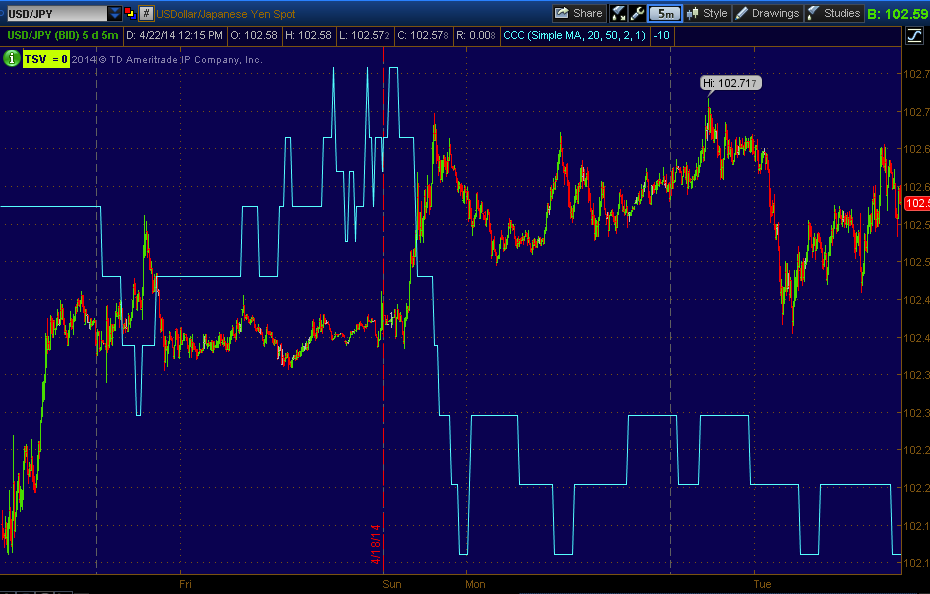

As far as 3C signals, today they were as you'd expect for a head fake move which would just be a run above the rounding top that was already in place, the head fake move itself occurs about 80+% of the time before a reversal in any timeframe, whether you are looking at 15 min charts, 5 day charts or intraday 1 min charts. The head fake move is one of the better timing signals we have when we already know there's an underlying trend of distribution or accumulation.

I decided to just leave positions that have already been put in place such as: VXX calls, QQQ puts and an SRTY long, remain in place without subtracting from them and without adding to them. One reason is that the SPY and Dow did hit the second target from the April 11th post which would be to break the line of lower highs and lower lows by making a higher high that looks like this...

While the SPX and Dow did make that higher high AFTER they broke below support to stage 4 (thereby shaking out new "confirmation" shorts), the NASDAQ 100 and Russell 2000 failed to do so...

While downtrend channels were broken, the string of lower lows/lower highs were not as you can see above on this daily chart of the NASDAQ 100.

In a reasonable world the breaking of the downtrend channel would seemingly be enough, but the market is FAR from reasonable, in fact one of my greatest challenges is discounting the absurd factor in the market, meaning whatever seems like a REASONABLE TARGET OR TIMEFRAME OFTEN NEEDS TO BE DOUBLED OR TRIPLED AS THE MARKET OVERREACTS which I'm sure is to make certain that EVERYONE, no matter how great their risk tolerance, is taken in by the move, FOOLED.

It does look like a move to the downside is ready to break, however I'm not ready to load up the back of the truck until I see the same sort of 3C extremes in the broad market.

I'll show you why using the SPY as a proxy for the broad market as the signals are similar whether between averages, S&P sectors, Index Futures or just plain thumbing through a watchlist of a hundred or so momo/favorite stocks

Intraday I needed to see proof that the move to the upside today wasn't being confirmed and rather was seeing distribution, unlike yesterday's VERY LOW VOLUME market, today's market had much better natural migration of divergences. The 1 min intraday is clean, clear and negative.

The 2 min chart looks as it should with migration of the divergence moving to longer timeframes (meaning the divergence is more serious and becoming stronger).

The 3 min chart is one that is long enough that it shows some more of the trend already, but it also added to the leading negative intraday.

The 5 min chart is usually the line in the sand for me between interesting and action, 5 min divergences are usually the minimum timeframe I need to see to enter a position and this is leading negative in a big way for such a short duration.

There's quite a difference between a 5 and 10 min chart and to see the 10 min chart leading negative like this, if I didn't already have positions open for a move to the downside, I'd have opened them today.

And the 15 min chart is where we get pretty serious signals of a swing+ nature, this is leading negative, but the positive divegrence and stage 1 base that led to this move was pretty substantial and before I add more downside trading exposure, I'd want to see this 15 min chart looking a whole lot worse.

The yellow trendline is where today's head fake move would be.

The 30 min chart still shows the positive divergence in what I was calling a head faked "W" base, but the negative divegrence isn't there yet, that doesn't mean the market can't or won't move lower from here, in fact it looks pretty likely that it does, but this is unresolved. Perhaps tomorrow this falls apart badly and then we'll decide how to react, but until then I'm weary that we may have a pullback that is a worthwhile trade, but not the one we are looking for.

Is the move down that we are looking for likely?

This 60 min chart says it's virtually a certainty, it's just we may have some near term scribble before the implications of this chart are realized and that's the market.

Is interest rates about to start going up?

-

Yes, I know - it does not make any sense - FED is about to cut

rates...but....real world interest rates are not always what FED wants it

to be.

6 years ago