Options expiration is a hurdle finally cleared, and interestingly right in time for Consumer Sentiment to hit 13 month lows, this should keep or move money out of risk assets and into safe haven assets like treasuries, so watch for an exodus from stocks this week. Like I've said so many times, we can see what they are doing, but it usually takes some time to find out why. For instance we just found out last week about the increase in the overall market short position by 4.5% in the last half of August, ironically or suspiciously about the same time we saw the bounce being set up. We are so far behind the information curve it's almost useless to guess “Why?” All will be revealed in good time.

As for our VIX positive divergence, it's still there and stronger then the last-that's got to be scary to bulls, or would be if they knew about it.

Compare the VIX positive divergences to the SP-500 during the same relative period.

Both times the VIX showed accumulation, both times the SP-500 showed distribution. Coincidence? I didn't make these up. These are two totally different assets, but linked with a high degree of correlation, still, 3C treats each one separately, what it finds in the VIX has nothing to do with what it finds in the S&P.

I wouldn't be long right now (generally speaking, there's always an exception) as this looks like a time bomb.

The NASDAQ 100 has been on a tear and why? I don't really care, the true reason is probably not something you're likely to find in any case. If one were trying to pull the other indices up through their August highs and pull the market into the status of a Dow Theory Intermediate Uptrend, why would you use the least important of the 4 majors to do it?

For me, this says, “If the market crashes, I want to be short the NASDAQ-100” as it has stepped a little further out on the limb then the others are willing to. Looking at the NASDAQ 100 breadth charts I always post, that limb seems to be getting thinner and thinner as it advances. A few ETFs to consider on a market plunge would be: PSQ, QID, SQQQ and probably the semis using something like SSG .

Here's how we left the market Friday...

Everything is still bearishly intact, distribution and all.

The gap up on 9/13 was aggressively sold into by institutions. The bulls smelling profits were all too happy to provide the demand Wall Street needed to exit the trade and go short. The relative position of institutional support via 3C is now below that of when the rally began and price is significantly higher. It seems obvious that they have put on a large short position.

To me this looks like the bounce didn't proceed up to the Bull Zone of $113 fast enough and most likely the market was goosed a bit to get it up there, seemingly “in time for something” meaning they needed the bulls in position in time for "something" and it wasn't proceeding fast enough so a little help was thrown out there. Something coming down the news pipeline perhaps? Remember, these guys are way ahead of the information curve and if my last post didn't show you the government is every bit as corrupt as Wall Street, then..... We do have some excellent swamp land for sale down here in sunny South Florida.

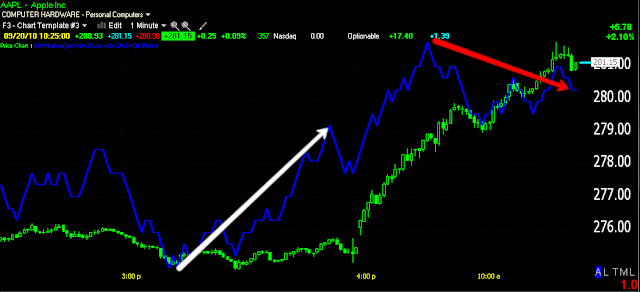

Thinking out loud... “I wonder what AAPL looked like?”

Well look at that, 3C confirmation-maybe a they got a little help from their friends, This is a 15 minute chart, remember though, changes that occur will be seen first on the shorter charts.....

This version of 3C is very fast to pick up on changes.

Is that a change in character I detect in AAPL's 5 min chart?

This one is better for smoothing out the trend and the blue one below, I wouldn't expect to see a divergence there yet as it's very long term, but it's there and it's negative. Note how AAPL was showing confirmation into the uptrend, a healthy stock until Friday. Also note the triangle that formed in AAPL Friday. Triangles are often signs of a top when accompanied by a 3C negative divergence. The reality that we see 3 or 4 times a day though is that even if this is as I suspect, a bearish top, the most likely outcome will be a false upside breakout-perhaps a gap up to clear the stops and orders above the very obvious triangle. Typically I'd say there's an 80% chance we will see this, but it should be short loved and once price falls below the apex (point) of the triangle, the longs will be at a loss and the supply/demand equation will rapidly shift as longs sell losing positions and flood the market with supply pressuring prices lower-this is the reason for a false breakout-that and the market makers pay day.

Why the fascination with AAPL? Because moving AAPL moves both the NASDAQ 100, the Composite as well and the S&P-500.

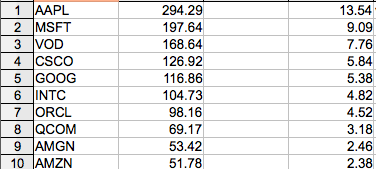

I've been told that AAPL

Here's the chart of the top 10 NASDAQ components using a calculation I put together based on what is known about how they weight their components....

That means if we had an index composed of AAPL, AMZN, AMGN, QCOM and ORCL-a 1% move in AAPL vs a 1% loss in the other 4 would still close our mini index higher-and those 4 companies are in the top 10 of the NASDAQ 100. Imagine if the real figure is 18 to 19%!

Imagine this, even using my number of 13.54%, which I'm sure is light, a 1% move in AAPL could still move the NASDAQ 100 higher if the bottom 53 companies all lost 1%! That's how powerful AAPL's weighting is and if it were 19% as the information I have received suggests, then you'd up that 53 stocks to 66 stocks. Imagine that-66 stocks of the NASDAQ 100 close down 1%, everything else is flat and AAPL closes up 1%, the NASDAQ 100 still posts a gain for the day!

This weekend I figured out the weighting of the S&P-500. I came up with XOM as the top dog, but still, AAPL had more weight then over 100 S&P stocks combined!

While the Dow is weighted differently, if I used the same weighting as the S&P-500, AAPL would have the weight of approximately the bottom 25% of the Dow-30.

As the Dow is actually weighted (to my knowledge), AAPL would, by my calculations, be the top dog on the Dow, by a margin of 2:1 over the current top dog, IBM. AAPL would have a heavier weighting then the bottom 1/3 of the DOW-30. Or in other words, AAPL by itself could take the place of slightly more then 10 Dow components.

The point is, if you want to move the market, AAPL is a stock that can move it. So by the looks of things, that's what has been happening and why we have followed AAPL so closely last week.

The change in character we are seeing in AAPL may be a leading indicator with regard to the course of the market.

So tomorrow a.m. I'll be online around 10:30. There's no telling what we will see as of this moment, but it seemed to me that smart money was in a rush (as if the market wasn't moving fast enough) to get the bulls locked into trades by throwing out a teaser, the break above $113 in the SPY which many bulls see as the neck line of an inverted H&S top. Their enthusiasm after seeing such a dynamic rally in September would have led many to jump the gun. Apparently we saw some heavy after hours action as well with bulls paying a real premium in a market that is nearly unregulated, save for the regulations your broker puts in place because no one else seems to want to. After Hours trading is the Wild West of the market for sure.

The advance we have seen on declining breadth (I've posted these breadth charts every day) shows that the market has been manipulated higher on a few heavy hitters like AAPL while a majority of stocks have posted net declines. That is a sure sign of manipulation and as pointed out, it looks like the manipulation in pushing the market higher via AAPL may have begun the process of being unwound. Keep an eye on AAPL it's in my mind, a leading indicator at this point.

If I didn't get to your emails, rest assured I will, don't be bashful about reminding me.

I'll see you in the a.m.