As always, I bring you the signals for the "Miners trading system".

If you recall the original system did very well, currently backtested over a 6 month period with the most recent trade, it' returned +74.60% on an equity line over the past 6 months. The second version of the system which I changed a bit to reduce the false trading signals has returned as of today 94.83% over the last 6 months.

The first system has earlier signals, but nearly double the losing trades. The winning ratio is 54% with a gain/loss ratio of 2.3x.

The second system has fewer failed trades, with a winning ratio of 65% and a gain to loss ratio of 2.0 (actually a little lower as the losing trades tend to run around -3.78% vs the first systems losing trades at 2.87%-I believe this is because the first system reacts a little faster, but also has more false signals because of that). The equity line for the second system is returning 94.83% over the 6 month test period with the latest trade-Incredible!

So here's your choice. The first system which triggered a long trade in DUST at $43.68 on June 3rd (vs the second system triggering on June 6th at $43.54) is now giving a signal to buy NUGT tomorrow morning on the open. The second system is still long NUGT as of tonight.

Both systems are outperforming some of the best hedge funds out there so there's probably not a wrong answer to the question, it's just a matter of preference and I've given you as much detail about both systems to make that choice.

So if you choose to take the first system's signal from tonight, you'd close out the DUST trade and buy NUGT on the open.

If you want to stick with the second system, then the signal is to stay long DUST at least for tomorrow.

The only other input I can offer is the 3C charts of both.

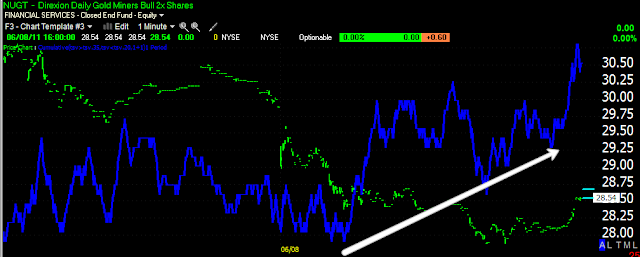

NUGT 1 min 3C positive divergence

NUGT 5 min 3C positive divergence

DUST 1 min end of day negative divergence

DUST 5 min negative divergence.

Please remember that 1-5 min divergences are important, but distribution and accumulation can carry on past these timeframes.

Also remember that to take advantage of compounding, the trades in both should be treated as a separate portfolio, with gains from the last trade invested into the next trade.

Best of Luck!

Is interest rates about to start going up?

-

Yes, I know - it does not make any sense - FED is about to cut

rates...but....real world interest rates are not always what FED wants it

to be.

6 years ago