SPY 1 min

However the 2 min , while a bit positive, isn't that impressive, 3 and 5 min aren't anything more than in line

SPY 5 min

The QQQ 2 min looks decent, usually 3C divergences pick up where they left off, so my gut instinct would say early positive price action Monday.

The 2 min Q's are not that impressive, there's a lot of what I'd call rotation, although that's generally seen in a healthy market. For instance, look at the IWM's close vs the SPY's.

With a QQQ 5 min chart like this, I'd find it VERY hard to justify taking any long position and that's something I may have considered (1-day call position) if all of the averages had charts like the IWM below, but had formed a second base (with today's lows being the first part of a "W" 2-part base)

IWM 2 min

IWM 5 min, if there were a second move down to this morning's lows with a continued positive divegrence, I'd have considered a quick options trade so long as the set up were there.

We might just get that chance.

Take a look at Futures...

This is the 1 min ES chart, there's almost no chance that the signal here would hold up Sunday night, overnight to the open Monday morning, but it does show some trend of distribution which may just be wrapping up positions before the weekend.

If we were to see some very early positive price action, because this 5 min chart isn't supportive, I doubt it would go far. You may recall there was a time in a choppy market like this (not quite as bad), that long or short trades depended almost exclusively or at least had the final say, right here on a 5 min chart. The way this one sits, it doesn't support much of a move.

However this ES 15 min does have a positive divegrence and could just allow enough space for the market or IWM to put in a more solid base as mentioned above, something like a "W".

Ad I demonstrated in this post, Perspective with the DIA, there really needs to be some overwhelmingly strong signals to take long risk against the market's backdrop.

Since USD/JPY has been and as far as I can tell, continues to be the only real trigger out there as $102 $.22 away and acting as a huge psychological magnet, that can move the market, the signals there continue to be some of the most important for the moment, whether "considering" a long trade or getting a great opportunity at setting up shorts or add-to positions.

The only areas ES breaks with the FX pair are resolved quickly with either accumulation on a short term basis or distribution on the same (yesterday saw distribution).

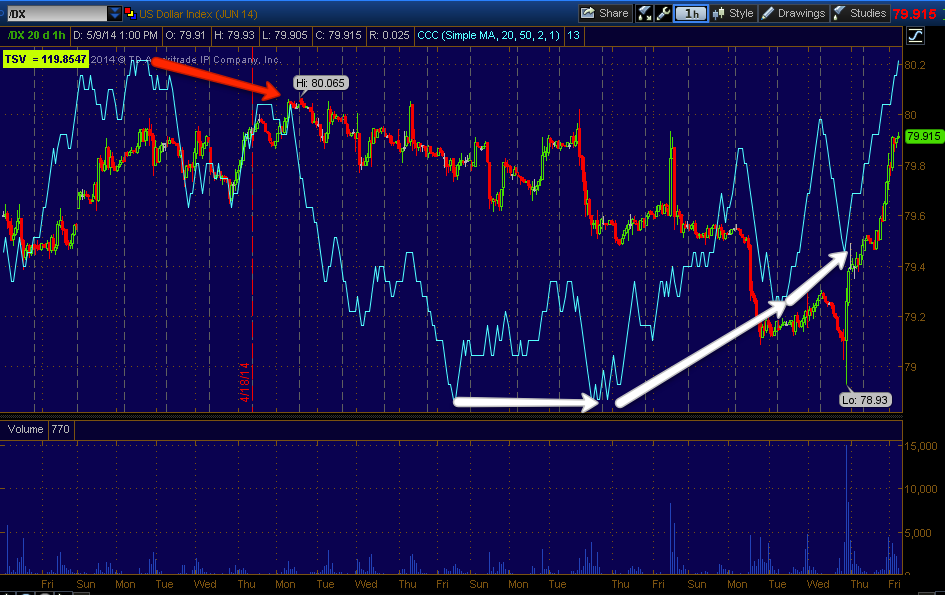

Of course the assets that move the pair are the single currencies, Yen and $USD. From what I can see, the Yen seems to be locked on downside trajectory (5 and 15 min charts), the $USD's 1, 5 and 15 min charts all look like it pulls back, that would explain the nature of any very short term strength early in the week (I'm thinking specifically Monday) and I do mean short term, so much so that I wouldn't even consider a 1-day options position. However the $USDX's 60 min chart is positive, so again this could be along the lines of a double bottom or "W" as mentioned before with regard to the IWM 5 min chart above, of course the market would have to pullback to do that so again, any price strength would likely be VERY short lived and a pullback would be the only real hope for a base significant enough to get a bounce off the ground that can be trusted for a day or two.

The VIX Futures continue to migrate out to a stronger divegrence as we had a 5 min and today added a 15 min and by the close it looks like a 30 min positive has been added.

As for VXX/UVXY, they continue to see stronger underlying trade...

VXX 5 min

VXX 10 min

UVXY 15 min and spot VIX

Finding support around the area, this fits very well with the DIA "perspective" post, especially on the urgency of the timing.

My overall opinion continues to be, "If we miss a long set up, I'm not too concerned as the Risk/Reward perspective looks very poor unless something big changes and still that would only be short term".

Otherwise, any price strength is more or less a gift to sell short in to assuming we can get it which I think is probable being USD/JPY $102 is so close by. However there's no reason I can think of that the pair need do anymore than cross $102 and trigger orders, I see no reason that it need run higher or linger, in effect it would be setting a bull trap.

It might look something like this...

Daily SPY...

As for GDX/NUGT, Gold and GDX do have a good correlation, this is the first time in a while I've seen a clear divergence in gold futures,

5 min gold futures leading positive

GDX intraday

The more important 5 min chart...

Honestly, although I expected it and wrote on Monday that the repair of the 10 and 15 min charts would be the key to the GDX/NUGT long trade, it was kind of hard to imagine... At that point we still hadn't even broken below support which is something we expected to happen first in order to repair those charts.

Just look at the leading positive 10 min above and the leading positive 15 min below.

The 30 and 60 min are already there.

I think we probably have a little more time to get positioned here, but since I'm expecting more of a trending trade and that's been hard to find in this market, I wanted to get some exposure and then add to if the opportunity arises.

So, while I think we have some short term details and maybe some smaller trades that we need a little more market information on, the set up for the big picture is looking very ripe, again I'd refer you to this post, Perspective.

It's more details right now than anything else and the market will give us those details as we move forward as it has very clearly with positions like GDX which was trading at a breakout, 3C or the market via 3C told us it would fail, price would move below support and the 10 and 15 min charts that were nothing but negative would repair, all of that happened this week.

Enjoy your weekend, I have a feeling things are going to be a lot busier than what we've seen the last several weeks, perhaps even months.