The signal is the same, long DUST, however, the original signal was on the open of 9/6 @$29.72. As the system has been designed and tested, there is a 3% stop-loss built in, which would give you a closing stop of $28.83. Today DUST closed at $28.45 which is below our 3% stop-loss, which would mean that you would sell DUST on the open tomorrow morning, even though the actual signal is still long DUST.

GLD/Gold has been a safe haven trade when the market falls and we have been in what I believe to be a bottoming formation, which means it has been choppy trading.

Here's tonight's continued long DUST signal...

This is the SPY in green vs GLD in white. You can see it's been very difficult to hold any kind of swing or trending trade. There are a few moments when GLD and the market have moved together rather then the typical inverse correlation.

As I have been saying though and this is a hint toward my market perspective, DUST has been building a solid base on a 60 min chart, wait until you compare it to NUGT/GDX. Since it seems DUST has a tendency toward an inverse relationship with GLD, the fact we are seeing such a long and apparently strong underlying condition in the base, hints to me that the market rise I've been anticipating (after we get a decent drop and I believe this month), is probably on track. The market rises, GLD falls and DUST with its largely inverse correlation rises.

Even the 15 min chart of DUST shows strong 3C positive divergences in the underlying action.

This is a 1 min chart of DUST with a late day positive divergence, so you may get a better price on the open and we may see a gap up that I hinted at with a few late day market divergences. I'll show you a Trend Channel chart of reversals at the end of this.

In contrast, NUGT's 60 min chart is going the opposite direction with a 3C negative leading divergence.. Remember, these are longer term trends represented by the 60 min hart and we are still in a choppy market. Furthermore, last month I questioned whether the typical correlations we have grown use to seeing are going to change.

Here's NUGT on a 15 min chart, again lagging in a negative divergence.

As well as on the 10 min chart

And the end of day 1 min chart looks the exact opposite of DUST.

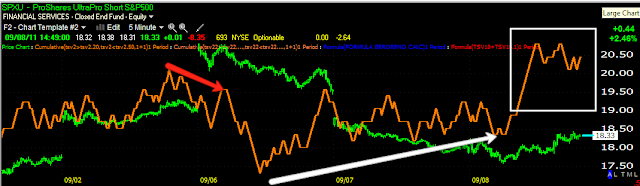

Now, this chart is more market related, but has to do with reversals which I often say, are a process, rarely an event.

Take a look at the SPY with my Trend Channel

This channel was designed to hold trending trades on a daily basis, but because the market has been so choppy, I have to set it to a shorter 30 min timeframe. When price crosses below the lower channel during an uptrend, it signals the end of the trend. However, as say it's a process, note at the red arrows when price first crossed below the channel and in the white box, some extra time before the market reverses down. In each of these cases, the stop signal came and 1 day passed after the stop signal and then the market reversed down.

Perhaps we do get a gap up and lateral trade tomorrow after the President's speech tonight. One thing is for sure though, the 5, 10 and 15 min charts are in some of the worst shape they have been in since we started this consolidation so I'm holding my short positions gap or no gap up.

Is interest rates about to start going up?

-

Yes, I know - it does not make any sense - FED is about to cut

rates...but....real world interest rates are not always what FED wants it

to be.

6 years ago