OK, so the last position is meant to be a quick trade only, hopefully it gives more and that's fine.

This goes back to the post just before, "

Market Update" and actually further back to yesterday.

There's a LOT of money wrapped up in options expiration, 90% expire worthless and who writes the options and collects the premium on that 90% that expire worthless? It typically isn't the average Joe.

Overnight Wednesday and through the wee hours of Thursday morning, the USD/JPY finally came alive after being very stagnant, but as I showed you from yesterday's charts (see the post linked above), I could already see that the USD was coming apart and the Yen was building strength so the USD/JPY pair that lifted the market (again see the previous post, they move nearly tick for tick) was not a short term manipulative asset that was going to hold the market much longer, this is why I suggested HYG might take over today by ,moving to the upside, it did too.

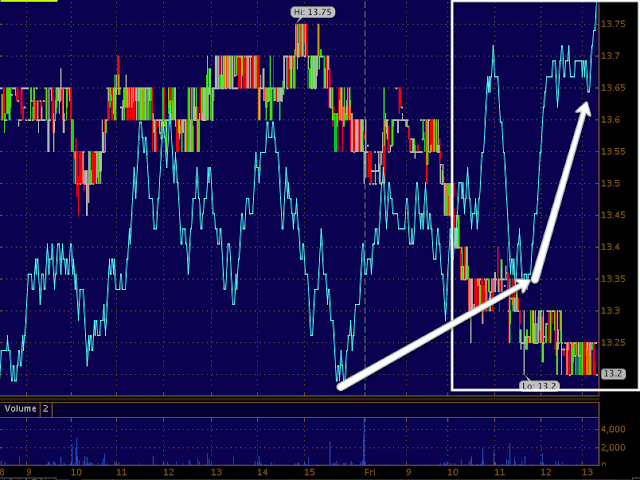

HYG did move up today as suggested today, but this isn't because of a "Risk on" posture, it's what I suggested yesterday as HYG was falling to lower and lower lows,

it would be a replacement for the USD/JPY as an engine to drive the market or at least hold it in place on an important day for cashing in, Options Expiration.

*Remember in the SPY arbitrage that algos use to buy or sell, there are 3 assets that are part of this arbitrage.

HYG represents risk on, algos see HYG moving up and they assume smart money is in a "Risk on" mood.

TLT (20+ year Treasuries) is a Flight to safety trade, algos see TLT move up and they assume that smart money is moving out of stocks and in to a safe harbor asset.

Finally VXX (or UVXY for 2x leverage) is seen like TLT, when VXX moves up it reflects the short term VIX Futures, you can't trade VIX itself, but you can trade the futures or the Short term VIX futures via VXX. When algos see VXX move up they assume smart money is reaching for protection as we saw yesterday and thus is worried about the market.

The thing is, these assets are fairly easy to manipulate intraday, that's why Capital Context keeps the SPY Arbitrage chart intraday.

You may recall yesterday I added to the TLT long (core) position, but today it is up,

TLT effectively cancels out any positive market arbitrage from HYG as it is a bigger move.

VXX typically moves opposite of the market/SPY so this mornings move down in VXX made no sense really, but it would be the only other asset left to shift the balance in the SPY arbitrage positive as HYG's positive is cancelled out by TLT's pop higher today, VXX is the tie breaker,

but what I noticed when I checked was the actual VIX futures were NOT trading as badly as VXX, they are not an arbitrage asset either.

Here's VXX in green today vs the SPX in red, they typically move almost exactly opposite, the move to the downside in VXX didn't make much sense at all (it's a little more complicated than that, but that's the gist of it).

Recently VXX has been trading in a range rather than down as it should be with the SPY moving up at the white arrow.

This is the actual VIX Futures, they have a large positive divergence in them and did not see the same level of downside movement VXX saw.

There was NO negative divergence at all on the VXX chart before it turned down which is strange, but there is a positive developing at the same area that VXX is acting better than it should.

UVXY also has no negative divegrence before turning down, but it too has a positive divgerence in the flat range and acting better than it should in this recent area.

XIV is the opposite of VXX and trades with the SPX, it had no positive divergence before moving up.

And it is seeing a stronger distribution signal as well.

As for the SPY Arbitrage, since VXX started acting better than the correlation suggests it should, the SPY arbitrage has lost strength.

I think VXX was used intraday for op-ex Friday to hold things together as USD/JPY couldn't do it, HYG couldn't do it with TLT up, the only asset left was VXX.

Even right now as the market acts better (remember in the market Update I said there was a slight positive intraday bias so it's no surprise, but as it does, VXX is still holding its ground.

And the VIX FUTURES themselves continue to improve...

They look even better than a capture about 10 mins. earlier.

I'm thinking this is going to pay off as the typical Friday op-ex behavior starts to fade around 2-2:30 in the afternoon. I'll be watching for additional signs too, I can always close the position out here at a very small loss.