I'm going to try to keep this short and not pretend there's more going on than there is.

As far as the earlier post about Peter Worden and changes in character in the market, I had a couple of questions about what that means.

I'd say until about 3-4 months ago (and this was an exponential process so a year ago it was even stronger), there were two market characterizations, "Risk on" or "Risk off", there was nothing in the middle.

If you wanted to play a bounce or a decline, it didn't matter if you used the SPY (options, leveraged ETFS, etc), DIA, IWM or QQQ... heck you could use Financials or Tech, EVERYTHING MOVED THE SAME WITH VERY SLIGHT DIFFERENCES. The only question was whether the market was in a risk on or risk off phase. I recall (because of the way I had risk management parameters set so no one position could be more than 20%) I'd pick the IWM, SPY, QQQ and XLF and they moved the same. THIS WAS A CLEAR EFFECT OF QE.

Now, the markets are dispersed, look at today for example, the NDX was up +.28%, the R2K +.46%, the SPX +0.06% and the Dow down- .24%, that's quite a bit of dispersion, nearly 3/4's of a percent and today wasn't a big mover like some other days, this would not have been seen a year ago and again, it's directly related to QE.

Market Breadth has been a longer one stretching through almost all of 2013 with the percentage of stocks above different moving averages almost twice what they are now. That's a change in character.

Who remembers the VIX's never ending bottom, it moved to 6.5 year lows and never seemed like it would find a bottom than spent 6 weeks holding its ground when it should have been moving lower, that's a change in character. The Carry crosses were in clear uptrends since November of 2012, now we have broken those uptrends, that's a change in character and the Yen itself if definitely seeing a change in character. There are plenty more. These are small things generally, but they are changes for a reason.

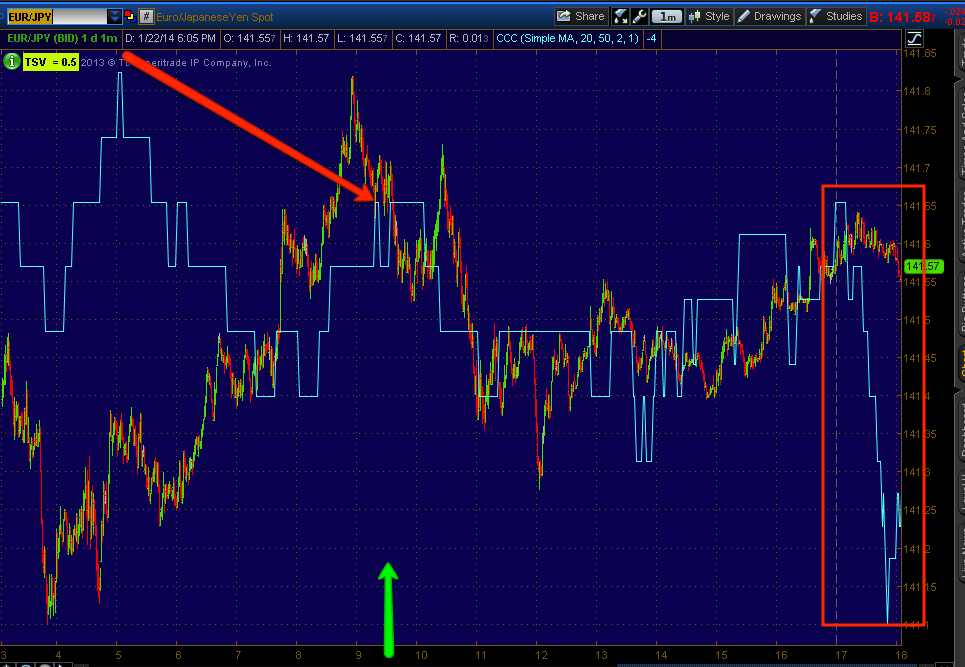

As for tonight, the JPY Carry Crosses I highlighted in the last post with odd, deep leading negative 1 min divergences that popped up suddenly re still there in the AUD/JPY and EUR/JPY, not the USD/JPY, however the 1 and 5 min Yen charts are seeing their positive divergences incrreease so I'd like to see USD/JPY stay under $104.91 where some technical buying could take place as it changes the short term trend.

As for today, there's no Dominant P/V relationship which is not surprising given the dispersion in the major averages.

Remember the SPX daily chart and the bear flag with what appears to be a Crazy Ivan shakeout? Now we have a bull flag, there's only 2 candles separating a bear flag from a bull flag, it's just an observation, I'm not saying or thinking it means anything until I see clear signals.

The Dow came out of a bearish Descending Triangle and put in a potential Crazy Ivan shakeout, it has a little range forming at resistance of the last week.

Sentiment is a bit unique today in that it has a clearer picture and a more bearish one as a leading indicator.

sentiment vs the SPX is clearly negative today as it has been more inline lately.

SPOT VIX (vs SPX inverted) is showing an outperformance today that's pretty clear.

Spot VIX also looks like it's quickly moving toward another Bollinger Band Squeeze, although the last one never really fulfilled the upside it should have shown.

As posted later today, there's a real change in character in HYG, 3C was showing it and now it's appearing in price, here it is vs the SPX and we haven't seen this kind of underperformance in HYG is a while.

HY Credit as well (longer term view) also showing that same deterioration at the May 22nd Key Reversal day.

And finally (and this is probably the biggest story of the day)...

High Yield Credit still wants NOTHING to do with any risk on posture , however Investment Grade credit (flight to quality or safety) which was down yesterday is up today as traders have movesd apparently from risk to safety, I suspect it was down yesterday as they were entering it at better prices, I unfortunately don't have IG credit on my system to look at 3C.

What I'm saying about the last week or so (beyond carry crosses and the Yen), Credit has become the story and that's interesting.

Other than that, I'm still waiting for the clear signals that give us a sharp edge, VXX / UVXY, 5 min Index futures, carry trades trending down again, leading divergences like we saw today in the Q's and IWM which were quite spectacular.

All of these things can develop in a matter of hours so we need to be patient, be on our toes, you know when the moment comes we may have 7 -10 positions whipped out in an hour.

Is interest rates about to start going up?

-

Yes, I know - it does not make any sense - FED is about to cut

rates...but....real world interest rates are not always what FED wants it

to be.

6 years ago