This morning's action in AAPL is exactly why we don't chase stocks in after hours, someone was left holding the bag at $354. In a few emails I received about AAPL, I reminded members that smart money isn't going to chase AAPL in After-hours, they may however us it to sell into strength/short.

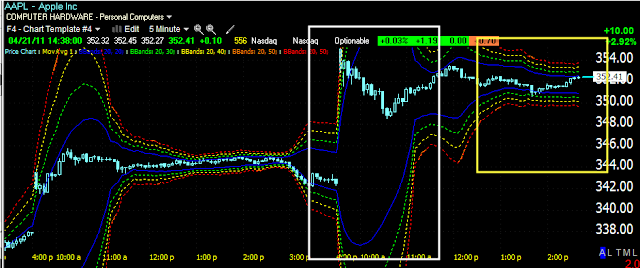

Here are the current AAPL charts and I think this one will be worth watching over the day and possibly tomorrow.

Remember, earnings for Wall Street aren't about what you did, that for main street, it's about what yu will do moving forward and AAPL's downgrade of EPS for Q3 could be seen as a problem for a company that is historically very conservative with guidance in the first place. Price will tell in the end.

For now, here's what the opening has looked like

AAPL daily

1 min chart, very little attempt at confirmation, the negative divergence on the open has caused the downdraft in AAPL. Locals used strength to sell into, that's part A of their plan, we need to watch carefully for what part B will be.

AAPL 5 min. Again, a very nasty negative divergence

10 min chart, I wanted to wait a bit to see how this chart would respond before posting, it's not looking good either.

Even on the 15 min chart there's no hint of confirmation, just an ugly negative divergence. I suspected it would be possible for AAPL to breach the upper trendline yesterday as it has done so at least once, arguably twice, this certainly qualifies.