I provided a list of quite a few stocks on my short watchlist, I want to take a look at AAPL and give you some ideas of how and when you can enter a short trade with AAPL as an example.

AAPL is turning in to an ideal short candidate. First we have a major top, it's difficult to short in the top as trade is choppy and you are likely to get stopped out unless you have a very long term perspective and wide stops. The fact AAPL has broken below the top is good and it's something you should look for in your short trades. Next it has seen the typical bounce into resistance, often breaking above resistance shaking out weak shorts and generating buying interest which Wall Street can short in to.

A simple indicator like ROC (Rate of Change) can be used similar to 3C, looking for negative divergences that show momentum is fading. Stocks only have 3 directions, up, down or sideways. Since we have an uptrend in the bounce, the next likely move is down.

3C closely mirrors ROC in this instance. Note as well that AAPL has underperformed the broad market on a relative basis the last 3 days.

This is a Swing type entry that I favor. The last green candlestick I drew in, as an example. When looking at the daily trend, we see an uptrend, which is comprised of higher highs and higher lows, other candles within the trend not making higher highs and higher lows are essentially noise in the trend. We want to focus on what I call the signal candle. Right now the signal candle is at the red arrow, it is the last daily candle to make a higher high and higher low, the candle after made a lower low so it's noise and today's candle made a higher low, but not a higher high, so the candle with the red arrow remains the signal candle, this could change tomorrow if we get a candle making a higher high and higher low, that would then be your signal candle, but for now, lets work with what has happened.

I want to go short when the trend has shown a high probability of reversing, we don't want to play guessing games. What I look for is a daily candle, it doesn't have to be tomorrow's, but what is important is that the high of the candle is lower the the low of the signal candle, as you can see, the candle I drew in as an example has its high lower then the low of the signal candle, this is an ideal spot to enter AAPL short. A stop can be placed above the highs of the signal candle or you can use the Trend Channel, resistance or any number of other stops, but my example stop will likely have very little risk.

You may have to read this several times and always feel free to email me with questions, but it will eventually make sense.

ADM provides us with another common market event that offers a high probability entry, that of the false breakout.

ADM shows 2 false breakouts, the first makes a slightly higher higher then local resistance, the more important the resistance level, the better the opportunity. At the first arrow ADM broke resistance, but closed below it on the same day, this s a high probability entry and a stop can be put just above the day's high. The second example ADM broke down below the top, an ideal situation, then rallied to resistance and broke above, the close was very poor, near the lows of the day, but didn't break support. The second day it did break support confirming the breakout as a false breakout and offering a high probability entry. A stop should be placed above the high of the first candle to break through resistance as it's a bit higher.

Here's another example using ADM, this is meant for longer term traders. Our entry is the same, a false breakout at the white arrow, even though it doesn't look as impressive on this 5-day chart, it still qualifies and you can use the 1 day chart to verify a false breakout. A down trend is a series of lower highs/lower lows, in this case, ADM would still be an open short position since the entry. While there are numerous stops we can use, and you can blend strategies like using a 1-day stop, but for the sake of explanation, will stick with the 5 day chart. Within the trend, the last candle to make a lower low/ lower high is our signal candle, we get a lot of noise and don't want to be stopped out on meaningless noise. In this case, we reverse the AAPL entry for the stop. Out signal candle s in yellow as it was the last to make a lower low/lower high, we would only stop out if a new candle, like the one to the far right that I drew in were to occur. What shows us a change in trend and therefore stops us out is when we get a price candle that has its low higher then our signal candle's high, like the candle I drew in at the red arrow. Again, only when we have a bounce that forms a candle in which the low of the current candle is HGHER then the high of the signal candle (the high is drawn in as a yellow trendline).

Not to be too confusing, but we can enter and maintain a longer term position and still use a tighter daily stop, there are many blended approaches, but I wanted to show you a few examples of entries and exits as you watch the stocks in your watchlist.

You may want to bookmark this post to come back to the concepts until you understand them well enough, they take a little time to understand, but once you do, you will see the logic in these high probability/low risk set ups.

As for the market, it's doing what we expected, we'll see if we get a false breakout which would be nice or a reversal of the trend. The last 3 days have looked strong as far as price, but internals including volume, Price/Volume relationships, breadth and 3C have shown them to be significantly weak in the underlying technicals.

I'm always here for questions and I have thrown enough at you tonght to probably generate some questions, but these are some effective ways to enter a trade, manage a trade and exit when the tme s right. At this point on a 5-day chart, ADM would still be a short and have you at a 19% profit.

Thursday, June 30, 2011

A seemingly odd resistance area

Usually resistance is pretty well defined, I've found that resistance formed from gaps is some of the strongest. At first glance, this resistance area seems arbitrary, but just follow along.

(A) The SPY declines in a 2+ week downtrend, lows are tested at point (A) and the market closes near its highs for the day and this on increasing volume. It is very common for volume to increase at reversal points.

(B) The market breaks back below the support level formed at (A), the first day the market can't break through resistance, the second day t gaps above it, but can't hold the gains and once again closes below resistance, the 3rd day, the market finally breaks above the resistance zone, but even with the 4 day bounce, the market remains in a downtrend (lower highs/lower lows) and the last day of the bounce forms a bearish Hanging Man candlestick.

(C) Unable to effect a change in the trend, the market sells off over 3% on increasing volume and breaks support, which now becomes resistance. The next day, the SPY just barely pierces resistance, but can't hold a close above it and the market drops about 4% over the next two weeks. This is where our base started forming and today we find ourselves once again at this resistance level.

Today's late afternoon market ramp just pierces this resistance zone, for all of two minutes and sees heavy sell-sde volume while a 3C negative divergence forms and we end the day below the level of resistance.

None of the negative divergences in the SPY that I showed you earlier in the afternoon have improved, n fact they are worse.

If the market does what it usually does, then we can look for a false breakout, probably a bit above this resistance level, but with so many undercurrents now in play, it's becoming difficult to say that we will see that false breakout.

In either case, we're in the neighborhood of where we'd like to be and where 3C has been pointing to for the last several weeks.

More to follow...

(A) The SPY declines in a 2+ week downtrend, lows are tested at point (A) and the market closes near its highs for the day and this on increasing volume. It is very common for volume to increase at reversal points.

(B) The market breaks back below the support level formed at (A), the first day the market can't break through resistance, the second day t gaps above it, but can't hold the gains and once again closes below resistance, the 3rd day, the market finally breaks above the resistance zone, but even with the 4 day bounce, the market remains in a downtrend (lower highs/lower lows) and the last day of the bounce forms a bearish Hanging Man candlestick.

(C) Unable to effect a change in the trend, the market sells off over 3% on increasing volume and breaks support, which now becomes resistance. The next day, the SPY just barely pierces resistance, but can't hold a close above it and the market drops about 4% over the next two weeks. This is where our base started forming and today we find ourselves once again at this resistance level.

Today's late afternoon market ramp just pierces this resistance zone, for all of two minutes and sees heavy sell-sde volume while a 3C negative divergence forms and we end the day below the level of resistance.

None of the negative divergences in the SPY that I showed you earlier in the afternoon have improved, n fact they are worse.

If the market does what it usually does, then we can look for a false breakout, probably a bit above this resistance level, but with so many undercurrents now in play, it's becoming difficult to say that we will see that false breakout.

In either case, we're in the neighborhood of where we'd like to be and where 3C has been pointing to for the last several weeks.

More to follow...

EOD SPY Update

The end of day ramp... Yet there's still no real improvement in 3C-the following are the 1, 5 and 15 min chart. Mostly they have just gotten worse.

Window Dressing and a reversion to the mean

The art of looking smart ends today. I scanned for stocks with the best performance in the R2k over the last quarter of so, and then a parabolic (window dressing) move recently. Many of these stocks should revert to the mean over the coming days as there's no longer an incentive to juice the returns and the momentum crowd takes profits.

ARIA

AVEO

CONN

CROX

CSH

DMND

ELGX

EXAS

GCO

GLBC

LMIA

MSTR

PCYC

SOLR

ARIA

AVEO

CONN

CROX

CSH

DMND

ELGX

EXAS

GCO

GLBC

LMIA

MSTR

PCYC

SOLR

VRML Follow Up

The 60 min chart on VRML is what is exciting about this long idea, it's very strong.

I know some of you are in the trade, you may want to consider a stop like this, a 22 bar average on a 60 min chart. It should guarantee at least a break-even trade. For those with more risk tolerance, you might consider the $3.72 area, that's based on the daily trend channel, if you don't have the trend channel, you can always email me for updated stops as t moves in the direction of the trade.

The Other Averages

The other averages are looking very similar to the SPY...

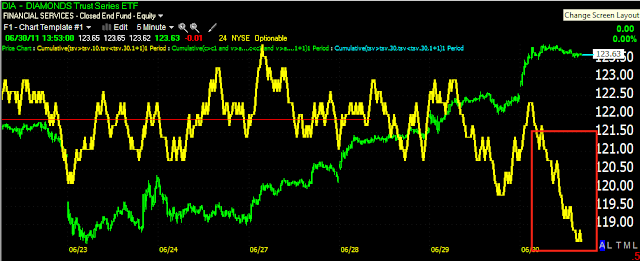

DIA 5 min negative divergence

DIA 15 min negative divergence

DJ-20 15 min negative divergence.

IWM 5 min negative divergence

The IWM 15 min is still largely in line with price except for a minor negative divergence yesterday

QQQ 5 min negative divergence

QQQ 15 mn negative divergence.

There are a number of (long) Short and Ultrashort ETFs for the averages.

A Few that come to mind include SPXU, QID, SQQQ, SDOW, TWM, SKF and FAZ (financials).

DIA 5 min negative divergence

DIA 15 min negative divergence

DJ-20 15 min negative divergence.

IWM 5 min negative divergence

The IWM 15 min is still largely in line with price except for a minor negative divergence yesterday

QQQ 5 min negative divergence

QQQ 15 mn negative divergence.

There are a number of (long) Short and Ultrashort ETFs for the averages.

A Few that come to mind include SPXU, QID, SQQQ, SDOW, TWM, SKF and FAZ (financials).

SPY Update

Remember, window dressing ends today.

The SPY has hit the 50-day moving average and seems like it's acting as resistance, which most retail traders will assume it to be.

The 5 min chart shows pretty good confirmation since this week's run up, there's now a decent size negative divergence at resistance.

Now the negative divergence is showing up on the 15 min chart as well.

There's multiple ways this could play out, there could be a consolidation in the area, there could be a drop from here, or any number of scenarios. For now, there's resistance and 3C is responding to that with negative divergences. Should they start to develop in to longer timeframes, we'll have some more clarity.

The SPY has hit the 50-day moving average and seems like it's acting as resistance, which most retail traders will assume it to be.

The 5 min chart shows pretty good confirmation since this week's run up, there's now a decent size negative divergence at resistance.

Now the negative divergence is showing up on the 15 min chart as well.

There's multiple ways this could play out, there could be a consolidation in the area, there could be a drop from here, or any number of scenarios. For now, there's resistance and 3C is responding to that with negative divergences. Should they start to develop in to longer timeframes, we'll have some more clarity.

SHORT LIST CANDDATES

As I am running scans and browsing charts, I'm adding stocks to my "Short Sale" Watchlist. This isn't a total picture and these are not necessarily short positions right here and now, but each one has something that has caught my attention. I'll be addressing specific stocks and ideas and my thoughts about them. I did want you to have this list so you can take a look and apply some of your own metrics to these ideas.

Here's one of the lists with "symbol, company name"

Here's one of the lists with "symbol, company name"

AAPL,Apple Inc

AGU,Agrium Inc

ARUN,Aruba Networks Inc

ASCA,Ameristar Casinos Inc

BAC,Bank Of America Corp

BC,Brunswick Corp

BCO,Brink's Co

BWS,Brown Shoe Co Inc

CAAS,China Automotive Systems Inc

CALD,Callidus Software Inc

CAT,Caterpillar Inc

CBD,Companhia Brasiliera De

CBRL,Cracker Barrel Old Country Store Inc

CCL,Carnival Corp

CIGX,Star Scientific Inc.

CMG,Chipotle Mexican Grill

CNQR,Concur Technologies Inc

CNW,Con-Way Inc

CTCM,CTC Media Inc

CYMI,Cymer Inc

DE,Deere & Co

DGI,Digitalglobe Inc

DKS,Dick's Sporting Goods

DLX,Deluxe Corp

DUG,ProShares UltraShort Oil & Gas

ELP,Companhia Paranaense De

EMR,Emerson Electric Co

FDX,Fedex Corp

GPI,Group 1 Automotive Inc

GRA,W.R. Grace & Co

GS,Goldman Sachs Group Inc

HD,Home Depot Inc

IHG,Intercontinental Hotels Grp Ad

IMGN,Immunogen Inc

INT,World Fuel Service Corp

IRF,Internat Rectifier Corp

IWO,iShares Russell 2000 Growth Index Fund ETF

JOYG,Joy Global Inc

KNL,Knoll Inc

LSTR,Landstar System Inc

LTD,Limited Brands Inc

LUV,Southwest Airlines Co

NOR,Noranda Aluminum Holding Corp

NSC,Norfolk Southern Corp

OSG,Overseas Shipholding Grp

PCLN,priceline.com Inc

PFCB,P F Chang's China Bistro

PLL,Pall Corp

PNX,Phoenix Companies

PRI,Primerica Inc

R,Ryder Systems Inc

RCL,Royal Caribbean Cruises

ROC,Rockwood Holdings Inc

RT,Ruby Tuesday Inc (Ga)

RTH,HOLDRS Retail ETF

SIRO,Sirona Dental Systems Inc

SLM,Slm Corp

TAL,TAL International Group Inc

TXRH,Texas Roadhouse Inc Cl A

UA,Under Armour Inc

UPS,United Parcel Service B

UTX,United Technologies Corp

VR,Validus Hlds Ltd

VZ,Verizon Communications

WBC,Wabco Holdings

WWWW,Web.com Group Incorporated

USO Pullback

USO looks like it's hitting some resistance here n the area. I should note that Reuters ran a story that the IEA may consider releasing more oil during the 3rd week of July (decision time). Obviously this is not going to sit well with what's left of OPEC, and of course the logic seems very flawed and bullish for oil when/if the Cartel decides to launch counter measures in the form of production cuts. It seems like a move by the US that just can't logically be brought to a favorable conclusion.

Daly USO resistance

5 min negative divergence at resistance.

10 min. negative divergence at resistance

15 min. negative divergence at resistance

30 min. negative divergence at resistance, but the longer term trend in 3C seems to support the idea of higher prices in crude.

I'm looking at an initial pullback target around $36.25 or so.

Daly USO resistance

5 min negative divergence at resistance.

10 min. negative divergence at resistance

15 min. negative divergence at resistance

30 min. negative divergence at resistance, but the longer term trend in 3C seems to support the idea of higher prices in crude.

I'm looking at an initial pullback target around $36.25 or so.

POMO Has Ended

And to show what a scam this whole process has been as well as a boon to the Primary Dealers, today's last Permanent Open Market Operation (POMO) just concluded.

The Fed monetized $4.909 Billion in treasuries and with no reason to try to make this farce look legitimate as it just ended, of the $4.909 Billion the Fed monetized today, a whopping $4.405 Billion was earmarked for the 7 year that Primary Dealers just picked up yesterday! That's right, the vast majorty of the operation bought treasuries that PD's didn't even hold a full day! Of course the PD's flpped these overnighters at a profit.

With QE2/POMO now in the history books, the questions still remains "Who's going to take up the space the Fed has occupied for the better part of the last 2 years?" We've seen the indict bidders fleeing the Treasury auctions lke rats on a sinking ship. This should be interesting.

In the meantime, the Treasury bear ETFs I mentioned earlier in the week as this newly emerging trend started, are still doing well.

TBT (Ultrashort 20 year Treasury) breaking the 50 day on some volume.

The Trend Channel with a daily stop around $33.50

3C 60 min chart, looks as if this change has been in the planning stages for awhile.

Technically I prefer all 3 signals to go long, but 2 will do. Look for the first pullback to the 10-day moving average which should be around the same level as the trend channel-$33.50 or so.

The Fed monetized $4.909 Billion in treasuries and with no reason to try to make this farce look legitimate as it just ended, of the $4.909 Billion the Fed monetized today, a whopping $4.405 Billion was earmarked for the 7 year that Primary Dealers just picked up yesterday! That's right, the vast majorty of the operation bought treasuries that PD's didn't even hold a full day! Of course the PD's flpped these overnighters at a profit.

With QE2/POMO now in the history books, the questions still remains "Who's going to take up the space the Fed has occupied for the better part of the last 2 years?" We've seen the indict bidders fleeing the Treasury auctions lke rats on a sinking ship. This should be interesting.

In the meantime, the Treasury bear ETFs I mentioned earlier in the week as this newly emerging trend started, are still doing well.

TBT (Ultrashort 20 year Treasury) breaking the 50 day on some volume.

The Trend Channel with a daily stop around $33.50

3C 60 min chart, looks as if this change has been in the planning stages for awhile.

Technically I prefer all 3 signals to go long, but 2 will do. Look for the first pullback to the 10-day moving average which should be around the same level as the trend channel-$33.50 or so.