to the expected TLT pullback, HYG forms a positive divergence in all of this market chaos? That seems to wreak of a lever being planned to help the market early next week.

In fact, VXX is about the only of the three that wasn't''t onboard, leaving some uncertainty.

Another curious signal is in the index futures, again I don't like when we don;t have multiple asset confirmation, but the IWM is the only of the averages not to put in a head fake move so perhaps as speculated above, this is a difference in relative performance.

While all of the averages are in line with the negative activity on the 1 and 5 min charts, the ES 7 min chart is also in line with the negative activity, but the Russell 2000 futures...

Again, the only average that hasn't put in a head fake move already, has a positive divegrence very different from SPX futures.

Either way, so long as we stay short , we either reap the rewards of more downside or get a chance to add a few more positions with all of the most meaningful charts showing the highest probabilities we have seen toward not just additional downside, but perhaps near historic downside.

I'll be on top of Sunday night futures, in the meantime, have a fantastic weekend!