Last night in my "Observations" post I said,

"While we have plenty of relative positive divergences, I would like to see more of these turn in to leading positive divergences like the 15 min SPY below."

"Being the 15 min is already there, the 1, 5 and 10 min can make it to that position pretty quick, it would certainly be possible within a day as I have seen a 15 min timeframe achieve that in a day. When we have those kinds of divergences on multiple timeframes and averages, the probabilities of being at a turning point are very high.

False breaks/head fakes are also good timing indiations, I showed you on in AAPL earlier tonight and you can see how quickly it fell once the head fake is completed and the longs start losing money from buying the breakout. In an upside reversal, a break below important support leads to the head fake and it is completed when price rise above the breakdown level.

We saw several important breaks of support today, the most serious being the S&P-500. I wrote about two weeks ago that I thought we'd have one more rally, followed by a new low and a strong move up off the new low. Some of the indications were in last night's post, such as the breadth charts and the Zweig Breadth Thrust."

"The only thing I would like to see at this point before issuing a screaming buy would be leading positive divergences pretty consistently. Should that happen, I think we could see a rally bigger then anything we have seen in the past nearly 2 months. A flat trading zone would also be encouraging."

A "Flat Trading Range" is the best environment to see positive leading divergences develop as each pullback to the bottom of the range offers and opportunity for 3C to make a higher low then the last one, this would create the kind of divergences I mentioned above.

Also, with regard to pre-market and futures indications as well as early morning trade, I had several panicked emails and I understand why, however the futures market are routinely manipulated (Watch the Cramer Video I posted again, I'll try to get the link up), furthermore, pre-market and after hours markets with their thin liquidity are not only very dangerous to trade, but they often magnify indications to extremes. As for early trade, as I have stated many times, when I did nothing but trade full time, I would RARELY make any decisions based on the first hour of trading. Many traders I know won't even start their trading day until 10:30 as the market flushes out limit orders and plays other games, mostly taking advantage of people who place orders and then head off to work.

It's still early, but as of now, from a substantial gap down, 3/4 major markets are green with the QQQ up 1.19% and the IWM up 2.16%. You can see how a limit order to sell short placed in premarket would have been hurt.

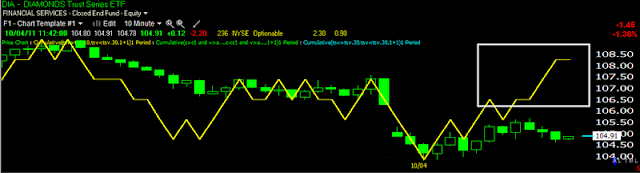

It took awhile to get all of these charts together and upload them so some action has already changed a bit. DIA 1 min is so far doing what I hoped to see, continuing a leading divergence, you can see a range in the red box and some resistance nearby.

DIA 2 min is still at a relative divergence, however since this hart capture it is now moving toward a leading divergence

DIA 10 min is moving in to a leading divergence, I would like to see pullbacks of 3C that make successively higher lows and remain leading.

IWM 1 min, hit a leading status and pulled back, it has since made a new high and is in line with price action. The red area is a resistance zone, which you can see is the likely place we will see these pullbacks in 3 and prices.

The 2 min was entering a leading positive divergence, it is confirming the price action in the IWM, having since moved higher.

IWM 5 min is showing a strong leading divergence, still, would like to see 3C pullback and make a new high as price pulls back, creating a kind of lightening bolt look.

The 10 min hart is leading and has the slight look of the lightening bolt, but the point is that it occurs on a pullback of prices, hopefully within a trading range.

We have a relative positive divergence which is impressive because of the timeframe, an hourly chart and because of the decline in price from the first relative comparison at the left side of the arrow.

QQQ 1 min is leading positive making new highs here.

A long view of the IWM 2 min relative positive divergence and the depth chart.

A closer look at the 2 min chart, leading and currently showing a minor negative divergence after moving higher, so this may lead to the pullback in price that is useful in creating the higher lows of a leading divergence.

Long view of what is really already a leading 5 min divergence in the QQQ and a very nice depth chart.

Red marks resistance in this closer look at the QQQ 5 min chart, which is leading, the 5 min chart also suggests a pullback in price.

QQQ 10 min leading positive, this remains leading positive, showing no short term negative divergence like the shorter charts.

QQQ 15 min strong relative positive divergence

SPY 1 min with some early resistance causing a 3C small negative divergence, this was resolved with a move higher both in 3C and the SPY, currently there is a very mall negative divergence suggesting a price pullback.

SPY 2 min leading positive and showing what the "lightening bolt" should look like as 3C made a higher low at the pullback which was at the same relative price level, this is what I want to see and why pullbacks are important in creating this pattern, I'm sure you understand the implication of a higher leading divergence at a pullback.

SPY 5 min in a leading divergence, it has since moved higher and is trading in line with the SPY within a leading status.

The 10 min chart leading, but not yet creating the lower highs, a more significant pullback would likely be needed.

SPY 15 min has remained in leading status and added upside to that today thus far. It is now higher then the previous high at the same relative level.