Sound crazy? It is, although there have been many economic reports we have predicted as well as earnings, all it takes is a strong 3C signal. And why do those 3C signals work? It's pretty simple, the market is that manipulated that we are actually watching what Wall Street is doing. This is how we have been in every up and down move the last 6 weeks to the day, sometimes to the hour.

Today was a surprise as I expected the market to sell off hard and fast and to see strong positive accumulation by now, but that was more me putting the different pieces together then it was 3C telling me, "The market will fall hard and fast". Friday we expected Monday to be down and it was, Monday we had a signal that the market would rise so I and many of you covered a portion of our shorts and then entered them at higher pries, which made us some more money. However today was not on the radar. I think it's one of a couple of things: 1) Overnight the European action changed the value of the Euro dramatically from yesterday's close 2) It could have been part of Wall Street's tactics (tactics are a means to a strategy), 3) Saturday's post may have been right on and we may have seen a shift in what Wall Street was doing, perhaps the Fed hanged course over European events. Remember, Geithner was just over there and to tell them what they had to do? That could have been done by a press conference. In any case, 3C straightened out the day and gave the direction of the market and all was well again, however, my thoughts about the FOMC are not in alignment with the 3C signals. The weak part of Saturday's analysis was always the timing. The market would have to sell off VERY hard and we'd have to see very strong accumulation in 2.5 days, that hasn't happened.

If I had my way, the market would drop 6% tomorrow morning, I'd cover 3/4 of my short and let the rest rise having locked in a profit.

However, we are dealing with the FOMC, first what will they say? Second, what will the knee jerk reaction be? There's almost always a knee jerk reaction and it's almost always wrong. Third, what will the real reaction be?

We've had 2 Fed events in which we have been told by the analysts and the media, "If the Fed doesn't give us QE3 tomorrow, the market will fall 600 points". Both times the Fed gave us just about nothing and both times the market was fine. Actually the first time launched the first rally after the August decline! So lets say the Fed gives us substantially more then in the past 2 meetings, a trillion dollars of QE3, but the market expects 2 trillion, well, the market could sell-off. What if they Fed gives the $hypothetical $2 trillion the market wants, then the market say, "Oh boy, we got it, we must be in bigger trouble then we thought" and again the market sells off. Or the Fed says, "We're still watching the economy with a lot of tools" and that's it, who knows, maybe the market rallies. As you can see, besides point 1, 2, and 3, we have what drives the market, sentiment and that can be unpredictable. I find the best way to play the market is to do what smart money is doing and as of today, it looks like they are in distribution mode or just finished it and getting ready for a solid decline. This is part of my Saturday theory, the short interest is so high and the margin interest, a break to a new low and a rally after that (a head fake) would do the most damage and make Wall Street the most money. This may still happen.

Heck, one year we got the signal that smart money was running from the market at 12 p.m. right up to 2:15 on a FOMC announcement. My theory, someone leaked the embargoed announcement from the media to Wall Street so we may still get some signal that points to direction.

Beyond that, 3C looks very negative at this last cycle top and a new low makes sense with what 3C is showing. Last week this was about the average size top/distribution event within the last 6 weeks, as of this week, it s the largest we have seen since the market fell from the late July top.

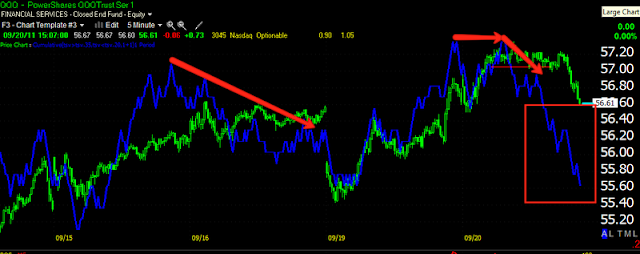

I showed this chart earlier, but here it is again...

intraday lows by mid morning, many of us took partial profits on our shorts and as the market went higher (3C had given us warning this would happen before we ever sold our partial position), we then re-established the shorts at a higher, better price, so we made money in the morning and re-established the full position in the afternoon. As of last week, this distribution area, Point (J), was between the depth of Point (D) and Point (F), or about average, which made sense from the accumulation zone for the move up at Point (I). Now Point (J) is the deepest and longest distribution zone of this entire 6 week period. What this tells me is that the accumulated shares were probably all distributed last week and since yesterday Wall Street has been adding to their short position for the move down. You saw the distribution today as prices went higher, Wall Street always shorts in to strength or a trading range-we saw both today.

It seems Wall Street is getting ready for a new low which will lock in just about every trader in to a short position. Furthermore, the Bear Flag that was present last week has now taken the shape of a bearish ascending wedge, traders are keying off the price pattern. To take the market to new lows would set up a historic bear trap, then to lift the market from there as we have long term indications that may be the plan, would force a massive short squeeze as margin and short interest is at multi year highs according to the NYSE.

The Dollar-

This is the dollar represented by UUP in green and the SPY in red, you can see there's an inverse relationship between the two, a stronger dollar generally means a weaker market and a weak dollar means a strong market.

Looking at 3C for UUP, the 5 min chart looks bullish for the dollar

As does the 10 min chart

And the 15 min chart, to the left you an see a negative divergence in red that sent the dollar lower.

As of this moment, the dollar is trading a bit weaker then the close on Euro strength.

The Euro is close to the levels seen this morning that helped send the market higher earlier. But just as I warned last night when the Euro was very weak after the Italian S&P downgrade, a lot can happen overnight.

Another correlation is between Copper and the market.

Here is FCX a copper stock in green vs the SPY in red, note Copper topped out well before the market did, but it tends to work on all timeframes.

Here's and hourly timeframe and you can see FCX diverging and heading lower while the market was climbing in the early afternoon, only to see the market give up most or all of it's gains in to the late afternoon session.

This 1 min chart gives you a closer view, Copper topped at the red arrow, it wasn't for another 3.5 hours before the market topped and headed lower.

Here's a look at why I think we could see a huge short squeeze in the not too distant future...

This is the daily hart of the S&P-500 going back to late 2009. You an see accumulation May-September of 2010, this is in anticipation and at the point Bernanke announced QE2 at Jackson Hole, Wyoming. You can also see distribution over a long period of time at the top. This most recent period is the shallowest trough since 2010 and hints that we may see a move up in the markets, this is a longer term perspective.

A head fake by setting a new low and setting a bear trap would create a VERY strong short squeeze that would send the markets much higher, for a time at least. Nothing will stop the eventuality we face on the downside.

This 4 day chart goes back to the accumulation of 2003 that started the last bull market, the 2007 top and now you can see how much worse our current divergence is, leading negative on a 4 day chart. Bernanke has built a huge house of cards and the higher he stacks them, the worse the fall will be. This chart already indicated the fall will be worse then the 2008 fall. However, I think we are still a ways off from this eventuality.

So why would I prefer to take substantial profits early tomorrow and leave only a fraction of my shorts in place? Quite simply said, the volatility around FOMC decisions. As I mentioned, the knee jerk reaction is almost always wrong. I would rather reposition myself after the volatility, but I will most likely hold if we do not get the chance to take the kind of downside profits 3C seems to be indicating are on their way, I'll be sure to let you know.

Tonight Republican leaders have sent a letter to Bernanke and the rest f the FOMC board members, you can find the text here.

If anything exiting pops up before turn in, I'll be sure to let you know.

Is interest rates about to start going up?

-

Yes, I know - it does not make any sense - FED is about to cut

rates...but....real world interest rates are not always what FED wants it

to be.

6 years ago