I'm not getting in to longer term expectations yet because we never really had any expectations other than a strong move up from the range and then to look for the distribution in that range.

For now though, as I've entered IWM puts and VXX calls, I do expect near term downside, I do think this will be choppy, but I'll have to have more data to make that case.

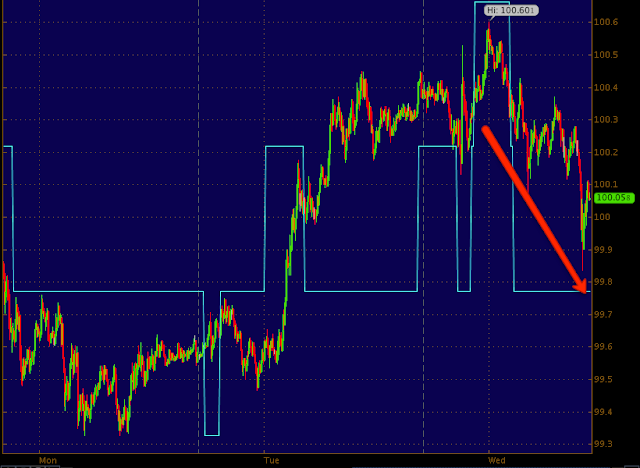

Here's what the intraday, more important charts looked like for the averages at the close.

DIA 3 min with a nasty leading negative, this looks like the positions entered today should hit with little trouble.

IWM 3 min and this has been one of the strongest underlying averages.

The Q's I considered, but it was too much correlation for me so I stuck with the IWM and VXX.

SPY 3 min with a deep leading negative

And VXX confirming with a strong positive.

I'm probably going to be doing more research tonight than positing, I'd actually like to put together a video and I'm thinking about running out and buying one of those screen tablets to annote the video, I think this is the best if not only way to get the thoughts I have about the market expressed to you.

This really doesn't change anything since the initial range started to form, that looked like this...

This is what the range looked like, the white arrows are accumulation areas on pullbacks, the yellow arrow is the expected pullback toward the bottom of the range and a heaad fake move below it would kick ogff the move to the upside, you can even see at "X" that the head fake started on Friday, that is why Monday the move lower was expected.

However at the same time, John Kerry changed the whole tone of Syria giving them a way out without a strike (I still don't know if it was a slip or real), whether it was a slip or real, Syria, Russia and China grabbed on to the "offer" which was a simple question asked of him, that changed the dynamics incredibly, but all it did from our perspective in changing expectations was to cut the range/accumulation process short by a day or two, we still expected the move at the green arrow.

This move to the upside is the "Final Market Gift" as we can enter shorts, core positions which we have not been doing because they have not been in the perfect place, but this move would allow them to move to areas that create supply and demand and allow them to be distributed, this is why this was and still is such a market gift, there's no way the market is coming back.

Here's the 3C accumulation through the range and in line on the move above it, which was all expected so no surprises there either.

As far as the market's condition, just look at the leading negative divegrence right now even in to an in line rally. Compare price and where 3C was at point a and point b and you can see how much damage is in the market.

My gut feeling is we have some near term chop, but after that it's difficult to say because I did expect an upside move that last longer, however funadamentals can change all of that, for instance a Syrian resolution would most likely create a "Sell the news" effect cutting a distribution zone short.

When I say distribution zone, this all comes back to the concept of the reversal process and how they are proportionate. The market could move up in to distribution, but at some point we get more laterla (rangebound) trade, the head fake move would be the strongest indication of a market ready to make the next leg lower which is the last part of our expectations.

I hope that gives you a better feel, I'll try to make this as clear as possible as we move forward, but other than a couple of days that didn't change expectations at all, except maybe made the rally we are in now will be a little weaker than it would have been because it didn't get that final accumulation spot at lower prices Monday.

This doesn't change that some stocks will be ready to short as core shorts now and some will take a bit longer, but this is what was needed.

One of the best explanations for why we needed this move and why it is a market gift can be summed up in PCLN, you might recall where I wanted to short PCLN, take a look...

I wanted to short PCLN ABOVE the recent former high on a head fake move that has distribution in to the breakout, there was little chance PCLN could do that without market help (not saying this is all about PCLN, it's the concept). Shorting PCLN above that last high is where the best price and the lowest risk are to be found. So long as there's distribution and I can't imagine any circumstance that is probable that would stop PCLN from being distributed, then we also have a very high probability trade.

This is exactly what we look for, we don't chase, we stalk. PCLN up there is the best price for a short entry which is the same as being long, sell high and buy low, you just happen to sell first. It's also the lowest risk and we don't enter without confirmation so it becomes a high probability position as well, this is but 1 example of why this move is even in place, THE SECOND REASON IS THAT RETAIL WAS EXCEPTIONALLY BEARISH, TRADING IS A ZERO SUM GAME, WE CAN'T ALL BE ON THE SAME SIDE OF A TRADE AND MAKE MONEY SO ONE OF THE MAIN EXPECTATIONS I HAD FROM THIS MOVE AND THE REASON IT NEEDED TO BE "STRONG" WS TO FLIP RETAIL'S SENTIMENT TO BULLISH.

Wall Street needs someone to hold the bag, who better than retail? Who else other than retail?

Is interest rates about to start going up?

-

Yes, I know - it does not make any sense - FED is about to cut

rates...but....real world interest rates are not always what FED wants it

to be.

6 years ago