We don't see many "V" reversals as they are an event, not a process, but this is the largest I recall in a while, but it also means there was no time to put together any kind of solid base or accumulation which we've already seen in the charts (last night's post shows almost all of the positives and they are tiny and mostly no further than 3 min charts.

So just to take a quick look at the damage and lack of repair...

SPY 5 min actually saw more damage today and it's already leading negative, not a hint of confirmation.

30 min chart which saw 3C move down today, but still leading negative and that mostly happened in 2 one day moves down.

QQQ 5 min

QQQ 30 min which also moved down today

IWM 5 min

IWM 15 min also down today.

The other feature I had been looking at and even talked about, wondering if a change in character would strip away the typical head fake moves and j start acting more like the charts of 15+ years ago, basically textbook technical analysis. I questioned this based on price patterns in place. I think today completed the answer to that question.

The Crazy Ivans...

The daily charts of the major averages...First check them out...

SPX daily had a bear flag in place, price moved down and then flagged so it was a real move, the first break below is textbook technical analysis, but we know that the market hasn't allowed that for some time, although retail traders still play by those rules, Wall Street uses Technical Analysis against them.

NASDAQ 100, another bear flag with a break below as technical traders would expect and then something they don't, a break above.

(also note the small body during the day and longer upper wick-no movement beyond the gap opening and higher prices rejected/resistance).

Russell 2000 Bear Flag and a Crazy Ivan.

The Dow was a bit different, but same concept, a move down followed by a bearish Descending Triangle which is suppose to break to the downside and make a new leg lower, it also saw a Crazy Ivan at the second yellow arrow.

What is a Crazy Ivan? A Crazy Ivan is essentially a shakeout on both sides of a technical pattern. With a bear flag shorts enter on the break below the flag (although there aren't many) and when prices move above the flag which they aren't suppose to according to TA dogma, it causes momentum as the shorts cover and they switch to long positions, typically the next thing to happen is the longs get shaken out with a move back down below the price pattern (bear flag or descending triangle) and this is usually when the real trend is exposed, but not before shaking out both longs and shorts.

This is why we call it a Crazy Ivan based on the submarine warfare tactic in , "The Hunt for Red October". IT'S A HEAD FAKE MOVE.

AS FOR THE CARRY TRADES THAT "LIFTED THE INDEX FUTURES OVERNIGHT...

They were a total flop.

Here are a few...

EUR/JPY 60 min #1 the top, #2 the decline that caused Monday, #3 the ramp that caused Tuesday, #4 the carry falls short of Monday's highs, we start to get a decline and a little bounce to the far right today.

In effect or truth, we have lower highs, lower lows of significant size from the New Year top, #3-5 are just smaller trends within the next lower high.

EUR/JPY 15 min, closer view. #1 Monday's decline, the bottom was Monday 3 p.m. and #2 Tuesday's "V" shaped Dead Cat bounce, I haven't seen many "V" reversals, what, maybe 5% are "V" shaped and most of those are dead cats. #3 is the start of the reversal and 4 is a minor wave. To really explain this requires understanding Dow Theory which is too much explanation for what we need.

This is that minor wave bounce and it sure looks like it's starting to round over to the downside, ES is in purple for comparison.

*Although ES followed AUD/JPY more closely today, a carry cross that is in the worst shape.

By the way, I don't know what the news is, probably something Asian, but something very ugly just happened there, 3C was picking up on it just before...

Talk about rounding over, this 1 min chart shows something pretty nasty, I'll have to check in to it, usually something Asian.

EUR/JPY vs ES (purple) 15 min shows that the carry cross didn't make a new high, it made a lower high so ES is pretty extended out there with no carry support.

It's the same story with the USD/JPY vs ES (purple) which is interesting because yesterday I showed several timeframes all positively divergence in the $USDX and wondered if those divergences which should and did send the $USDX higher, would effect USD/JPY positively, apparently not.

$USDX 15 min positive and the move up off the divergence, but...

The 5 min looks like that move is going negative now, that certainly won't help $USD/JPY and thus it's not helpful for the market.

This is USD/JPY vs Es (purple) intraday, looking a bit like momentum has faded and rounding over.

This is the USD/JPY vs. the Yen single currency which is the key now, there's an inverse relationship because USD/JPY means $USD long/JPY short, so JPY moving up pressures the pair downward.

Note the very sharp "V" reversal leading the market since 3 p.m. Monday and the current rounding as the carry cross failed to make a higher high which puts the trend that broke this week, in a continued bearish trend (I'm careful not to say downtrend as we have the start of lower highs/lower lows, not a complete trend, but this is what we've been expecting and why we've been paying so much attention to the carry crosses and Yen.

As for the Yen, I showed it a few times today, as of yesterday we had some 5 min positives, a start...

The rounding process for a move higher is only important if there's accumulation which in this case is likely to mean that the carry pairs are being closed, thus their downward movement since the start of the year, except AUD/JPY which went negative off April.

The 5 min has just grown, but you know we look for the divergence to migrate to longer timeframes to show it is strengthening...

Yesterday there was no 15 min positive, today there is.

The 30 min was in line and holding well, but no positive, today it's leading so we have migration as well, right around the same time the market has pulled a double shakeout, Crazy Ivan in EVERY major average.

I don't usually follow most of the standard Technical indicators, but there are a few I like if used in an unconventional way. This was pointed out to me as being present in the SPY, I found it everywhere, RSI is negative.

RSI 6 is negatively divergent not on just the SPY, but the SPX and the NASDAQ 100 where it is even worse, the Dow as well and the Russell 2000, this is often a quick forming, quick reacting signal.

The red line is about equal highs, RSI should be the same, it's not even close to price, but worse, compare the two relative points at the orange trend line. Check the other averages, all have it.

You already know what the damage is at the top of the post, intraday updates, Market Wraps, etc. Once we have larger divergences and longer timeframes in place, we go back to the fastest timeframes, it's not exactly the true mechanics anymore, but you can think of it the same. After a market maker fills a large position and before it has moved, we have a large/long term divegrence, typically just before it moves, the short intraday charts will go divergence the same direction in what use to be market makers/specialists filling up their account for the move since they filled it, they know when it's done and about 30% of all of their activity was for their own accounts, HFT has changed that, but the concept is the same.

That's why the EOD action struck me. *The way I confirm is by looking at multiple correlated assets, but because they are different like leverage or inverse, different managers (companies) and most importantly, different volume despite price being correlated, THERE WON'T BE CONFIRMATION UNLESS THERE'S ACTUALLY SOMETHING GOING ON.

I NOTICED THIS AS ONE OF THE FIRST, QQQ 2 MIN

QLD is the 2x leveraged of QQQ, same signal in the same timeframe at the same time.

TQQQ is the 3x leveraged version, same thing.

IWM 2 min showed the same, the 1 min which was so perfectly in line yesterday, totally fell out today, this is why I chose the IWM for a February Put, the change was very dramatic.

UWM is the 2x leveraged.

SRTY is the 3x leveraged inverse.

SPY 2 min also toward the EOD/late afternoon

SPXU is the 3x inverse, same signal except stronger as the 3x leveraged often are.

I even checked the leading industry groups today, Financials and Tech...

XLF-Financials

FAZ 3x short Financials is confirming.

UYG 2x long financials also confirming.

XLK, very interesting

TECS is the 3x inverse, it's confirming.

And TECL 3x long confirming, in fact, almost a spitting image of XLK.

As for the Index futures as of the capture...

I noticed these too were showing similar signals around the same time, ES/SPX futures

NQ/ NASDAQ 100 futures

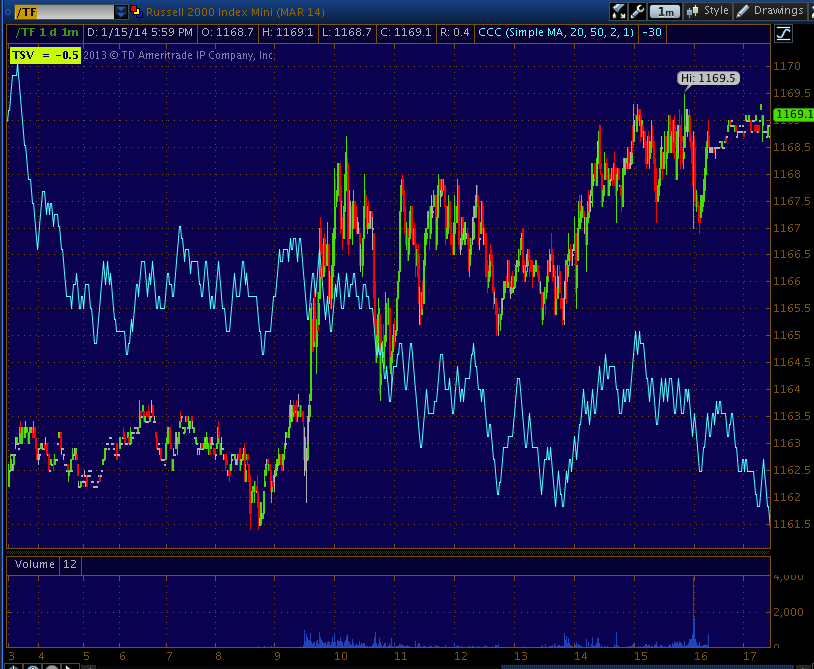

TF, / Russell 2000 futures, remember what I said about 1 min IWM today because TF was confirming just like IWM yesterday and today, the wheels fell off.

This is what I mean...

Perfect price/3C trend confirmation right until the close yesterday, today, a very different story and the reason I opened the IWM Feb. Put position today.

As far as odds and ends, VXX was solidly underperforming early yesterday allowing the market lots of help on the upside, that fell to equality by the close, today there was a huge outperformance in VXX, it would seem to me that VIX futures are now once again in significant demand.

HYG is still in line, but the distribution is just worse and worse.

High Yield Credit held up strangely Monday as if it knew what was coming Tuesday, but yesterday it started falling, today it fel further making a lower low, there's no correlation or arbitrage in HY Credit like HYG so the price action there is the real deal.

Sentiment indicators were split just like yesterday.

TLT was also much better performing than it should have been , in fact so much so I have to consider that this may be it for its pullback.

Yields were up a bit today as money rotated from yields to risk assets, but still negatively dislocated. 10 year Treasuries saw some positive support, but I'm thinking it was just a cycle and it may not be done pulling back, hard to call there too.

There was no Dominant Price/Volume Relationship today.

I assumed gold (which has been trading opposite the market) had more downside to go, but today saw some very strong positives, thus I closed the DGLD position at a small loss. The GLD positives were from intraday through 15 min and strong.

DGLD P/L

I ended up taking a -3.5% loss here, but I wasn't taking the chance with the GLD movement, for example.

GLD 2 min, the red is why I opened DGLD for a GLD pullback, the white is why I closed it. This is a market I'm not taking chances in, if it's not standing out, I'm out.

GLD 10 min leading positive today, that was enough, I don't care if I was wrong, I don't want to get caught on the wrong side in this environment (carry trade underperformance and trending down and Yen positive).

Index futures right now look worse than what is posted above, still 1min charts, but it's the Yen that's really the important asset, probably the most important right now.

I'm going to check futures before I head in tonight, there could definitely be action. Remember that 3C on the averages during market hours almost always picks up where it left off, I didn't post all of those EOD 2-3 min charts for nothing.