While ES will trade overnight, here's a look at how powerful the move in ES was today (as well as the broad market: SPX +1.60%; NDX +2.68%; Dow-30 +1.09% and still the laggard as 3C has been suggesting for well over a week; R2K +2.32% and finally AAPL +5.83% confirming the last move higher in the market would be led by tech and specifically AAPL, this is a great move higher for AAPL)

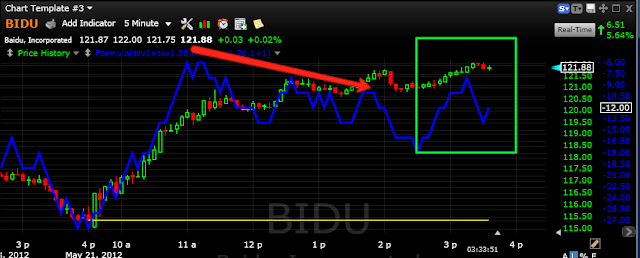

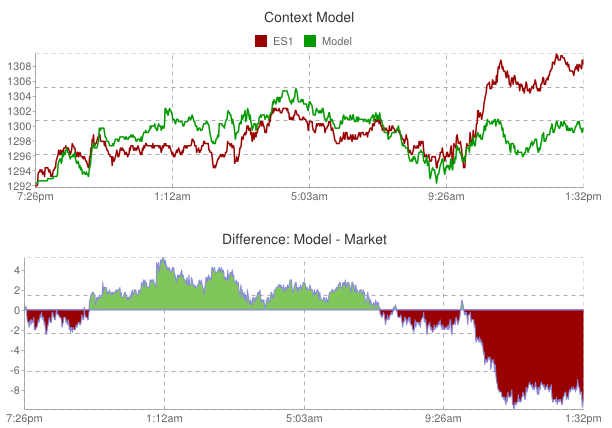

As you have seen, ES was in a positive divergence pre-market and added to that on the opening dip to the intraday lows where 3C went positive again on heavier volume. We saw confirmation throughout the day except for a brief period in which the Euro was pulling back. I think because the market was rallying ahead of the FX implied correlation on an intraday basis (the FX implied correlation over the last week has been much more positive) I think short sellers came in to the market expecting today to be a failed attempt to bounce off an oversold condition. As the charts have been showing, this does not strike me as an oversold bounce at all, but rather a cycle that has been planned, has been under accumulation for some time and we also see that in the Risk Asset Layout leading indicators. In other words while most traders view this as an oversold correction, the information we have is that this has been planned and under accumulation before the market reached an oversold condition. It now appears that the market was waiting for OP-EX to end and with the heavy Put open interest, I'd say 1 of 2 things, either Wall Street was counting on those puts to be exercised or (although it would be rare) Wall Street was the owner of those puts, which is much more complicated subject being retail wouldn't be the ones writing them, I lean more toward the second option.

During normal market hours there was that final positive divergence/accumulation at the ES intraday lows, confirmation, a brief dip in 3C based on the Euro pullback (however the market broke with the correlation on the pullback and stayed positive as it was only an intraday pullback that didn't do any technical damage to the Euro) and finally 3C shows that there was aggressive support (probably some short covering) that sent 3C in to confirmation of ES's intraday highs.

Looking at ES's VWAP, the only break below VWAP was at the 3C positive divergence and volume picked up there, it appears institutional money was soaking up shares on this move below VWAP which represents value. The rest of the day ES walked the upper standard deviation of VWAP in a very impressive show of strength.

Finally her's ES with some Bollinger Bands, whenever an index walks the upper band, it is a very strong show of momentum, the only sticky area was the Euro pullback.

As you can also see, there's a definitive change in character in the SPY/SPX

The SPY's downside momentum is obvious as the SPY was walking the lower BB's, it's now moving toward walking the upper BBs on a 15 min chart, next target the 30 min and 60 min and maybe we even hit the daily.

Downside momentum as SPY walked the lower BB's and now moving toward the upper Bollinger Bands on a 30 min chart.

Thus far I'm very happy with how things are developing starting with the Euro changes in character in 3C which led to price changes as downside momentum gave out and the Euro formed a base which should be able to support the impressive kind of move I have suspected for some time we would see before the next and very dangerous leg down.

Is interest rates about to start going up?

-

Yes, I know - it does not make any sense - FED is about to cut

rates...but....real world interest rates are not always what FED wants it

to be.

6 years ago