The gist of the analysis was as follows (excerpt from the linked post above)...

"This is a possible scenario I've come up with for today's intraday trade based on the charts we have now. I started considering this based on the USD/JPY overnight action... why save it for now? Here's a scenario...

First let me show you the QQQ, we have been watching this deteriorate and it's in unrecoverable position, but this is what we expected from a head fake move as well so it shouldn't be a surprise....I want to let you know because it allows you to consider how you might want to use it to your advantage, I'll tell you at the end how I'd be looking to use it....

As far as all the intraday chart like 1 min they were negative and in line, this is at reversion. From here on an intraday basis, the Q's could make a lateral price move (with the broad market) that allows enough intraday accumulation for a intraday pop higher from here. I think the minutes sealed the fate of this last trend so it's not anything I'm concerned about, but it may be something I can use."

The thing I was wrong about was the lateral intraday price move that allows accumulation for a short term move. The easiest way to think about this concept is a lateral base is like putting gas in your car, the larger the base, the further it can take you (even though we are talking about a very small base/move). Instead what we got was...

This is the 2 min QQQ today, you can see there's a VERY small positive divegrence around 10 a.m., but there's no lateral trend which would allow the Q's to build a little strength, again it's like putting gas in the tank if you don't have a substantial base, it's very difficult to support any upside move, we did not get the lateral move today. In to the upside move expected AFTER a lateral base to build a little strength (even to support a very short move of a few hours to a day or so) we see intraday distribution.

Back to the a.m. expectations...

"With the SPX so close to resistance, a pop above will change retail's sentiment to bullish as it is a breakout above resistance, many of them will buy it and that creates the trap as you can see above, the destruction in the charts is complete, however intraday, that makes sense especially looking at the QQQ price trend I drew above."

Although we got a move to the upside, we didn't quite get the SPX move suggested...

This is the resistance zone I was talking about this morning, we didn't get a break of it and if we did, we have no base to support much here, thus the initial expectation of such a move creating a small, but effective bull trap would be even more effective.

On a 60 min chart though we do have a wider topping process, this is similar to the base mentioned above, the larger the base, the further it can move the market; however it's a bit different with a downside move, markets fall of their own weight, they don't need the same lateral move, but they often do have a wider top reversal compared to the narrower bottom reversal pattern as you see.

The clear change in the market is HUGE volatility, you may recall as we transition from stage 2 mark-up to a stage 3 top, price sees an increased Rate of Change, it looks bullish at first, but it's a red flag that we are transitioning to a stage 3 top. As always, changes in character lead to changes in trend. The point here in a primary trend, the increased volatility on this scale is a major change in character which precedes changes in market trends.

Back to this morning's "Scenario" post....

"USD/JPY 1 min is already negative and we are already seeing some downside volatility, but this divergennce should be bigger to really break the Carry trade, to do that it needs the Yen to develop a bigger positive divegrence and the $USD to develop a bigger negative divegrence, that all is just a matter of time, that's it."

Here's what we have in the USD/JPY , the Yen and the $USD... the key influential element for the market this week ($102)...

This is the intraday 1 min USD/JPY, the divergence is deteriorating here, but beyond that, what the Yen and $USD do is more important, this comes back to the concept of how much gas you have in the tank.The intraday Yen not only subsided in its downside, but did exactly as we predicted this morning in making a lateral move and allowing accumulation. This move is not the primary trend in the USD/JPY in which the carry trade is close to entering a primary bear market as the carry trade is closed, it is a shorter term divergence to get the primary trend jump started again and to break $102 on the downside in USD/JPY specifically which for now is a market negative.

The longer 5 min $USDX saw a deep leading negative divegrence in to the afternoon.

This is the primary trend in the Yen and thus USD/JPY and Market...

4 Hour Yen positive leading divergence which largely formed near the start of 2014 (green arrow).

To understand what is going on here you have to understand a Carry trade, institutions use Carry trades to increase their AUM (Assets Under Management), it's a kind of leverage, the trade moving up makes them money, but it also allows them to leverage their portfolio size.

When a carry trade is opened (in this case) the Yen is sold and the $USD is bought, as long as the trade moves up, there's much danger, but when it starts moving down, the 100:1 leverage that is common to these kinds of trades can literally destroy a company.

Note the uptrend and more so the positive leading divergence in the Yen, this is a reflection of the carry trade being closed, the last thing that needs to be done to close a carry trade is to buy back the Yen, thus the upside move in the Yen this year and the accumulation in 3C.

Why close the carry trade?

This is the USD/JPY carry pair, since the start of 2014 (we noticed a change in character late December) is now trending down, each pip down (typically 100 pips in a $1 move) costs a 100 pips in losses, so the carry trade is being closed. One other thing that is done to close the carry trade is to sell the asset that was financed by it, if you look at the decline in market breadth you can see how this is true.

We have lower highs and lower lows since the start of 2014, a downtrend and right now a bear flag/consolidation. It's possible there's a head fake move on the flag, although it's largely pros trading FX in size, not as much retail like equities, it has long been known that currencies trend better than stocks.

The bottom line vs this morning's expectations is that we got exactly what we were looking for, the Yen to stop its downside move and to move lateral and the USD to see distribution.

If you are newer to trading or got involved after 2009-2010, then the correlation you are use to is $USD up / Market up; THIS IS NOT THE RULE, IT IS THE EXCEPTION. SOON THE $USD CORRELATION IS GOING TO FLIP BACK TO THE HISTORICAL NORM, "THE LEGACY ARBITRAGE CORRELATION".

Because of the "Bernanke Put" via QE, institutional funds felt safe to open carry trades and leverage up their portfolios, however the correlation of $USD/JPY (or $USD up) and market up is not normal, the historical correlation is $USD strength and stock , precious metal, oil/energy weakness, the opposite of what we see now, the reason we see it now is because of the carry trade, but historically they are not that common, they only have been because of the Bernanke put. THE CORRELATION WILL FLIP AT SOME POINT AND $USD STRENGTH WILL CAUSE MARKET WEAKNESS.

One of the effects of QE/printing more money or increasing the money supply is a weaker $USD, as QE is phased out, the $USD will gain in value as it is no longer being diluted, that will send the market lower and by that time the carry trades should be completely closed and we'll return to the historical $USD correlation (opposite the market).

Back to this morning's post...

"While all of this is building, the market is not usually going to just sit in one place so why not hit buy limits just above on the SPX in the mean time, it only helps as a head fake with downside momentum once the USD/JPY is ready to break down.

The way I'd use this is in assets like GLD I mentioned yesterday, I wanted to short them in to strength, if the SPX does what I am proposing, that strength in price in GLD should appear allowing me to enter the position that I refused to chase lower yesterday.

There are plenty of other assets tat the same concept can be applied to."

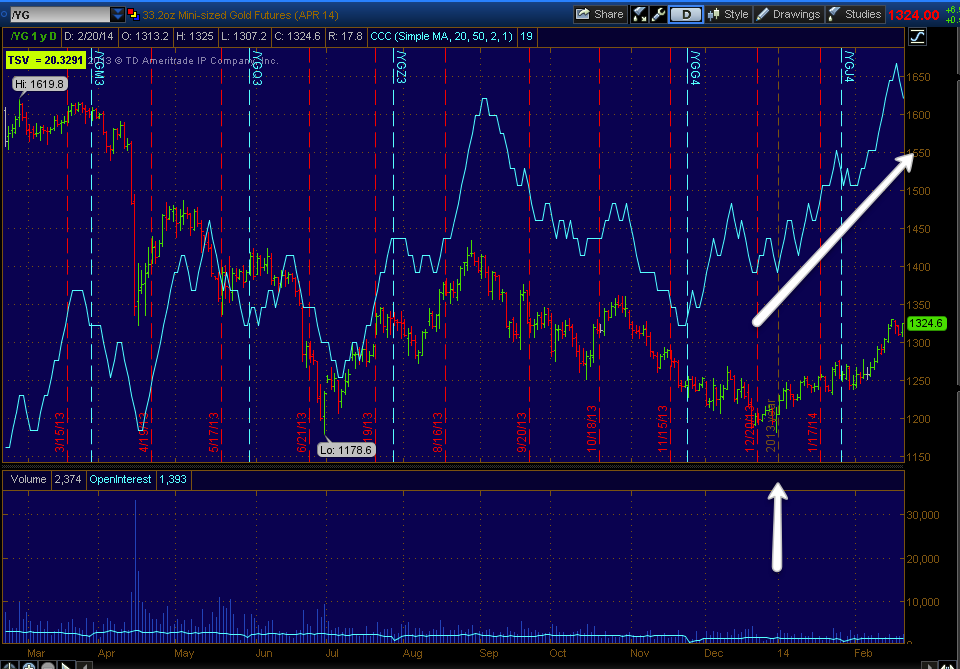

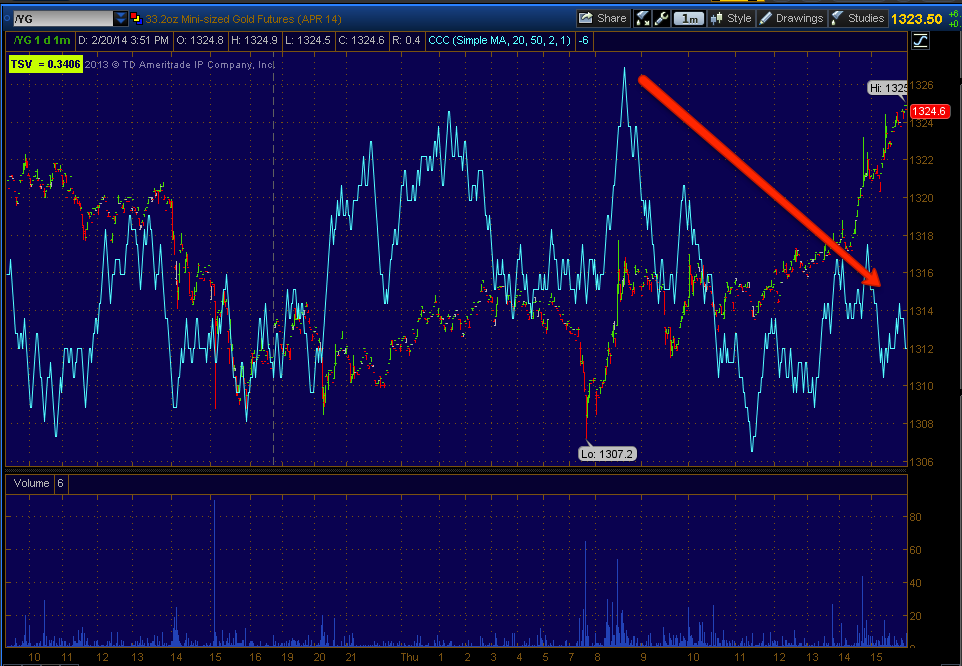

Although we didn't get the SPX move through local resistance, we did get enough of a move to move assets like Gold.

I closed the AAPL March $535 puts for a +24% gain because I think it has some upside, whether it's part of tomorrow's Option Expiration Max Pain Pin or just a bounce in AAPL, there was no reason to hold it when I can take the gains, wait for the move to end and re-enter the trade and make another gain on an AAPL put.

Here's how AAPL ended the day, it looks a lot more like what I had expected from the market today in creating a small lateral base...

AAPL 30 min chart with large distribution and then the accumulation that was around the same time as the head fake accumulation in the market creating the last move to the upside. The overall divergence is still leading negative so AAPL still has downside in the bigger picture, I do like other assets better though as discussed earlier.3 min intraday, the distribution is obvious, it's on a much larger scale, but we did get a positive divergence today in AAPL, thus closing the puts and preserving the gains was the most reasonable course of action.

Note the lateral trend in price (green arrow), this is what I expected in the market, but we didn't get that, this means the market doesn't have much support at all right now even for a very short term move.

AAPL 5 min intraday, it's not just the divergence, but the lateral trend/base. This will allow AAPL to make an upside move with some support, the size of the base and the following move are proportional, a 1 day base isn't going to create a 2 week rally.

AAPL 10 min with accumulation at the same time as the market in to the head fake move, AAPL has moved up like the market off that accumulation which was about 6 days of accumulation for AAPL, the leading negative divergence is significantly bigger, but this is what we expected to see as was posted before any upside move even began. The current positive is seen to the far right, when this fails after a small move up I'll look at another AAPL put or maybe short position although there are other assets I like more for a longer term short.

Note that despite having evidence of a bounce in AAPL, I did not enter a long/call position, this is because the probabilities for AAPL and the market are skewed severely to the downside and when a market is getting volatile like this at a trend pivot, I DO WANT TO TRADE WITH THE PROBABILITIES, NOT AGAINST THEM. So my plan for AAPL would be to set some upside price alerts and look for the next short entry, there may be other assets that look better at the time, but AAPL is on the watchlist for another trade similar to the one closed today.

Tomorrow is an option expiration Friday which means the market typically opens around today's close and usually stays pretty close to that range for the Max Pain Pin, around 2 p.m. most contracts are closed and the market will do what it will do the last 2 hours, we usually get very good signals those last 2 hours, they allowed us to predict the range starting the next trading day (over the weekend) on Jan 27th, they allowed us to predict the head fake move and ultimately the last run to the upside so we'll be checking that out carefully.

FB was brought to my attention, not their acquisition of WhatsAPP, but the fact that it's VWAP closed today almost exactly where it closed yesterday, often large institutional orders are filled at a consistent area and VWAP is used to rate the performance of the market maker or specialist in this case who filled the order, it's a sign of institutional money exiting the asset. Buy the rumor sell the news? Perhaps. FB has a daily divergence on par with the market, but that's not what's interesting.

Daily 3C chart, you may remember when FB was the most hated stock, we were among the first to go long at accumulation to the left, actually at the low of the trend and did very well. Currently there's a much larger negative divergence, part of this is broad market based.

As far as the specific move on the acquisition, here's what we have...

FB intraday, so it looks very possible, we'll see if we get migration to longer charts, if so, FB would make a nice long term trend short.

I'll check futures later tonight, right now there are 1 min negatives in NQ, TF and especially ES right now.

Daily 3C chart, you may remember when FB was the most hated stock, we were among the first to go long at accumulation to the left, actually at the low of the trend and did very well. Currently there's a much larger negative divergence, part of this is broad market based.

As far as the specific move on the acquisition, here's what we have...

FB intraday, so it looks very possible, we'll see if we get migration to longer charts, if so, FB would make a nice long term trend short.

I'll check futures later tonight, right now there are 1 min negatives in NQ, TF and especially ES right now.