It seems that one of the wildcard events of tomorrow may have been defused for a short time as the Greek government has asked the IMF to bundle tomorrow's 300 million euro payment with the rest of June's payments, giving the government a few more weeks to try to find a solution. This would create a total debt of €1.5 billion due to the I MF by the end of June should they accept their request which is widely believe the IMF will accept the bundling request. Just for some perspective, considering the Greek government made their last IMF payment by using their last IMF reserves ( essentially paying the IMF with their own money) and can't afford to pay the current €300 million due tomorrow, it's difficult to imagine them paying he €1.5 billion due in June much less the €274,340,000,000 debt scheduled to last through 2057. In any case, that seems to be one bullet at the market may have dodged for the moment. For more information see ...

Greece asks to bundle IMF payments to pay at end of June-Kathimerini

If indeed the IMF accepts the bundling request tomorrow's main event will be non-farm payrolls out at 8:30 AM. A print above 250,000 may cause some volatility in the market to the downside as a rate hike would be more likely. On the other hand if there is a print substantially below 250,000 we may see some upward volatility in the market. I am curious as to whether or not we see some stronger signals if indeed the Greek drama has been put off until the end of the month.

Otherwise volatility in China Will certainly be one of tonight's main events as well as the ongoing volatility in German Bunds and EUR/USD as the pair has seen a 400 pip move in the last 3-days alone. Interestingly, the US 10-year yield has been tracking the FX pair quite closely this week.

The EUR/USD (candlesticks) vs. the 10 year UST. Yields move opposite Treasuries so if the 10 year Treasury (purple) were inverted, the 10-year yield would be exceptionally close to the EUR/USD.

The EUR/USD (candlesticks) vs. the 10 year UST. Yields move opposite Treasuries so if the 10 year Treasury (purple) were inverted, the 10-year yield would be exceptionally close to the EUR/USD.

As I said earlier today, I expect the USD to put in a corrective bounce and judging by the 3C chart of the USD and the euro, I expect that's exactly what we will see.

USD 15 min positive divergence for a corrective bounce ...

USD 15 min positive divergence for a corrective bounce ...

EUR 15 min negative divergence suggesting the $USD see a bounce. Furthermore...

The daily chart of the USD with a bullish (reversal) hammer.

The daily chart of the USD with a bullish (reversal) hammer.

I would normally expect a bounce in the $USD to send $US Dollar denominated assets lower, however in this case, I think we made the right decision this morning in closing the $USO put position, Closing USO July 17th $20 Put Position which resulted in a nice 3-day gain of +45%, USO Follow Up. As shown before the close, I expect oil/USO to bounce, however it looks quite the opposite, USO / Oil Analysis short term any way.

For instance...

USO 3 min intraday not only turned lateral shortly after we closed the put position just after 10 a.m. this morning, indicating a small base to bounce from, but also put in several positive 3C divergences like the one above.

USO 3 min intraday not only turned lateral shortly after we closed the put position just after 10 a.m. this morning, indicating a small base to bounce from, but also put in several positive 3C divergences like the one above. Crude Futures (5 min and longer) are also showing the same probability of a near term bounce, allowing us a new opportunity to let the trade come to us and set up a new short/put position as the longer term charts suggest oil has more downside to go.

Crude Futures (5 min and longer) are also showing the same probability of a near term bounce, allowing us a new opportunity to let the trade come to us and set up a new short/put position as the longer term charts suggest oil has more downside to go. For instance, this 60 min chart of Crude Futures showing a deep leading negative divergence. However on a longer term basis, I'm still expecting crude to come back down in to this year's base, finish up some remaining work and then put in an upside trend reversal. However, we do have the OPEC meeting tomorrow where production is expected to be left at current levels if not boosted which would be a selling catalyst for oil. With the 3C divergences in place though, I suspect the market already has a good idea of what OPEC will do, which I'd venture to guess will be to leave production at current levels. Nonetheless, we'll be looking for our next trade set up here very soon as one of the few assets showing enough volatility to be able to trade.

For instance, this 60 min chart of Crude Futures showing a deep leading negative divergence. However on a longer term basis, I'm still expecting crude to come back down in to this year's base, finish up some remaining work and then put in an upside trend reversal. However, we do have the OPEC meeting tomorrow where production is expected to be left at current levels if not boosted which would be a selling catalyst for oil. With the 3C divergences in place though, I suspect the market already has a good idea of what OPEC will do, which I'd venture to guess will be to leave production at current levels. Nonetheless, we'll be looking for our next trade set up here very soon as one of the few assets showing enough volatility to be able to trade.

The same can't EXACTLY be said for equities despite today's downside volatility in which the Dow lost its psychological level of 18,000 and the SPX lost its psychological level of 2100. Perhaps tomorrow's NFP will introduce more volatility, as you know (despite already having core shorts set-up and wanting to see them profitable), one of my main concerns this week has been the market falling too soon before a decent upside move allowing us to enter a number of watch list shorts at better prices/less risk and good timing. I don't see anything in the charts at the moment that suggests the Non-Farm payrolls are leaked as we only had a slight 1 min positive divergence in the SPY today, it didn't go any further than that and that's not very impressive.

SPY 1 min intraday positive divergence which appeared right around the time we called an intraday bottom for the day at 2:21 p.m. this afternoon, Intraday Flameout-SPY/Market intraday Capitulation Likely

SPY 1 min intraday positive divergence which appeared right around the time we called an intraday bottom for the day at 2:21 p.m. this afternoon, Intraday Flameout-SPY/Market intraday Capitulation Likely However note that the divergence was not strong enough to migrate even to the next intraday timeframe of 2 mins which remains in line with price action (3C price/trend confirmation).

However note that the divergence was not strong enough to migrate even to the next intraday timeframe of 2 mins which remains in line with price action (3C price/trend confirmation).

The Index futures are inconsistent or in line at best, none of them have enough confirmation that would give me the confidence to make any long trade at the moment, I say at the moment because the market is as dynamic as any living organism out there and things can change quickly, but for now, it is what it is. Certain assets I'm hoping to get us in to are showing some promise on the watch list such as the NFLX Trade Set-Up I posted yesterday or perhaps Transports, although they are struggling to do much with a divergence that would have sent them higher for a good 2-eweeks a year ago. The market has simply seen a lot of damage and although it's silly, overtime I look at internals, Leading Indicators or the charts, this image comes to mind...

I do believe we are close a strong counter trend rally in TLT (20+year Treasuries) as posted when it first broke and set up the Channel Buster Concept which can be seen in the original post here, Bond Rally / Swing

As for the charts...

TLT Daily chart with the stage 2 trend at #2, the stage 3 top at 3 and already in decline, stage 4 with a break below the long term trendily setting up a Channel Buster counter trend rally concept and by the size of the base, I suspect it will be a doozy.

TLT Daily chart with the stage 2 trend at #2, the stage 3 top at 3 and already in decline, stage 4 with a break below the long term trendily setting up a Channel Buster counter trend rally concept and by the size of the base, I suspect it will be a doozy. Here's a closer look at TLT's daily chart. Note the head fake/stop runs on all of the charts at the yellow areas. Yesterday's stop run on high volume looks to have been accumulated in size.

Here's a closer look at TLT's daily chart. Note the head fake/stop runs on all of the charts at the yellow areas. Yesterday's stop run on high volume looks to have been accumulated in size.

And the 3C chart showing the base area as well as the recent stop run and 3C positive divergence showing the shares having been accumulated. I'm just looking for the short term timing charts to scream or jump off the chart. 30 Year Treasury futures are also showing positive divergence adding more credibility to what "should" be an exceptionally strong move. If we can make +40% on a short term pullback trade here, imagine the counter trend rally as they are some of the strongest rallies you'll see in any market.

As for internals tonight, yesterday we had no interesting internals at all. Tonight the Dominant Price/Volume Relationship is mixed. The NASDAQ didn't have one. The Dow and SPX were both Close Down/Volume Up, with 22 and 249 stocks respectively. This is a 1-day oversold condition and usually sees a green close the following day. However the Russell 2000 was Close Down / Volume Down which is the least influential of the 4 possibilities with 1055 stocks. In addition to the NDX not having a Dominant P/V and the miix between the other averages, I would NOT call this a strong 1-day internal condition, but does lean toward a higher close overall.

Interestingly only 13 Dow stocks are above their 50-day moving averages, less than half of the R2K are above their 50-day at 842 and less than half of the SPX at 201 stocks.

Interestingly at the same time, 9 of 9 S&P sectors were in the red, Energy led to the downside. Among the Morningstar groups ONLY 14 OF 238 SOTCKS CLOSED GREEN. THIS IS AN EXTREMELY DEEP 1-DAY OVERSOLD CONDITION. ALL IN ALL, JUDGING BY INTERNALS ALONE, I'D EXPECT A 1-DAY BOUNCE OR A GREEN CLOSE TOMORROW.

However I'd be remiss not to remind you that tomorrow is an options expiration Friday and we most often see the max-pain options expiration pin right around Thursday's close. Although it's difficult to believe any pin would hold if the 8:30 Non-Farm Payrolls come out significantly off a 250k print.

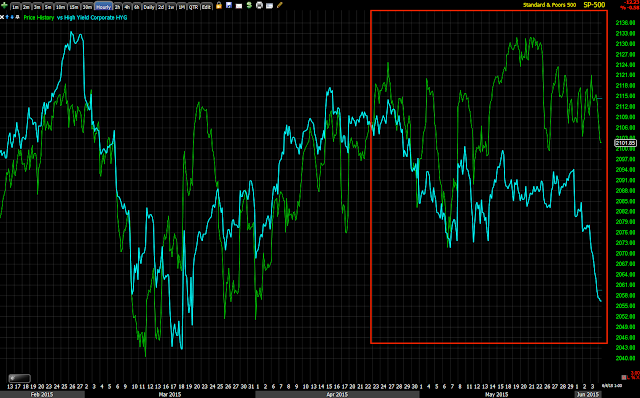

Additional influences that are effecting the market would include our custom SPX:RUT ratio which is not confirming today's downside, but rather leading to the upside VERY near term. Pro sentiment indicators closed in line with the market and are overall negative regarding the larger picture as a leading indicator. If indeed 30 year yields are still acting like a leading indicator as they have been for several week, but not for months before that, then they are pointing to a bounce in the market. However most telling in my view is the total and complete collapse in High Yield Credit. While I'd prefer all of these were pointing in the same direction and most are except 30 year yields, this is not the kind of slam-dunk immediate, "Hit the panic button" market decline expectations often shown by leading indicators, but it is darn close, especially HY Credit.

For some time Yields which had been one of my favorite Leading Indicators, but had stopped working (I suspect as the $USD carry trade unwind began) and I expect soon they will stop working again, but over the past few weeks they have been pretty accurate and right now point to the short term upside /head fake bounce I had been expecting to fill out the "Igloo/Chimney" top pattern

For some time Yields which had been one of my favorite Leading Indicators, but had stopped working (I suspect as the $USD carry trade unwind began) and I expect soon they will stop working again, but over the past few weeks they have been pretty accurate and right now point to the short term upside /head fake bounce I had been expecting to fill out the "Igloo/Chimney" top pattern

Perhaps more telling than any other Leading Indicator is High Yield Corporate Credit... Looking at HY Credit in blue, remember the phrase, "Credit leads, stocks follow". In that light, it's pretty hard to imagine this market holding up for very much longer as credit has completely dislocated from the SPX on a long term, intermediate term and now near term basis.

Finally as to Futures indications tonight, NASDAQ futures are showing a pretty negative intraday / 1 min negative divergence since the lose in which it looked like the market was trying to ramp back up to VWAP. The SPX futures (ES) don't look quite as bad since the close, but they are in line with the downside all day and do also show some deterioration since the closing ramp to try to make it to VWAP before the close. I can't really spin the tea leaves here in to a coherent strategy for the broad market and there are too many short term wild cards such as Greece and Non-Farm Payrolls, but I do have a feeling we will be seeing better signals if indeed Greece receives the bundling request by the IMF to avoid all out default on tomorrow's $300 mn Euro payment.

ES/SPX futures late day closing attempt to hit VWAP above.

The NASDAQ 100 futures closing ramp toward VWAP

The NASDAQ 100 futures closing ramp toward VWAP  And the deterioration in ES/SPX futures in 3C since the 4 p.m. close (red arrow) since VWAP was no longer important with the cash market closed. You probably get the drift... VWAP is used as a measure of a market maker's or Specialist's fill for institutional orders. Typically in a market that is trending down, they are looking for the middle man in that particular asset to sell/fill their orders at VWAP or better. It seems after the cash close, it didn't matter much anymore and that shows in ES's 3C chart above, but more so in NQ's below...

And the deterioration in ES/SPX futures in 3C since the 4 p.m. close (red arrow) since VWAP was no longer important with the cash market closed. You probably get the drift... VWAP is used as a measure of a market maker's or Specialist's fill for institutional orders. Typically in a market that is trending down, they are looking for the middle man in that particular asset to sell/fill their orders at VWAP or better. It seems after the cash close, it didn't matter much anymore and that shows in ES's 3C chart above, but more so in NQ's below...

NQ 1 min 3C chart since the 4 pm close (red arrow)...

As always I'll check futures before I turn in and if there's anything standing out, I'll let you know. I suspect we'll see more volatility in Asian markets, they are starting to trade like a penny stock. Have a great night and let the trade come to you.