This obviously is not all of them, but a good sampling. I think one of the main pieces of evidence were our expectations for today from last night's Daily Wrap,

"Everything is pointing to a 1-day oversold condition in which a bounce or next day green close is highly probable, however in the current situation, it would seem some small 1-day reversal process such as a Doji or Star candlestick would be in order and perhaps with that, a positive divergence."

That would be this closing candle...

This meets the Star candle criteria for the Daily chart as well as a Tweezer Bottom and a Harami Reversal (or inside day).

As for the divergences, you've seen them throughout the day, but here's a run down ...

SPY 3 min

IWM 2 min.

I obviously thought the IWM looked better. The speculative call position here is the most minor of trades, I'm really looking for some upside to re-open the QQQ puts closed yesterday, the VXX calls closed yesterday, maybe TLT calls and we'll see with USO.

HYG-High Yield Corp. Credit is the first lever they'll pull in trying to support/bounce the market and today's gains in HYG were confirmed if not better.

HYG 3C chart in line, maybe a bit better on some timeframes.

As for Leading Indicators...

Our custom SPX:RUT Ratio showed several intraday divergences vs. the SPX, but closed strong.

The main signal from Leading Indicators that we don't see very often, but has an excellent track record is our VIX inversion indicator (white = inversion), this is on a 15 min chart showing signals yesterday and today.

This is on a daily chart of the SPX and you can see where past inversion/buy signals (white) have led to bounces.

The Pro sentiment Indicators that have been leading the market lower since May are slightly positive for the first time in probably just about as long.

High Yield Corp. Credit is leading the SPX as I showed above, it looks like that lever is being pulled for market support as is the norm.

And High Yield Credit which has also been severely leading negative vs the market is positive as well.

Between Leading Indicators, short term oversold conditions, the reversal process and reversal candle put in today with 3C positive divergences, it looks like we'll get the bounce that we saw hints of yesterday which is why we took QQQ put profits, VXX call profits and several others. Basically we closed all of our leveraged, time sensitive trades while leaving our core / trend positions in place and we'll be looking to re-open those leveraged/options trades in to some price strength as the underlying tone for the market is where we expected it with the slice through the SPX's support yesterday at the 150-ma as we have expected.

Biotechs in particular look like they may offer us a nice second chance entry.

Yesterday we closed out our crude/USO July put, Closing Out USO July 17, $20 Put for a +26% gain, USO Follow Up and Update. As the previous update showed, there are some charts that may be just transitional in nature and may come back down in underlying trade toward our intermediate term goal of a larger pullback in to the base's range (approx. $16.50-$20), but with July 17th coming up and the charts a little fuzzy, it made sense to take the gains off the table. As for the USO equity short, it is still at a +5% gain and will be left open until I feel pretty certain that these charts are more than transitional noise.

Speaking of Crude, the last 4 weeks we have been rallying in to or just after the Tuesday 4:30 p.m. API inventory data and then selling off in to the 10:30 a.m. Wednesday EIA inventory data. API just came out a little bit ago and surprised after 8 weeks of inventory declines, API registered its first build of 1.9 mn bbl. The reaction in crude futures...

Oil futures reaction to API.

Even though the USO near term charts were a bit positive as seen in today's update, there was an interesting bout of distribution in to the close which makes me wonder if we are getting inventory data leaks again...

USO 2 min chart in to the close going negative. Tomorrow I'll update USO again after the EIA data comes out, perhaps today's movement was a gap fill and we actually do get the anticipated move lower in to the longer term stage 1 base's range.

As for Index Futures, being we fulfilled the events expected in yesterday's Daily Wrap, I'd expect a bounce tomorrow as today served as the reversal process for yesterday's 1-day oversold condition that usually ends up with a bounce, I reiterate this is not expected to be anything more than a bounce and should be used as such to enter new positions such as the new QQQ puts (or perhaps SPY/IWM) and VXX calls as an example. Core shorts remain in place and will remain in place as the next major event for the market should be taking out the October lows.

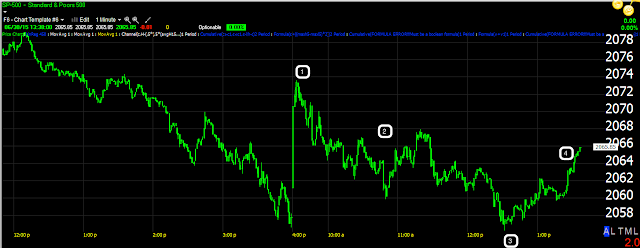

Index futures right now look like this...

EUR/USD has been pretty flat since Merkel's "NEIN" this morning to the proposed Greek 2 year ESM bailout, essentially throwing all rumors to the side and all possible last minute deals until the Greek referendum on Sunday July 5th or unless the referendum is cancelled, but being it's past 5 p.m. EDT, I would think that Greece is now in default on their June IMF payment of $1.6bn Euros with the EFSF also running out today as confirmed earlier.

EUR/USD has been pretty flat since Merkel's "NEIN" this morning to the proposed Greek 2 year ESM bailout, essentially throwing all rumors to the side and all possible last minute deals until the Greek referendum on Sunday July 5th or unless the referendum is cancelled, but being it's past 5 p.m. EDT, I would think that Greece is now in default on their June IMF payment of $1.6bn Euros with the EFSF also running out today as confirmed earlier.

Which reminds me of the misguided well intentions of the "Crowd-funding movement" who said enough of this Troika bickering, "We're going to take matters in our own hands" and raise the $1.6bn euros Greece needs and they were up to $100,000 euros as of this morning, the problem being is Greece needs $1.6bn Euros to make their June IMF payment which is now past due, to really raise the money the campaign seeks to raise to get Greece out of trouble, that $1.6bn figure needs to be re-adjusted to $275 billion Euros. Well it was well-intentioned and did pretty well for 1-day, just missed the mark when they did the math.

ES/SPX futures intraday are about in line as you can see above, although as posted earlier, the 3 and 5 min charts which I consider necessary for any bounce and for even the shortest term trade, are positive.

ES/SPX futures intraday are about in line as you can see above, although as posted earlier, the 3 and 5 min charts which I consider necessary for any bounce and for even the shortest term trade, are positive.

Beyond that, things are pretty quiet right now, but I suspect we'll soon have news of Christine LaGarde informing the IMF board that Greece is officially in default. Given Merkel slammed any possibility of any deal making before the Greek referendum this morning, I don't see rumors having the same impact as they did the last month or so, which would give the market a nice peaceful little area to pull off its oversold bounce, but who knows, it is the EU and if there's one thing they are exceptionally good at, it's bungling the unbungable.

If anything should pop up before I turn in for the night of import, I'll bring it to you.

Have a great night.