I'm not sure if there was a sugar rush rumor in to the close or just algos trying to jump start momentum in to the close, however, credit make me very comfortable and if had time I would have used closing trade to add to shorts.

Look what credit did in the final minutes of trade vs the S&P

Credit sold off to new lows on the day, which is signifiant, even more so is that it gave up all gains on the day.

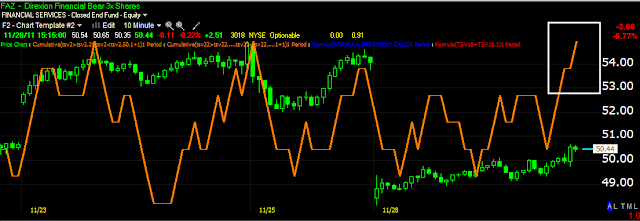

The late day push was on a small positive divergence on the 2 min chart, which has been leading negative all day (below).

The 5 min chart was throughly unimpressed as it continued making new parabolic lows in a strong leading negative divergence.

It appears that today we finally got an opportunity that we had been looking for. Any further upside would be appreciated so long as the internals stay weak like they were today, however if today is all we get (and I did mention there was a gap from 11/23 that could be filled), well then hopefully you were able to take advantage of what the market offered today, did.

Is interest rates about to start going up?

-

Yes, I know - it does not make any sense - FED is about to cut

rates...but....real world interest rates are not always what FED wants it

to be.

6 years ago