"Understanding the Head Fake Move" as this is a concept in every asset, every timeframe and it's seen at least 80% of the time, usually just before a reversal so it's worth reading or re-reading.

* Understanding the Head-Fake Move Part 1 "How Technical Analysis Went from an Asset to a Trap"

* Understanding the Head-Fake Move Part 2 "Motivation"

As for the chart examples...

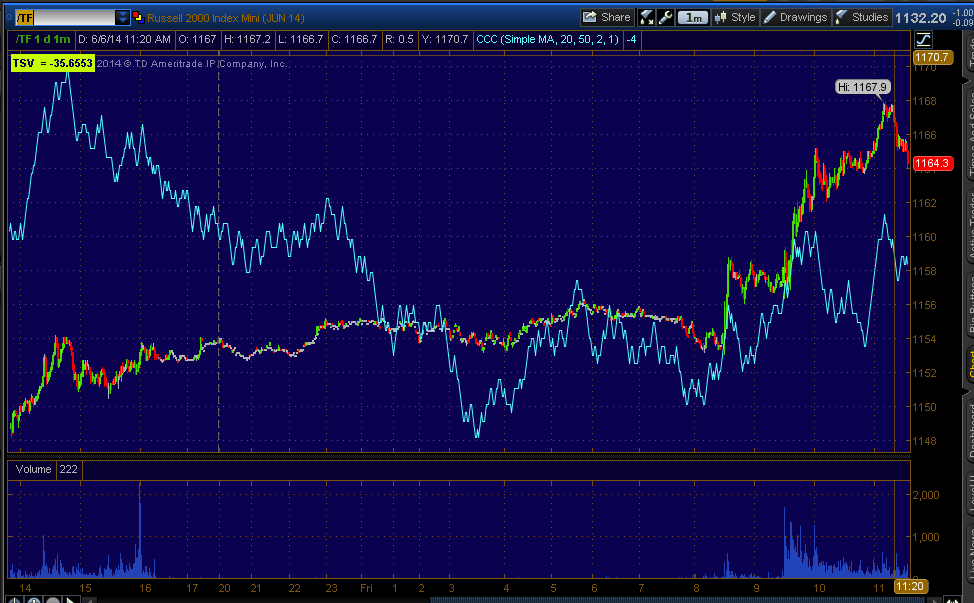

For the most part the 1 min intraday charts just made small adjustments/divergences, today was the first day of the week that a larger divergence was seen on the timeframe (negative)

However, after 1 min charts, there was a lot of underlying activity, this is a 2 min chart's trend, notice the trend as the SPX crosses above the range resistance at $1900, the trend is nearly straight down.

In addition, the price trend change shouldn't be ignored, we often see an increase in the Rate of Change just as we did yesterday, just before a new trend/stage is introduced. This is a concept that works on any asset in any timeframe, for example...

Whether a 5-day chart or..

A 15 min chart. "Changes in character lead to changes in trends".

Again, as for the underlying action above the multi-month range which we expected to be a head fake move weeks before it started as that's another broad concept that works in any asset and any timeframe, note the longer term chart's trend .

This goes back to January, but I'm most interested in where the February cycle/rally started and the range forming after it and what has happened during that time.

The longer term charts remove noise and some details, but they give you a broader perspective of the trend. I found this interesting because another money flow indicator which is not 3C, had almost the exact same signals, definitely the same trends.

I'm pretty much looking at both charts starting from the distribution around January leading the market lower in to the February lows and rally, then the indicator unable to make a new high with price and quickly falling to a new low, exactly the same as 3C above, although I have no idea how this indicator is constructed.

The 1 min Q's also just saw minor "steering " adjustments, again that is until today which is the largest 1 min divergence of the week (negative like the SPY today).

The longer timeframes beyond 1 min showed a negative trend and again, in this case it starts right around the time price crosses resistance from the Feb. high in the QQQ which was completely retraced in the Q's.

Again, close to inline until price crosses in to the "Head fake zone" above resistance, the breakout level where retail will buy and offer demand institutional money can sell/short in to.

The trend of this week (red) is notable.

QQQ 15

Although the Q's have their own underlying trend, it is reminiscent of the other "Smart Money Flow" indicator.

Again, distribution in to early January leading to the Feb lows and rally, distribution at the start of the Feb rally top and a new leading negative low. The signals aren't exactly the same, but it's also the Q's rather than the SPX and of course different indicators, but showing the same broad trends.

Compare...

Note there's no distribution here in the IWM (yellow) as there's no higher prices, as soon as there are higher prices to sell in to/demand, note the change in 3C.

I had been saying I expected the IWM to outperform as it had underperformed and was slipping, it had its best week of 2014.

There were several reasons I expected the IWM to show better relative performance vs the other averages, here's one, however the positive divegrence sending it higher has turned negative quickly today.

And the broad trend , Jan distribution, February distribution, new leading negative lows in which the IWM followed.

As for leading indicators...

This is the trend in High Yield Credit, Institutional money's "Risk on" asset, they aren't quite so excited as the SPX.

This is HY credit today specifically.

Again, the trend among smart money (our smart money sentiment indicators) shows they aren't buying either.

This is the second sentiment indicator we use for confirmation. Ever since the cross above the range, pros have not been keen to follow.

This is 20+ year treasuries today, I'm still not sure I understand the dynamic or new dynamic in Treasuries, but, this is not suppose to happen...

TLT vs SPX, this is a risk on trade and a flight to safety trade at the same time, for months the argument is one has to be wrong, I'm not sure as Treasury sentiment has changed massively as the F_E_D backs out of purchases with no other major buyer left. Or it could be distribution in one frees up funds to buy the other, it's one of the puzzles I'm interested in solving quickly.

VIX was pounded today, in fact to Feb. 2007 lows, and anyone wonders why the F_E_D is worried about complacency in the market?

However as VIX hit its new low, the market gained nothing from it today.

And talk about strange...

Look at the After Hours volume spikes in VXX, the first one sent price a bit higher on the hit. What is going on here? I suspect we'll find out over the next few days as VIX futures (not spot) were showing strength today as seen in today's futures update.

As for breadth...

The NASDAQ Composite (all NASDAQ stocks) is seeing strong deterioration in its advance/decline line (A/D in green, COMPQX in red).

The Absolute Breadth Index is also falling off to one of the worst historical readings on record.

High levels are associated with bottoms as you see in 2009, low levels are associated with tops as you see an extreme divergence through 2014.

Looking at a longer view...

The 200 top can clearly be seen as ABI falls off, the 2002/2003 bottom can be seen as it rises, the 2007 top is seen as well as the 2009 bottom, compare price vs the fall-off in 2014, that's extreme.

Here's the same chart as above so you can see it with no notations..

And finally, NYSE new highs, again not a picture of health, especially given the recent short squeezes.

I'll be looking through my 300 stock watchlists and looking for trends as I did last Friday and had decided to wait on any new entries, the trend of several hundred stocks often becomes clear and gives you a different or unique perspective.

Have a great weekend!