On Thursday, August 4th, I wrote this long piece in which I laid out 3 scenarios as to why 3C continued to show positive divergences, despite the market falling-this is the nature of 3C signals, to contradict price movement and depict underlying institutional movement.

I also posted this piece about some difficult calls I've had to make with 3C when everything seemed to be against 3C, however they worked out,

A Controversial Call

So timing wise, thus far it seems Scenario 3 is the winner, but we still have to see follow through buying. The idea was that the Fed would say something that would get this market turned around. The meeting between the Fed and the large Wall Street Investment Banks/Primary Dealers preceded the sell-off by one day. I still believe some plan was put into motion then, I've seen too much manipulation, leaked information and actual documents over the course of my trading to believe otherwise. The fact 3C works at all is a testament to this belief.

However, I was as shocked as most with what the Fed did and didn't say. First lets take a look at what the Fed did say, and if you like,

HERE'S A LNK TO THE FULL FOMC RELEASE TODAY.

Instead of QE3 or some other out of the box, market supportive statement, the Fed essentially admitted failure, they admitted that QE1/QE2 did not work in saying,

"Economic growth so far this year has been considerably slower than the Committee had expected."

"Household spending has flattened out, investment in nonresidential structures is still weak, and the housing sector remains depressed."

They admitted temporary factors such as the Japanese Earthquake, were less significant then they had previously telegraphed.

The outlook on growth and unemployment could only be called, "pessimistic". This sounded like a Fed admitting failure and that they had few options left to deal with the economy.

I noted today,

"Beware of the FOMC knee jerk reaction". There really didn't seem to be anything substantive for the market to grab hold of and get excited about. The only thing I think, and this is important and was telegraphed by Janet Yellen back in late February when she said that, “forward guidance” would be the next tool used by the central bank-she was right!

The Fed certainly gave a realistic view of that and the FOMC said it would keep the target federal funds rate at between 0 and 0.25 percent, where it has been since December 2008. And -- here's the news -- given the current environment, it is promising to keep them at this level "at least through mid-2013." In other words, the central bank is committing to keeping the interest rates it controls at this exceedingly low level for another two years. This may have been the kicker; ever hear the saying, "When the missiles fly, it's time to buy"? It has nothing to do with war, it has to do with the build up to war and the uncertainty, when war breaks out, there is certainty and if there's one thing the market hate more then anything, it's uncertainty.

In keeping short term rates low for a CERTAIN period of time, the FOMC is creating an environment where banks have a window of nearly 4.5 years of nearly free money-Certainty was assured today in an unprecedented way by assuring the market that they will not be withdrawing the extraordinary measures of cheap/free money at least until 2013. The FOMC by saying this, is also saying they feel inflation won't be a problem for this period, whether that is true or not, remains to be seen; the Fed's forecasts have been dismal at best.

As I warned of the initial knee jerk reaction, the market headed lower on disappointment, having expected some hint of QE3. I don't know if the market rallied after that because they realized that the certainty factor was in place, I suspect this has more to do with the chess board being set up well in advance and institutions as well as the Fed's PPT went to work in the market creating support and crossing some levels that initiated short covering. The idea of the 3C divergence is just that, the massive rout in the market has a lot of people short using record levels of margin, should those shorts continue to lose money in a rising market, the margin calls and short covering alone would be enough to create a break neck rally. That's what Scenario 3 was all about.

As I have said recently, tops are volatile and the closer we are to the second shoe dropping, the more volatile they get. Yesterday was interesting in the fact that we saw what in my view was unprecedented capitulation

as outlined in this post from last night.

Also interesting was the convergence of

Greece and South Korea banning short selling for two months on the same day as the FOMC policy statement. Furthermore,

last night's futures signaled an epic plunge in the markets today, before reversing and moving in to positive territory, this was sure to take out stops, draw in shorts and stop them out as well and create an accumulation area for Wall Street.

Should we see follow through on this move, we'll have a good idea of exactly why 3C has been showing a positive divergence and that alone should speak volumes as to how the market really works.

As far as today's price action, 3C did a good job of calling the weakness before the FOMC announcement. I watched the market nervously, but expecting a bounce off the lows as the knee jerk reaction to FOMC announcements is almost always wrong.

advancers for every 1 decliner, a huge change from yesterday. The NASDAQ Composite had 2237 advancers vs. 461 decliners and 65 unchanged. The NYSE had 5475 advancers and 1437 decliners. The Dow had 29 advancers and 1 decliner, a near mirror reversal of yesterday. The NASDAQ 100 had 7 decliners vs 93 advancers, another near mirror image of yesterday. The Russell 2k had 1546 advancers and 403 decliners. The S&P-500 which had 500 decliners yesterday, had 471 advancers today! Of my 5+% gainers, there were 1250 and -5+% decliners came in at 162.

The dominant Price/Volume relationship today was Close Up and Volume Down for the NYSE components, with second place, Close Up/Volume Up at 1215. The NASDAQ 100 had 79 stocks at Close Up/ Volume Down. The Russell 2k was Close Up/ Volume Down at 1236 and the S&P-500 had 384 at Close Up/ Volume Down.

Typically this dominant relationship is bearish, but considering yesterday's huge volume, the relationship doesn't concern me at this point, especially considering the cautious trade ahead of the FOMC statement.

Of the 239 MorningStar Industry/Subindustry groups, 230 posted gains and only 9 posted losses-again, a mirror reversal from yesterday and one of the strongest days I've ever seen in this respect; 202 posted gains of 2% or more, 77 posted gains of 4% or more which s exceptionally strong considering these groups can have hundreds of component stocks. Some of the top gainers included Retail 8.48%, Aluminum 7.9%, Internet Software and Services 7.27%, Regional Mid-Atlantic Banks 7%, Heavy Construction 7%, Broadcasting/TV 6.92%, Major Airlines 6.7%, Residential Reits 6.69%, Credit Services 6.38%, Copper 5.85%, Mortgage Investment 5.68%, Money Center Banks 4.71%, Financial Services 2.95%.

Losers included: Manufactured Housing -5.67%, Wholesale Building Materials -2.86%, Home Health care -.53%, Residential Construction -.30%, Toy and Hobby Stores -.20% and Long Distance Carriers -.08%

As you can see, even the losers weren't that bad.

The Charts:

GLD

Today was another day n which GLD gave up its opening gains and came in on a .92% gain on the day.

The short term 3C chart did an excellent job of tracking underlying Acton in GLD.

The 15 min chart which called a recent move higher, is negatively divergent at today's highs.

The hourly chart still looks rough.

As does the daily

DIA

As mentioned, it was the intermediate to longer term charts that were giving the signals while the short term charts were caught in the volatility, however this is important because usually 15,30 min charts don't move this fast unless there's very strong underlying action in the market. Here the DIA 15 min chart puts in a higher positive divergence at today's afternoon capitulation

The persistent positive, leading divergence on the DA 30 min chart, also note the leading positive divergence as afternoon capitulation took hold.

DJ-20 Transports

The long term positive divergence on the 30 min chart, with a huge uptick this afternoon

IWM

Again, it was the 15 min chart that put in a leading positive divergence at afternoon capitulation, a very strong signal.

Even more impressive is the way the 30 min chart went in to leading status at the afternoon lows.

QQQ

QQQ 15 min chart

And the long term 30 min positive divergence, which suggests we have more upside over the coming week/s

SPY

SPY 10 min leading positive divergence at the lows of the day

As I said, it takes a lot to make a 30 min chart move this fast, usually it is a process of days.

The 15 min 50 bar average has been resistance throughout the downtrend, decisively broken to the upside today.

FAS-Financials

Another impressive 30 min positive divergence puts financials back in the game

The 5 min chart was pretty sharp at picking positive divergences at the lows.

FAZ Bear Financials

Negative divergence on a new high, a typical reversal/head fake trapping longs who bought the breakout in this inverse ETF.

Again, a negative divergence at the highs, which also showed volume churning

FCX Copper, often a leading indicator

15 min chart

10 min chart

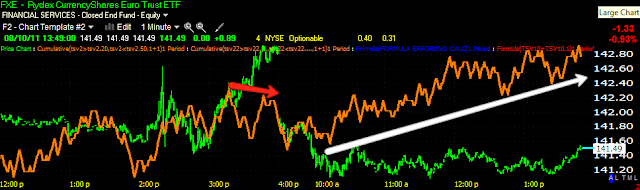

FXF-one of the safe haven trades I've been watching

A nasty daily candle

3C going divergent at the highs

a sharp 5 min negative divergence at the highs today

TLT Another Safe haven trade

Today's daily candle looks like churning in TLT-Treasuries

An RSI negative divergence at the highs, churning on high volume

3C also calling the negative divergence at the highs

UUP/$USD

Falls sharply on a 3C divergence and volume

VIX

VIX puts in a reversal formation today

VXX-good thing I updated the stops last night on this trade, another example of a negative dvergence at new highs on heavy, churning volume

3C 15 min quickly going negative at today's highs.

XLK Technology

The long term 15 min hart, note the red negative divergence that started this rout in the markets compared to the size of the positive divergence. This seems like a well planned out market rout.

A sharp 10 min positive divergence on afternoon capitulation.

As you can see, the long term positive divergences are quite large and suggest that we have quite a bit of upside. Yesterday's unprecedented capitulation was another serious warning of what was to come today. It looks like we have the reversal 3C has been suggesting, if 3C's positioning tells us anything, the upside should be substantial.

Lets see what tomorrow brings.