In NFLX's case, an open longer term core short position for us that's still at a +14.35% and +2% gain even after yesterday, things are a bit more complicated than the headline earning's print.

As such, a few members have asked me to keep an eye on it which I intended to any way and to make a long story short, while I don't think this is the exact moment to enter any new positions in NFLX, I'm not concerned about the long term core short position and I think given a little time, we'll likely have a great entry for new or add to positions (short).

First earnings came in with Q4 EPS of $1.35, nearly double the $0.72 expected which started a massive short squeeze in after hours last night.

While EPS beat, Revenues missed expectations of $1.49Bn, printing at $1.48Bn, yet EPS was nearly double consensus, how?

Here's how: NFLX Q4’14 Net Income/EPS includes a $39m / $0.63 benefit from a tax accrual release related to resolution of tax audit if traders bothered to read the full earnings, but with algos trading at supersonic speed, no one has time for that anymore.

If you subtract the $.63 per share from the $1.35 EPS print, you get... $.72%, right at consensus/expectations.

I don't like Jim Cramer, but I'm not going to say he's a buffoon, he's a smart guy, but he only shares that wisdom in rare instances, in my opinion the rest of the time he's more vested in his Wall Street buddies who are in a far greater position to help him out than he is in his viewers, but that's my opinion and I'm probably the last person to give an opinion considering I don't watch CNBC or Cramer.

However in a Street.com interview he gave to Aaron Task years ago before the first I-Phone came out, one I suspect many people including himself wish he hadn't given, he was remarkably candid in talking about how Wall Street and he himself would move the market through less than ethical means. They'd create an atmosphere that traders would follow and then they'd fade that to make a long story short. I think some would call it market manipulation, I believe he called it a "Grey area" and said he did it as a fund manager, it was fun and anyone who was not willing to do it, shouldn't be in the game.

I use to start all of my Technical Analysis classes (when I taught Technical Analysis for the Public School system's adult education program for nearly 4 years) with this video/interview and I can't tell you how disheartened everyone in the class looked after hearing it, they realized the market is not a fair and level playing field, that everything they believed was bunk and they heard it straight from the mouth of someone most of them probably watched every night. I'd purposefully show this not to dishearten people, but to let them know what the reality of what they were up against actually was and more often than not, you have to think like these criminals to beat them.

However, the point about Cramer was he said one of the truest things you'll ever hear about the market ad I paraphrase, "The market is not about value, earnings, etc. THE MARKET IS ABOUT PERCEPTIONS".

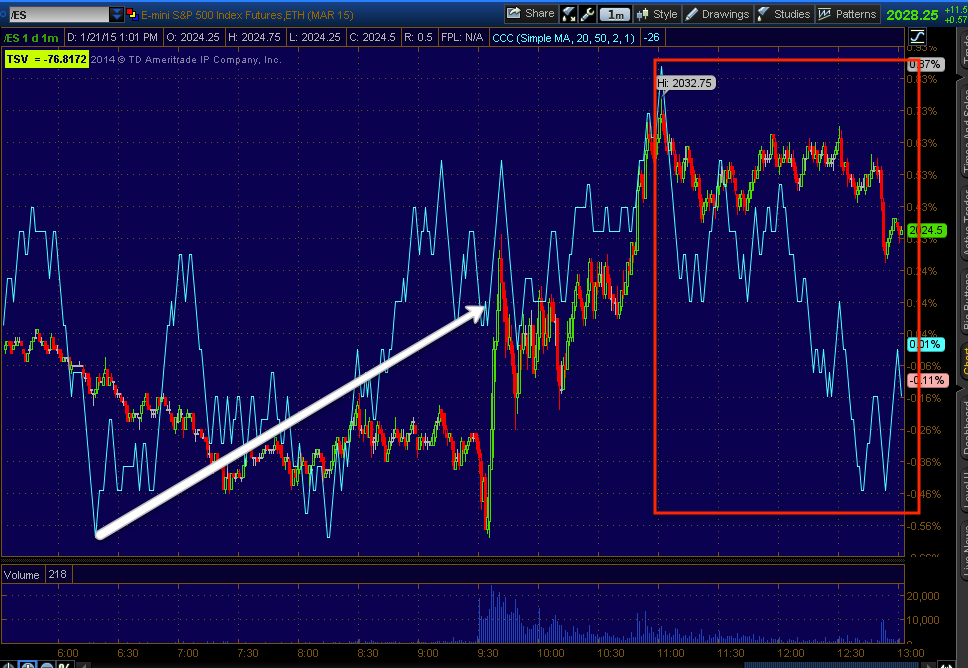

We have forecasted this in advance before an F_O_M_C_ policy statement as 3C showed a small stage 1 base for a bounce/rally in place almost a week before the F_O_M_C and it fired off at the policy statement on a knee jerk reaction and as I always warn, "Beware the knee jerk reaction, they are almost always wrong" and then after some time the entirety of the F_O_M_C gains were retraced.

Again the point being, at the speed of trading these days, the reaction is out far before the entirety of the information is out and as such, it's the reaction (price movement) that dictates the initial "perception" of the information. For example, take the December 16/17th F_O_M_C meeting, I had warned about this back then, that there was a small base in place and that the knee jerk reaction was going to define the policy statement despite what it actually said...

Here are some excerpts from posts on the 17th of December (F_O_M_C announcement at 2 p.m. that day)...

A.M. Update

"The 7 min charts are starting to really look impressive ... I suspect we will likely see the IWM move ABOVE the range soon enough, I would think today either in to the 2 p.m. F_O_M_C or at the press conference after....Remember this is not a move that can last...I'd sell short in to the move at the appropriate time or just be patient and continue to manage shorts that have been doing well, they'll come back with a sharper downturn when this is all over"

Market Update at 11:45 a.m.

"As for the scenario... HYG has been one of the biggest give-aways that this scenario was on track. The accumulation I've seen the last several days in HYG (as well as other places like the averages/Index Futures)..has been screaming "Set-Up". There's only 1 good reason to accumulate HYG even in small size while HY credit and even investment grade credit is breaking down and that's to use it as a leading lever to manipulate the market higher when it doesn't have the strength to do it on its own."

Levers In Action @ 1:34 p.m.

"While I believe TLT will head higher, near term it is being used as a ramp today...5 year yields, a leading indicator are leading the SPX higher today...30 year yields, part of our TLT analysis are leading the market today as we have been forecasting due to 3C signals in treasuries....The most obvious lever of all, HYG as there's only 1 reason to accumulate it as they have this week in such an environment and you see the reason on this chart as HYG leads the SPX higher as one of our best leading indicators...And the 4th is the simple USD/JPY, which is also leading the market today."

"In any case the F_O_M_C is in less than an hour, while I don't think the signals this week and price move are an F_O_M_C leak, otherwise the averages would have more accumulation, price initially determines how the F_O_M_C is received even if it is very hawkish, if the market is rallying, the knee jerk response will be that it was favorable and it provides the perfect cover, obviously considered when we first considered this Friday/Saturday."

5 min SPY positive divegrence in to the December 17th F_O_M_C policy announcement, along with all of the levers (all 4 ) activated the same day, virtually guaranteed an upside knee jerk response no matter what the F_E_D said.

I also warned above on the same day, that the knee jerk move wouldn't hold...

Here's the F_O_M_C on the 17th at 2 p.m. and the market retracing all knee jerk gains.

And here's the 3C negative divegrence in to higher prices setting up the retracement of those gains whether selling longs in to strength that were accumulated just before or setting up short positions for the downside retrace.

By now it should be clear that it is the market's reaction (price) that determines how information is initially PERCEIVED which is all that really matters to the market, PERCEPTION.

SO BACK TO NFLX...

So we have Revenues that missed. We have EPS that actually came right in at consensus and additionally and perhaps most importantly...

Q1 guidance, at $0.60 which is not only lower than a year ago, but also substantially below expectations of $0.78. This is the killer of earnings, even a strong beat will sell-off on poor guidance because it's not what you did, it's what you'll likely do in the future and if guidance is calling for less EPS than a year ago, less than expected, there's few good reasons to stick it pout long NFLX, you could say (at least for the time), they have created and it doesn't get any better than this, in which case, there's no reason to expect NFLX to sustain higher prices.

Additionally, Free Cash Flow. At ($78) million, this was the worst quarter for the company in years.

So why did NFLX pop over +17% today... Well just like the pre-F_O_M_C set up, just like the "bounce" set up now right in front of tomorrow's ECB meeting... NFLX was already set to ramp higher as you'll see on the charts below...

The daily NFLX chart shows a stage 1 base, stage 2 mark-up and a stage 3 top (Broadening) with the appropriate long term daily negative divergence at the top. The next stage is 4, decline.

However as you can see, before earnings were released, NFLX was already set for a pop higher,

I doubt this was on a leak as earnings were pretty ugly, it was more likely on the need for a gap fill.

Again, the 15 min chart was set up in advance for a move higher near term.

As of today, the intraday charts already started showing strong leading negative divergences like this 1 min chart.

Which was strong enough to migrate to long timeframes like the 2 min

And 3 min

in fact out to the 10 min chart in a single day, so there's some heavy distribution underway.

What we need to see is the a5 min charts go negative, once that happens, NFLX should be approaching a great area for a short set up at higher prices and much lower risk. The longer term charts point to that, the charts today on the move to fill the gap point to that.

As you know, while it sounds nice and we'd like to see it, the market rarely sees a reversal down from a move like this on a dime, it's a topping/reversal process, not an event unless some fundamental data changes that, so I'd look for a topping process over the next days and week/s, it probably will have something to do with what the broader market does and when its bounce is over.

All of that being said, all objective information we have suggests NFLX will be or already is a great looking short position, for new entries it's more about timing than anything and at the rate we saw the charts move today, I think NFLX will probably be ready about the same time the broader market is ready to roll over from the bounce it has set up and in place, which is probably (just like the F_O_M_C) set up as a sentiment mover for the ECB policy due out tomorrow, whether it disappoints or not, in the short term on a knee jerk response, it's perception and price leads that, then the details and truth set in and the market responds appropriately.