Today has been a day of a lot of events, events that shape sentiment. However as we have seen with the demise of the financial trade, the market has shown that it too seems to be closely linked with the sentiment there. If you watched the 3C charts over the last week in financials, you got a real look at the inner workings of the market, quiet accumulation, a rally and then distribution into higher prices until there was no more inventory to unload and then a 3 day reversal down that has weakened the market every day.

Most people would acknowledge that sentiment shapes perception and perception shapes the market, however, as we saw with the financial charts, smart money's perception is a bit ahead of the general public's.

Some of the events shaping sentiment for better or worse:

Riots in the streets of Greece which started out as a strike, except a strike in Greece isn't a news ordeal or a political statement, it's an economic event that deteriorates GDP, not good for a country that needs to restructure its bailout received just a few short months ago in May.

To a lesser degree, we saw riots in Italy today as well, although they were more about the election then austerity measures.

Remember last week it was Britain over student tuition hikes. Ireland has seen it's share of violence and its probably not done.

And the French took to the streets en masse over pension reform a few months back.

The point? European governments must take on austerity measures, but the backlashes are growing increasingly violent. The hard choices that the governments in Europe have to make are becoming more difficult due to protest/violence that can cripple Gross Domestic Product and make the situation they are trying to remedy even worse. Not to mention politician's distaste for being booted out of office. The only thing that would help would be selfless politicians putting their countries interests first, even if it meant they would lose office. How many of those type of politicians do you think are out there?

Spain on downgrade watch-either the ECB steps up bond purchases or Spanish borrowing costs lead to the next leg of contagion.

Belgium is in the S&P's rating cross hairs with a negative outlook.

A weak Portuguese bond offering, seeing yields (borrowing costs rise)

Germany is not looking like it wants to play ball in expanding a European bailout mechanism

The very real specter of a Chinese rate hike within the next quarter, probably sooner then later due to very palpable inflation concerns

The Housing Crisis may be quiet, but it's not better. Prices are falling. I told you my personal opinion, I wouldn't touch a short sale of bank owned REO. I shared with you some of my favorite trades as well-SRS at the top of that list.

The tax cut ordeal in the US is a bi-polar issue when good is bad and bad is good, it's just that the opinion of what is good changes nearly daily.

Pressure on the Fed as Ron Paul openly supports abolishing the Fed, certainly they'll come under greater scrutiny and that is one thing the Fed has managed to avoid for a long time.

Recall my comments on Cramer and BAC, today BAC is trying to settle the issue of putbacks with PIMCO and the NY Fed-this is just the start for the fnancial industry and could very well set a precedent that could effect many that put together these toxic mortgages as they are forced to buy them back-the big problem, they don't have the reserves set aside to do so. Banking Crisis # ????

In any case, what has manifested seems to be the markets finally taking the lumps they so desperately deserve.

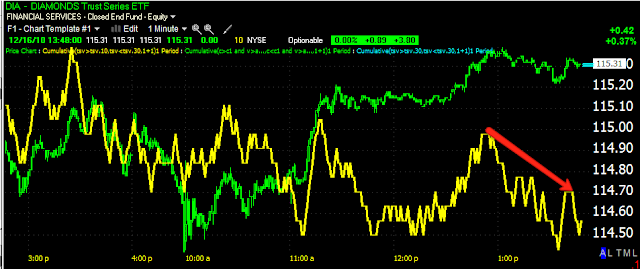

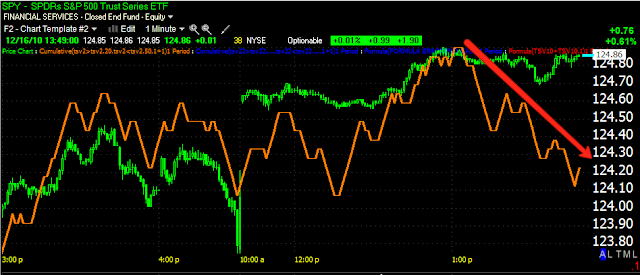

The charts below show price rounding back over to the downside, but the 3C readings show how dramatic and negative the underlying action is.

DIA

QQQQ

SPY

Tomorrow morning, unless we get some Asian or Euro data that send the dollar higher, I'm expecting little early morning strength. There may be an opportunity in that strength to enter some of the trades listed today and recently at better prices.

I'll also be adding the next 2-3 industry group trades from my scans. Be sure to set these on alerts so you don't miss opportunities.