A few things occurred today toward the end of the day and I looked at the market in a totally different way.

I was chatting with a member and said, "Don't expect Wall St. to show their cards on the NFP print, they aren't that dumb and logistically we are essentially jet skis that can turn on a dime, they are super tankers that take 2 miles to come to a complete stop. Their reaction to the NFP will be seen in felt in the coming week/s and I don't think it will be good.

I think I've just scratched the surface of a change that has occurred in 2 weeks that introduces a whole new dynamic. Putting the pieces together is going to take a lot of study and some time, BUT I CAN TELL YOU THIS, IT'S IN THE AREAS WE HAVE BEEN WATCHING CAREFULLY, BONDS, BOND YIELDS, CARRY TRADES, THE YEN, MARKET CHARACTER AND NOW THE SHIFTING OF THAT CHARACTER.

Many members have asked about "blow-off tops" and the like, yes they occur, but for this to work for Wall Street, they aren't going to send up a flare letting everyone know that things have changed, they''ll be like a thief in the night and looking around today as you saw in several charts, we are not only past that point in which a flare would go up, we are on the slippery slope of the right side of stage 3 in more assets than I imagined simply because using the market itself as a map is a flawed concept.

All of the above was from Friday's EOD Post and there's a lot more there, ironic huh?

As I often say and we have all seen, "Wall Street will never make it easy", or as it was put Friday (above), "for this to work for Wall Street, they aren't going to send up a flare letting everyone know that things have changed, they''ll be like a thief in the night"

Watching today's action I saw several small divergences try to get a foothold and they were crushed. There are a few things here and there, but a big part of me thought all day about 2011 which looked like this and this was much like now, one of the last times the 10-year yield was above 3% as it has been popping above and below recently and the divergence for this move was there, but no where near the size of now.

Fear is stronger than greed, 7.5 months of gains taken out essentially in 5 days.

As for the averages today, by far the worst showing of the year and keeping the averages in the red for the year...

SPX Bear Flag break

Dow Bearish Descending Triangle break

NDX takes out 2014 low and closing low

IWM (I had a bad print on the R2K chart) with another bear flag break.

Some of these patterns are textbook technical analysis, that's not normal for this market that has been characterized by head fake moves, but as I've thought for a long time, quickly figuring out the new dynamics is going to be key to being on the winning side of what will most certainly become a difficult, but likely very rewarding market.

Safe haven treasuries, in fact short term Treasury Bills saw so much action today as a flight to safety that the Yield went negative, people are paying to protect their money as they rotate it out of stocks.

There was a clear Dominant Price/Volume Relationship today, Close Down/Volume Up which is the most bearish of the 4 possible relations, but also often signals a 1-day oversold event.

The Dow had 22 stocks in this category, 7 in Close Down/Volume Down and only 1 of 30 in the green, MRK at a +6.48% gain.

I suppose it wouldn't be surprising to know that the Investor's Intelligence Sentiment Survey had the largest bullish reading ever. Another site that we get periodic sentiment updates on, Investor.com was bearish, but the comments from our resident sentiment follower said this today,

"This is the tone today:

"No action in the markets at all today #boring"

Investor.com is really bullish at only 54% bears, haven't seen it this low all last year!"

12:30 p.m. today

As far as the rest, I thought I'd just take you on a tour of some charts...

First the Carry Trades, USD/JPY which has broken its uptrend and EUR/JPY.

USD/JPY daily with 3C (yellow line is the May highs that were taken out today, breaking the up-trend.

Daily chart of the Yen, note all of the small bodied candles as downside momentum failed in to the end of the year, leaving the door open for a reversal which we have been tracking on 15 and 30 min charts.

Speaking of which, the Yen 30 min, Enormous volume on Friday, I mentioned something on Friday about the reaction to the NFP print, but it wouldn't be seen immediately, it would come this week, however it looks like they were busy covering their carry trades Friday.

Some of the averages, note what looked like a very strong divegrence last night now looks almost puny compared to today's action.

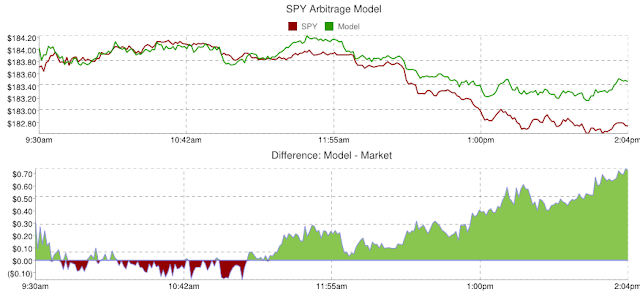

SPY 5 min, the leading negative divegrence at the red line is today's action only. As of last night the previous divergence looked substantial.SPY 15 min, at the yellow arrow is today's action only.

SPY 30 min, at the yellow arrows are 1-day moves, to the right is today only.

SPY 4 hour, in last night's post I mentioned that this entire cycle looks like one large rounding process with the Chimney and all, the 4 hour chart along with the others, seems to agree.

QQQ 5 min

QQQ 10 min

QQQ 30 min

QQQ 4 hour, very similar to the SPY.

IWM 2 min

IWM 5 min

IWM 15 min

IWM 2 hour, note the hammer at the yellow arrow, a short term support candlestick.

As for VIX futures, it is one of the key assets I've been watching for a change in character. The character of the market moving forward is something I think is essential to understand, whether the same concepts hold or as I suspect, fear changes everything.

Furthermore, you have seen between Friday's post from above and the 2011 chart, Fear moves much faster than greed, that doesn't leave much time for a "Process".

VXX 3 min giving the kind of signal I've been looking for, but does the parabolic move come down and scratch out a wider short term base? For now I'm content to let the short positions work and that means the VXX/UVXY long positions to do the same, but I'll be watching for underlying trade/divergences that may tell us something is coming.

UVXY 5 min, this could very well be considered the "Process", they are usually in proportion to the preceding and proceeding trends.

VXX 10 min in a similar situation

And the 2x leveraged UVXY just because I haven't adjusted my VXX chart for the split.

Between the market averages and charts like this above, Friday's commentary that I took some excerpts from at the top of this post, seems to be timely.

While I can't go through each group and each asset, I figured I'd show you FAZ (3x short Financials which we have a position in) vs XLF, the financial sector (3C divergences should be opposite each other on the two different assets just like price).

XLF Financials 30 min

FAZ 15 min

XLF 15 min

FAZ 10 min

XLF 10 min

FAZ 2 min

XLF 2 min.

The degree of the divergences and the degree of confirmation among these two assets that are completely different in volume and thus 3C signals would only confirm if there were similar activity in both, is staggering.

There are quite a few charts for you to go over, I'm just kind of shocked at Friday's EOD commentary and today's action.

I'll check futures later to see if anything interesting pops up. It seems like both EUR/JPY and USD/JPY are finding some support for now.