DIA 1 min shows the positive divergence I mentioned in this post yesterday, in which I thought we weren't quite done with the upside. Today however has shown a leading negative divergence, which is the strongest kind of divergence.

DIA 2 min here's yesterday's strength

DIA 5 min again yesterday's divergence and in line trade

DIA 10 min shows a relative negative divergence today

DIA 15 min this important timeframe shows a continued nasty divergence, the longer/stronger, the more downside we expect.

DIA 30 min longer term chart, showing a very important timeframe going leading negative.

DIA 60 min this chart speaks for itself and is one of the nastiest long term negative divergences seen in a while.

QQQ 1 min this also shows yesterday's strength from this post.

QQQ 2 min negative into the closing highs

QQQ 5 min yesterday's strength and inline trade

QQQ 10 min a relative negative divergence

QQQ 15 min the important 15 min chart is leading negative (the longer the timeframe, the more important, but at 15 mins, it gets pretty serious).

QQQ 30 min an even worse divergence

QQQ 60 min one again this hart speaks for itself, it includes the top in which we saw a very bad downside move from in late July/early August.

SPY 1 min showing yesterday's end of day strength suggesting more upside.

SPY 2 min close up a relative negative divergence as well as yesterday's EOD strength

SPY 2 min expanded view showing the depth of the negative divergence

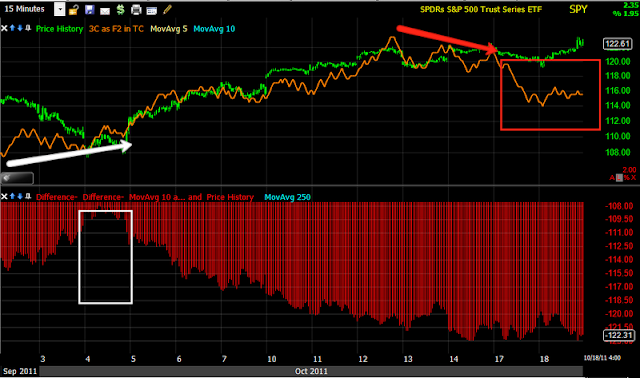

SPY 5 min this is the entire short squeeze rally with initial distribution on the 7th, remember how much accumulation went in to this 15 min chart, basically the whole 10 week consolidation was used as an accumulation zone.

SPY 15 min a leading negative divergence

SPY 30 min this chart also speaks for itself, especially in this timeframe

SPY 60 min the longer view of the 60 min, this is the worst 60 min divergence seen in several months

ES 1 min shows very early morning accumulation as was expected Monday, there's distribution in to the highs of the day and now it's leading negative in after market trade (ES trades 24 hours during the week)

ES 5 min shows yesterday's signal for more strength, this is a relative negative divergence in to today's highs, there's a hint of a positive divergence tonight, we'll see if it dissipates or strengthens. Maybe Emma will wake me again for a very early morning update!

Is interest rates about to start going up?

-

Yes, I know - it does not make any sense - FED is about to cut

rates...but....real world interest rates are not always what FED wants it

to be.

6 years ago